How Much of a Portfolio Should Be Invested in Bonds?

This series of articles will tackle the basics of bond investing.

Editor's note: This article is part of our "How and Why to Invest in Bonds" series. Click here to read other articles.

Knowing the right bond allocation at a portfolio level is complex, but it should always be tightly linked to the investor’s goals. Jack Bogle famously said a bond allocation should roughly equal your age, which assumes an investor's risk tolerance reduces over time and bond holdings rise.

That may seem simplistic, but off-the-shelf asset-allocation guidance provided by many advisors and fund companies doesn't vary significantly for people who are still accumulating assets for retirement. Sure, there are human capital considerations: A worker with a more volatile earnings trajectory, such as a commissioned salesperson, should typically have more-conservative assets than a tenured college professor. Similarly, the worker with a secure pension should generally be investing more aggressively than the investor who will rely exclusively on her own savings, plus Social Security, in retirement. Beyond variations like those, however, allocations for those still putting money away for retirement tend to look pretty similar: stock-heavy at the outset and well into middle age, transitioning to more bonds and cash as retirement approaches.

Closing in on retirement, however, one-size-fits-all recommendations won't cut it. Some retirees should have 50% (or even less) of their portfolios in stocks, while others should hold portfolios that are much more aggressive. From Christine Benz's vantage point, the gold standard for setting an asset allocation is to employ a financial advisor who can recommend an appropriate mix of assets given factors such as proximity to retirement, the amount of retirement savings, and comfort level with volatility.

There are other resources, as well, that investors can turn to for allocation templates:

Target-date funds, often available in U.S. employer-sponsored retirement plans, are designed as one-stop investments appropriate for a given retirement date and can provide an additional, professional view of appropriate asset allocations throughout the different time horizons to retirement. It is valuable to take a look at target-date offerings from a couple of different fund companies--funds for the same retirement date can vary substantially based on glide-path philosophy and types of holdings.

Morningstar's Target-Date Fund Series reports do a good job of summarizing the glide paths, as well as the pros and cons, of various target-date series. Some target-date programs maintain very high equity allocations before and even during retirement, a stance informed by the view that longevity risk--that is, the chance that you'll outlive your assets--should outweigh concerns about short-term fluctuations in an investor's principal. Others maintain more-conservative allocations: If a fund limits volatility, the thinking goes, investors are more likely to stick with the program in good markets and bad.

Morningstar's Lifetime Allocation Indexes, informed by the research of the Morningstar Investment Management LLC team, provide another vantage point on the asset-allocation question. In addition to providing separate asset allocations for various time horizons, the indexes also allow customization by risk profile for each age band: conservative, moderate, and aggressive. In addition, the indexes show allocations for various asset classes--they include percentage weightings in Treasury Inflation-Protected Securities and emerging-markets equities, for example.

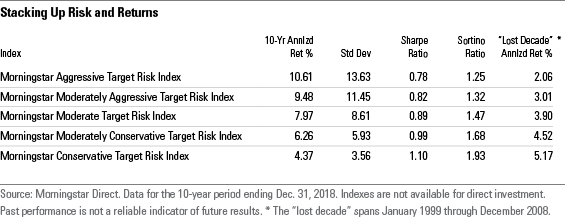

Here's a look at returns on the five indexes, which have allocations to bonds ranging from 5% in the Morningstar Aggressive Target Risk Index to 73% for the Conservative Target Risk Index.

The 10-year returns through 2018 tell the story of a bull market for stocks. The performance of the Aggressive index over the decade may settle the case for investors in it for the long haul. But even investors who can white-knuckle through the rough spots aren't always going to get a worthy payoff. The final column of the exhibit shows how each index fared during the stock market’s so-called “lost decade” from 1999 to 2009.

With an annualized return of 2.1%, the Aggressive index was more or less on track with inflation. That is not even close to the kind of return that equity investors expect over the long term. Investors who chose a middle ground fared far better than equity-heavy investors, as evidenced by the 3.9% return of the Moderate index. Meanwhile, the Conservative index returned a not-too-shabby 5.2%.

Part 6: What Kinds of Bonds Should I Hold?

The following authors contributed to this series:

Tom Lauricella, Editorial Director, Professional Audiences Christine Benz, Director of Personal Finance Sarah Bush, Director, Fixed-Income Strategies Jeff Westergaard, Director, Fixed-Income Data

Click here for important information about this commentary.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)