What Role Do Bonds Play in a Portfolio?

This series of articles will tackle the basics of bond investing.

Editor's note: This article is part of our "How and Why to Invest in Bonds" series. Click here to read other articles.

One of the great features of holding bonds is diversification--they bring something different from equities to the table in terms of performance. For instance, during a steep stock market decline, government bonds tend to appreciate, serving as a valuable offset for those losses. While a seasoned long-term investor may well ride out the ups and downs in the markets, a well-diversified portfolio can help smooth out bumps on the way to meeting a desired goal.

There's a fundamental reason for the diversification feature of bonds: When an investor or fund buys a bond, that bond issuer is promising to pay bondholders a stream of income in the form of interest (aka yield.) The value of that income contract typically acts as an anchor for the price of that bond even during times of uncertainty.

The primary risks to bonds are inflation, which erodes the value of those fixed payouts, and default, when the issuer is unable to make good on the promised interest or principal repayment.

It is critical to differentiate between government bonds and corporate bonds when it comes to the degree of diversification they can add to a portfolio.

Government bonds tend to be the more protective of the two during market panic for three key reasons: 1) they are considered to have little to no default risk and are generally very actively traded, therefore prices can rise during market turmoil as investors make a "flight to safety," 2) the yields tend to be tightly linked to the health of the economy, so prices benefit if interest rates get cut, and 3) they often involve longer holding periods, which increases the sensitivity of their price and yield to changes in the economy.

Meanwhile, corporate bonds share some of the same risks as stocks. For example, if a company goes bust, both the stocks and the bonds of that company will fall in value. High-yield bonds--often called junk bonds--are those issued by companies considered to be at higher risk of default. Performance trends in the high-yield market typically move in the same direction as the stock market.

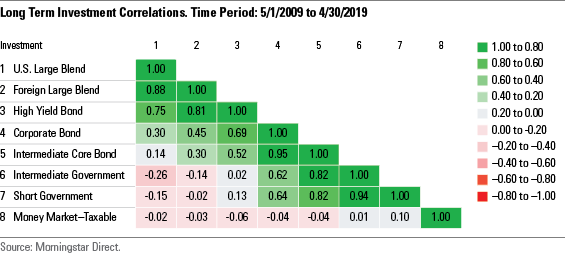

These relationships show up in the statistic called correlation, which is essentially the relationship between returns on two sets of investments. For a bond investment to provide diversification to a portfolio, it requires it to not move in lock step with other investments. (Morningstar's director of personal finance, Christine Benz, highlighted how to assess diversification efforts in this article.)

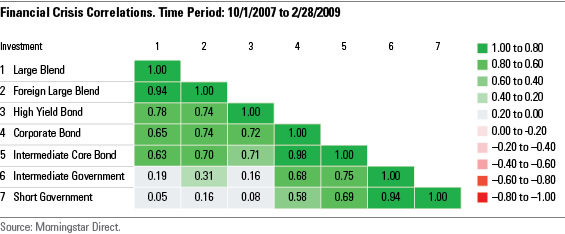

Using this statistic, a correlation of 1 indicates that two assets move in lock step--hence the statement that "all correlations went to 1" during the financial crisis. At the other extreme, a correlation of negative 1 indicates a perfect inverse relationship; if one asset goes up, the other goes down. Finally, a correlation of 0 indicates no correlation at all. The readings in between reflect the varying tendencies to move in relation to each other.

To find the correlations between key Morningstar mutual fund categories and what that means for how bonds can diversify a portfolio, we turned to the Morningstar Direct database.

We can start with the correlations between U.S. and non-U.S. large-blend stock funds. These categories of funds hold the stocks of companies with large market capitalization but don't favor a growth or value style. They include popular broad market index funds. Correlations between the U.S. and non-U.S. stock categories have been very high over the past 10 years, suggesting that they provide very little portfolio diversification to one another. High-yield bond funds, too, have a very high relationship to large-blend stocks.

Returns on funds in the intermediate core bond Morningstar Category--which holds a mix of high-quality government and corporate bonds--have very little relationship to the returns on large-blend stock funds. Government-bond funds, meanwhile, tend to move in the opposite direction, adding a greater amount of diversification. In other words, this data shows that when large-blend stock funds are losing money, government-bond funds are poised to make money.

The following table shows correlations as global financial markets were under the severe stress of the financial crisis. This was an extreme set of conditions--recognized by most analysts as the worst economic downturn since the Great Depression--so investors can think of this as a worst-case scenario. During the financial crisis, core bond funds became more highly correlated with large-blend stocks. It was only government bonds that provided diversification, though less than in more-normal market conditions.

Why Not Just Hold Cash? As seen in the long-term correlation table, cash also acts as a diversifier in a portfolio. So, why not just hold cash?

As Karen Wallace wrote in this article, the "right" asset allocation depends on an investor's or household’s specific time horizon and risk capacity. An investor who will need funds in the very near term might be better off holding cash or a cash-equivalent investment.

It is important to remember that cash yields have been so low in recent years that investors are losing purchasing power when factoring in inflation, which over time averages between 2% and 3% per year. In other words, cash loses its value over time.

So for investors who have a little more time--say, at least three years--a short- or intermediate-term bond fund can make more sense, even if rates are expected to rise.

Christine Benz notes that, in normal environments, investors should be able to pick up a higher yield than on cash instruments with just a little bit more volatility. (Of course, unlike true cash instruments, principal is not guaranteed in bonds.)

Another consideration is portfolio diversification. Cash won't lose money during an equity-market shock, nor will it gain. As discussed above, though, bonds can have a negative correlation with equities and can gain in price during stock market declines.

Part 3: Bonds Vs. Bond Funds

The following authors contributed to this series:

Tom Lauricella, Editorial Director, Professional Audiences Christine Benz, Director of Personal Finance Sarah Bush, Director, Fixed-Income Strategies Jeff Westergaard, Director, Fixed-Income Data

Click here for important information about this commentary.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)