Price Continues to Rule the Target-Date Fund Landscape

What we learned from Morningstar's recently released report on target-date funds.

Following another year of strong flows from investors, assets in target-date mutual funds and target-date collective investment trusts totaled more than $1.7 trillion at the end of 2018. The persistent growth and massive amount of assets mean that target-date funds play a key role in helping more and more investors meet their retirement goals.

Here's a few highlights on the competitive landscape from Morningstar's recently released 2019 Target-Date Fund Landscape report.

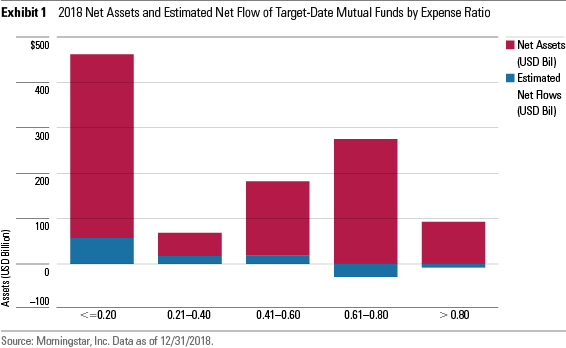

Price Driving Popularity Low-cost target-date funds took more market share from pricey funds in 2018. Exhibit 1 illustrates 2018's estimated net flows by current expense ratios. Target-date funds with expense ratios less than or equal to 0.20% led the way, gathering an estimated $57 billion in assets in 2018. Target-date funds with expense ratios between 0.21% and 0.40% as well as those with expense ratios between 0.41% and 0.60% also saw positive flows in 2018--$17 billion and $19 billion, respectively. Conversely, target-date funds with expense ratios greater than 0.60% experienced outflows in 2018. While target-date funds with expense ratios between 0.61% and 0.80% still had approximately $277 billion in total assets at year-end, second behind the lowest-cost cohort, those funds saw an estimated $29 billion leave in 2018.

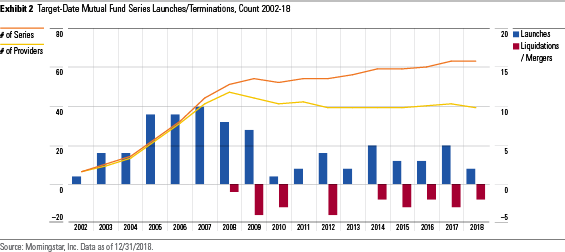

Adapting to Meet Demand Multiple target-date providers have responded to the low-cost demand by launching lower-cost versions of their existing target-date series. Exhibit 2 shows that by year-end 2018, roughly 40 providers offered 63 different series of target-date mutual funds, reflecting the growing trend for providers to offer multiple target-date series to investors.

When providers offer multiple target-date fund series, investors tend to choose the cheapest one. Nine of the 14 firms with multiple series have created a lower-cost alternative to an existing series while sticking to the same equity glide path. In each of these cases, the cheaper series saw higher net flows than the legacy series in 2018, and in seven instances, the lowest-cost series' flows were positive while the legacy series saw outflows.

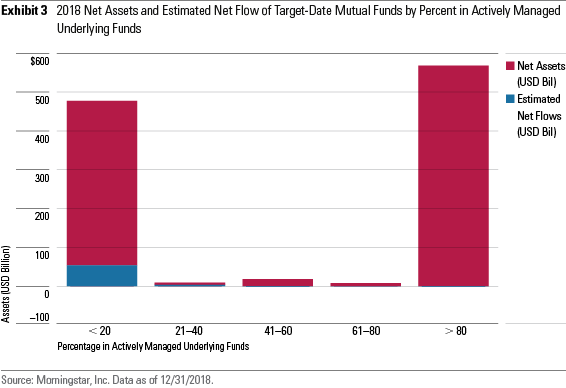

Lower Costs Via Index Funds Growth in target-date funds that hold mainly index funds has exploded with the demand for low-cost options. Exhibit 3 shows 2018 asset and flow data for target-date funds grouped by the amount they held in actively managed underlying funds. Virtually all the $55 billion in overall estimated 2018 net inflows to target-date mutual funds went to series that held more than 80% of assets in index funds. By contrast, series that held less than 60% of assets in index funds saw little demand in 2018.

Target-date series that held mostly actively managed funds still had more assets than series that invest predominantly in index funds at year-end 2018, but the latter is catching up quickly. Exhibit 3 shows series with more than 80% of assets in actively managed underlying funds held approximately $570 billion in assets at year-end 2018, whereas ones with less than 20% in actively managed underlying funds had roughly $480 billion. If recent trends hold, series that invest predominantly in index funds could overtake series that hold mainly active funds within a couple of years.

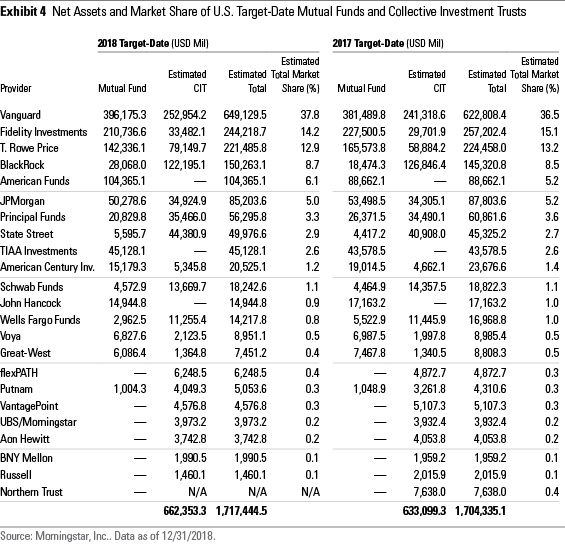

Collective Investment Trusts: A Lower-Cost Alternative The demand for lower-cost options has propelled the growth in target-date series offered as collective investment trusts, which typically cost less than mutual funds. (CITs are designed for qualified institutional investors and aren't subject to the same regulations or public disclosure requirements as mutual funds.) Exhibit 4 shows the year-over-year change in total assets in target-date CITs for the 10 largest providers of target-date mutual funds as reported to Morningstar, plus asset and flow data for other CIT series with more than $1 billion in assets.

Assets in target-date strategies from the providers shown in Exhibit 4 totaled $1.72 trillion at year-end 2018, with an estimated $662.4 billion in target-date CITs to go with $1.09 trillion in mutual funds. Target-date CIT assets grew significantly in 2018 from $633.1 billion in 2017. Assuming the average return on target-date CIT assets resembled that of target-date fund assets, target-date CITs' asset growth in 2018 was largely attributable to significant net inflows.

Adding firms' mutual fund and CIT assets provides a more comprehensive view of the competitive landscape. While Vanguard already held the top spot for target-date mutual funds at year-end 2018, an additional $253.0 billion in target-date CITs lengthened its lead over peers, bringing the firm's total target-date assets to an astounding $649.1 billion. Fidelity and T. Rowe Price remained in second and third place, respectively, when looking at total target-date assets, but T. Rowe Price's $79.1 billion in assets in target-date CITs at year-end 2018 more than doubled Fidelity's $33.4 billion. Indeed, T. Rowe Price saw a significant asset growth in its target-date CITs in 2018, up from $58.9 billion at year-end 2017. BlackRock's $122.2 billion in target-date CITs--the second-highest amount--lifted the firm to the fourth spot, bumping American Funds. In addition to BlackRock, the following firms each had more assets in their target-date CITs than their target-date mutual funds at year-end 2018: Principal, State Street Global Advisors, Schwab, Wells Fargo, and Putnam. Eight of the 10 largest providers, in terms of total target-date assets, offered their strategy through both mutual fund and CIT vehicles.

/s3.amazonaws.com/arc-authors/morningstar/0c1d596a-78d2-477f-acfc-a1ff33479805.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/0c1d596a-78d2-477f-acfc-a1ff33479805.jpg)