Who Cares About ESG Investing?

A broad swath of investors, apparently.

Sustainable investing--the use of environmental, social, and governance factors to assess investing alternatives--is often discussed in the industry, including on Morningstar.com. Although most investors are aware of this development, it isn’t always clear how widely sustainable investing is being applied or what groups of investors are particularly interested in it.

A common belief, promoted by some prior work in the field, is that millennials and women are the primary drivers of the new interest. At Morningstar, we wanted to better understand the profile of ESG investors and found that interest in sustainable investing is much more diverse. Three of our behavioral researchers, Ray Sin, Ryan Murphy, and Sam Lamas have just released a research paper with their findings, titled The True Faces of Sustainable Investing. Here's a quick summary of their results.

A New Way to Identify ESG Investors Most industry surveys measure interest in sustainable investing with questions like, "On a scale of one to five, how interested are you in sustainable investing?" These types of questions, however, are subject to behavioral biases that can distort the results.

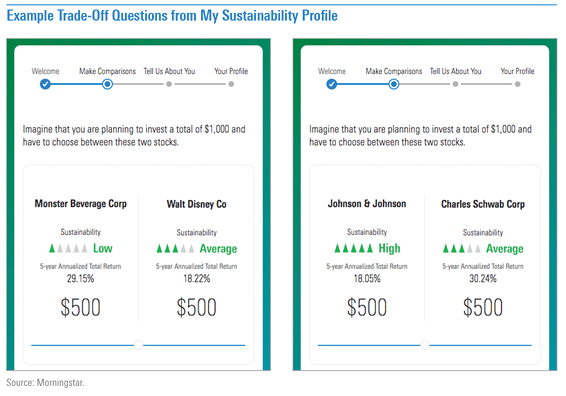

As part of our research, we developed a tool called My Sustainability Profile, which works to mitigate these biases and objectively measure a person’s interest in sustainable investing. As shown below, the tool prompts users to choose one of two stocks in which to invest--a decision that requires carefully constructed trade-offs--and then calculates a sustainability-preference score based on their answers.

The scores range from zero to 100, with zero indicating no interest in sustainability, 50 indicating an aim to balance returns and sustainability, and 100 indicating that the investor is guided entirely by sustainability. According to the score, each person is then slotted into one of five different profiles:

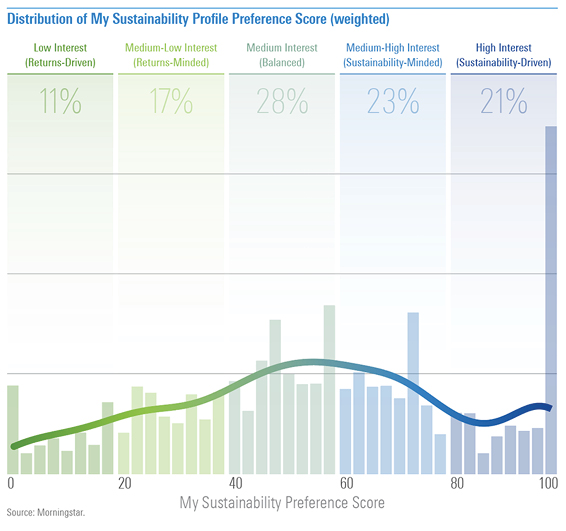

1. Returns-driven (score of 0-19): low interest in sustainability

2. Returns-minded (score of 20-39): medium-low interest in sustainability

3. Balanced (score of 40-59): medium interest in both sustainability and returns

4. Sustainability-minded (score of 60-79): medium-high interest in sustainability

5. Sustainability-driven (score of 80-100): high interest in sustainability

Which Demographics Include the Most ESG Investors? We used the My Sustainability Profile tool to measure the sustainability-preferences of a nationally representative sample of 948 Americans over age 18. Overall, our results showed that respondents representing 72% of the adult population in the United States expressed at least a moderate interest in sustainable investing, qualifying as "balanced," "sustainability-minded," or "sustainability-driven."

We also examined how this sustainability-preference score varied across different demographic groups, such as among genders and generations.

Although we did find that women had a slightly stronger preference for sustainable investing than men, the difference between their weighted averages was small (59.08 versus 53.53) and disappeared when we accounted for other sociodemographic variables like income and age.

The same was true when we compared the average sustainability-preference scores of different generations: millennials, generation X, and baby boomers. The average preference scores for millennials and generation X were statistically equivalent (60.21 versus 57.26). And while millennials, on average, showed a slightly stronger preference for sustainable investing when compared with baby boomers (51.96), the statistical significance between the two was not there after factoring in sociodemographic variables.

Moving Past Prior Stereotypes In the past, women and millennials may have been the most interested in sustainable investing (or, because of how prior surveys were conducted, they may have simply been more comfortable discussing the issues). That doesn't appear to be the case anymore. Interest in it is generally unrelated to age or gender. Some men are especially interested in sustainable investing, and some women couldn't care less. And that's probably how it should be: a personal choice for each investor, based on one's understanding of what drives investment returns and social outcomes, and not the domain of a single demographic group.

To learn more about the study, and the implications for investors and financial professionals, see the full paper. This study is part of Morningstar's Investor Success Project.

/s3.amazonaws.com/arc-authors/morningstar/cc15194e-3c37-4548-9ca8-782ff113938c.jpg)

/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7JIRPH5AMVETLBZDLUSERZ2FRA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XTXQYAMAL5EKRLGIS3IDVAZ3R4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/cc15194e-3c37-4548-9ca8-782ff113938c.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)