2018 Morningstar Fee Study Finds That Fund Prices Continue to Decline

Investors saved an estimated $5.5 billion in fund fees in 2018.

Investors paid less to own funds in 2018 than ever before. Morningstar's annual fee study of U.S. open-end mutual funds and exchange-traded funds found that the asset-weighted average expense ratio was 0.48% in 2018, a 6% decline from 2017. This is the second-largest year-over-year percentage decline we have recorded since we began tracking the trend in asset-weighted average fees in 2000. Consequently, we estimate that investors saved roughly $5.5 billion in fund expenses in 2018 compared with 2017 fee levels. This fee decline is a big positive for investors because fees compound over time and diminish returns.

In this study, we used the asset-weighted average expense ratio to examine the trend in mutual fund expenses paid by investors. The asset-weighted average is a better measure than an equal-weighted average as it approximates what investors paid for the funds they invested in rather than what funds charged.

There are several factors driving the average asset-weighted average fee lower:

1) Greater awareness: Investors are increasingly aware of the importance of minimizing investment costs, which has led them to favor lower-cost funds.

2) Intensifying competition: Asset managers have been cutting fees to vie for market share.

3) Evolving advice model: The move toward fee-based financial advice has spurred the demand for lower-cost funds like ETFs.

4) Unbundling: Institutions and advisors have increasingly opted against costlier share classes that embed advice and distribution fees.

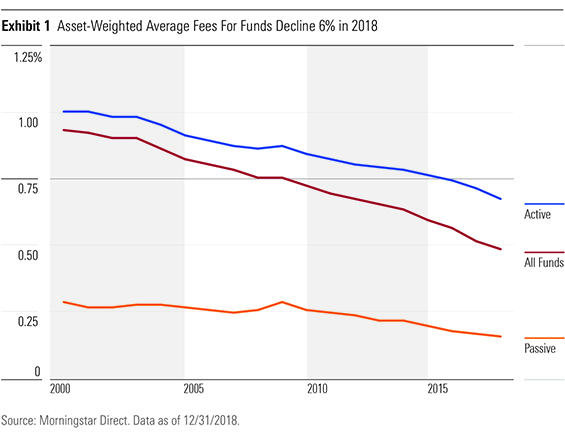

Trends in the Fund Fees Paid by Investors The asset-weighted average expense ratio has fallen every year since 2000. Investors are paying roughly half as much to own funds as they were in the year 2000, when the asset-weighted average fee stood at 0.93%; they're paying 40% less than they did a decade ago, and about 26% less than they did five years ago.

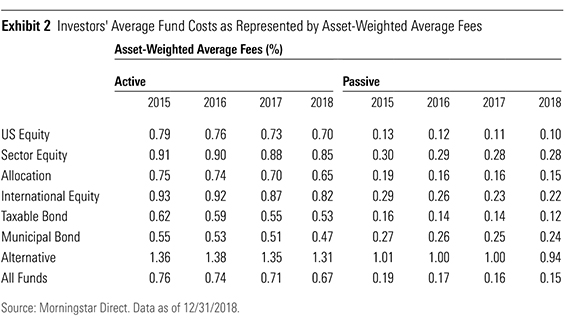

The asset-weighted average fee for passively managed funds fell to 0.15% in 2018 from 0.16% in 2017. That roughly 6% decline reflects strong flows into the very cheapest passive funds, as well as fee cuts by some asset managers for widely held broad index funds. Among passive funds, taxable-bond funds saw the biggest year-over-year cost decline, as the asset-weighted average fee fell 10% to 0.12% in 2018. This resulted largely from a spike in flows to very low-cost short- and ultrashort-term bond index funds and ETFs, reflecting resurgent investor demand for cashlike alternatives amid market turbulence. These index funds and ETFs accounted for approximately a third of flows into all funds in 2018.

The asset-weighted average fee for actively managed funds also fell, from 0.71% in 2017 to 0.67% in 2018. This 5% decline was the largest we've measured since we began tracking the trend in active funds' asset-weighted average fees in 2000. It was driven primarily by large outflows from expensive funds, inflows to cheaper funds, and an increase in the number of active funds cutting fees.

Although fees are mostly lower across the board, active-fund investors paid about four-and-a-half times more than passive-fund investors on each dollar in 2018. This is the widest relative disparity between active and passive fund fees that we've observed since we began tracking trends in asset-weighted average fees in 2000. The gap widened because the asset-weighted average fee of passively managed funds fell more in percentage terms than that of actively managed funds, notwithstanding the fact the average fee fell for active and passive funds alike.

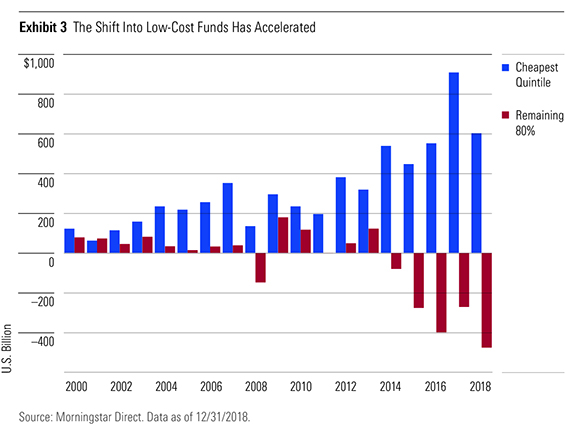

The asset-weighted average fee fell again in 2018 because $605 billion flowed into the lowest-cost funds (those with fees that rank within the bottom 20% of their Morningstar Category group), and $478 billion flowed out of all other funds (those that rank in the most expensive 80%). Roughly three fourths of the dollars that flowed to the lowest-cost funds went into passively managed funds. In addition, the average fund's price tag fell; the equal-weighted average expense ratio dipped to 1.05% in 2018 from 1.10% in 2017.

Though the equal-weighted average cost of investing in active and passive funds has been declining over time, the average active fund still charges about 1.8 times as much as the average passive fund. That's basically unchanged from 2017 and slightly higher than 2015, when the average active fund charged about 1.7 times as much as the norm for passive funds. This is because the equal-weighted average passive fee has fallen slightly more (roughly 10% cumulatively) than the average active fee has (about 8%) since 2015.

Fee cuts by fund sponsors, the launch of lower-cost share classes, and the shuttering of higher-cost share classes all play a role in the decline of asset-weighted fees. Fund sponsors may take these actions to drive asset-weighted fees lower, but investors vote with their feet and tend to favor low-cost fund share classes over high-cost alternatives. The mass migration to lower-cost funds has been a key driver behind the decline in the asset-weighted average fee.

Asset Flows Favor Lower-Cost Funds and Share Classes Morningstar research has found that fees are the best variable for predicting future relative performance. Low-cost funds generally have greater odds of surviving and outperforming their more expensive peers.

Since 2000, we've seen the cheapest funds (that is, those whose fees rank within the bottom 20% of their category group) rake in assets from investors. That trend continued in 2018, when these low-cost funds saw net inflows of $605 billion, with around three fourths of that going to passively managed funds.

On the flip side, we've seen all other funds--the remaining 80% of funds sorted by cost--hemorrhage assets. Indeed, flows have been negative for five years running for funds in this cohort, and 2018 was no exception; they saw a record $478 billion in outflows.

Of the $605 billion that flowed into the cheapest 20% of funds in 2018, 97% of it went into the cheapest of the cheap, the least costly 10% of all funds.

Because of these trends, 83% of all assets are in funds whose fees rank among the least-expensive 40% of their respective category groups. Meanwhile, just 7% of investors' money is in the most expensive 40% of funds.

What Are You Paying in Fund Fees? Low-cost funds are good for investors. Morningstar's Price Pillar rating indicates how a fund's fee level stacks up against its category peers. Look for funds that earn Positive Price ratings to ensure you're not paying too much for the funds that you own.

/s3.amazonaws.com/arc-authors/morningstar/64dafa24-41b3-4a5e-aade-5d471358063f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/64dafa24-41b3-4a5e-aade-5d471358063f.jpg)