Two Strategies That Might Work for Tactical Allocation

It's hard to succeed with tactical bets, but simple momentum and contrarian strategies show some promise for tactical allocation.

A version of this article appeared in the February 2019 issue of Morningstar ETFInvestor. Download a complimentary copy of Morningstar ETFInvestor by visiting the website.

It is hard to beat the market by making tactical adjustments to a portfolio in response to (or in anticipation of) changes in the market, like rising oil prices or changing interest rates. Because everyone can read the same news, it’s hard to find public information that isn’t already reflected in market prices. As the market tends to get things right over the long term, there is nothing wrong with avoiding tactical investing altogether and sticking to a long-term buy-and-hold approach.

While it is difficult to succeed with tactical bets, it’s not impossible. Simple momentum and contrarian strategies show some promise for tactical allocation, though they don’t always work. While these are very different strategies, there are strong economic rationales for both, which suggests they have a good chance to succeed in the future.

Momentum is the tendency for performance to persist in the short term; it has been observed in nearly every market studied. The best explanation is that investors are slow to react to new information, which means prices adjust more slowly than they should.

Contrarian investing is almost the opposite of momentum. Both can work because they focus on performance over different time horizons. Contrarian investing is based on the idea that assets with poor returns over a long period, like five years, should be poised to offer better performance going forward. This effect was documented among individual stocks by Werner De Bondt and Nobel laureate Richard Thaler in 1985 [1]. It is related to value because assets that have underperformed for a long time are likely cheap and priced to offer better returns going forward, while those that have strong performance over a long stretch are probably expensive. Like traditional value investing, contrarian investing could work if investors overreact to past performance, or if assets with poor past performance are riskier and priced to compensate investors.

Here I’ll take a closer look at the effectiveness of using simple contrarian and momentum signals to time exposure to sectors, regions, and factor portfolios. The analysis that follows uses pretax performance, but it’s important to keep in mind that tactical adjustments may result in a bigger tax bill than a simple buy-and-hold approach. Tactical investing can also reduce diversification, which can increase risk. To mitigate this issue, it’s prudent to maintain a consistent core set of holdings and make tactical adjustments at the margins.

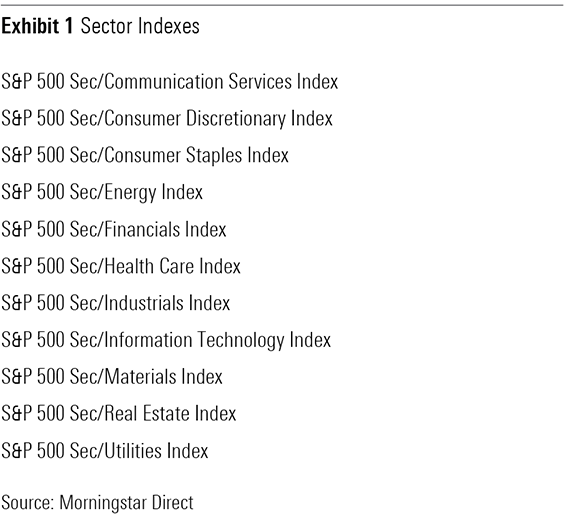

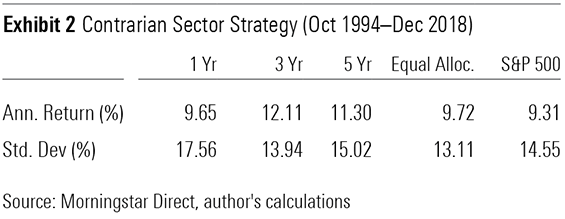

Contrarian Strategy Contrarian investing appears to work well for tactical sector allocation, but less so for tactical allocation across factors and regions. To test this, I used the sector indexes from Exhibit 1, which the suite of Select Sector SPDRs track. I selected the three indexes with the worst returns over the past five years, equally weighted them, and held them for a year before rebalancing. I then repeated this exercise using three- and five-year holding periods. The results are shown in Exhibit 2.

Over all three holding periods, the contrarian sector strategy outperformed the equal sector allocation and the S&P 500 from October 1994 through December 2018. However, the strategy worked better with the three- and five-year holding periods, which suggests it can take a long time for valuations to rebound.

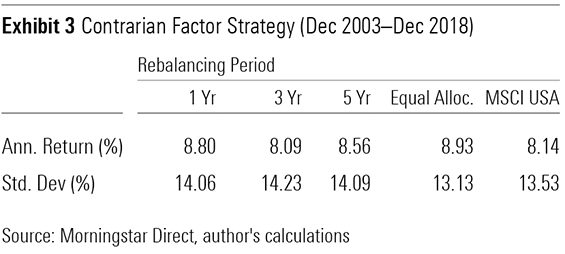

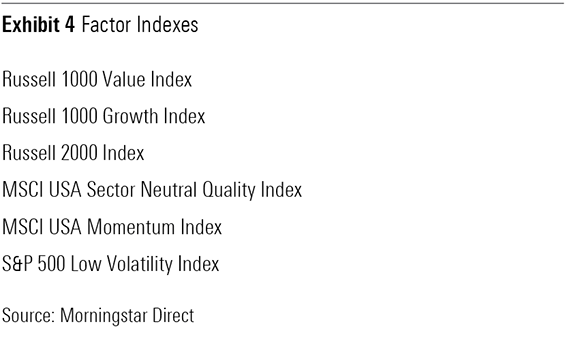

The contrarian signal didn’t work at all for factor selection between December 2003 and December 2018, as Exhibit 3 shows. That said, the results can be influenced by the factors and time period included. I used the factor indexes from Exhibit 4, selected the two with the worst returns over the past five years and weighted them equally, using the same holding periods as the contrarian sector strategy.

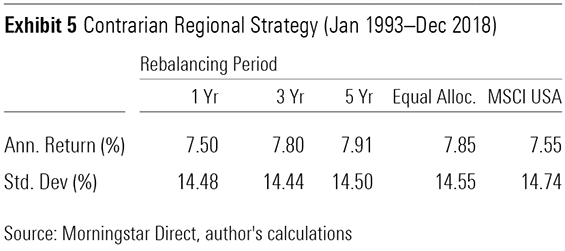

The setup for the regional strategy was a bit different. Here, I used the MSCI USA and MSCI ACWI ex USA indexes to represent U.S. and foreign stocks. Each year, the strategy allocated a 60% weighting to the index with the worst returns over the past five years, and 40% to the other one, using the same holding periods described for the sector and factor strategies. I chose to limit the regional tilts because it’s always important to be globally diversified. The results are shown in Exhibit 5.

This strategy didn’t significantly help or hurt returns. With a one-year holding period, the contrarian strategy lagged an equal allocation to the two indexes by 35 basis points annually from January 1993 through December 2018. But with a five-year holding period, it beat the equal allocation by 6 basis points.

It was a little surprising that this strategy didn’t work better, but that could be attributable to the limited opportunity set of the two indexes. A modified version of this strategy that used six regional indexes beat an equal allocation across those indexes and the MSCI ACWI during this time. So it’s possible to come to different conclusions about the efficacy of a contrarian regional strategy, depending on how it’s applied. It’s not foolproof.

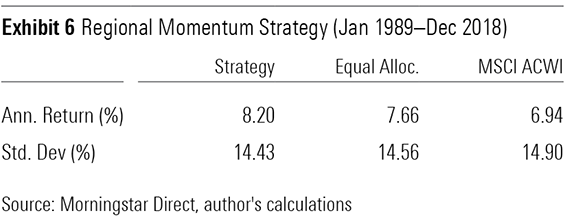

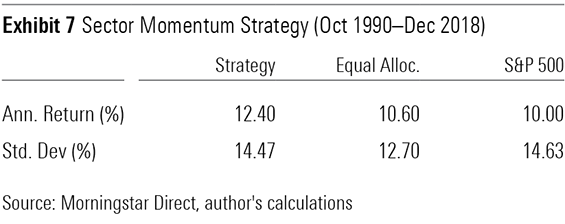

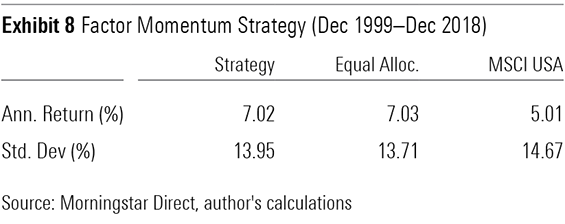

Momentum Momentum-driven tactical investing flips the contrarian strategy on its head, targeting the areas of the market with the best recent performance. Here, the setup is the same as the contrarian strategies, but instead of selecting the indexes with the worst performance over the past five years, I selected those with the best performance over the past 12 months and rebalanced monthly. So, the regional strategy gave a 60% weighting to the regional index with the best performance over the past year, the sector strategy held the three best-performing sectors, and the factor strategy held the best two factor indexes. The results are shown in Exhibits 6–8.

The sector and regional momentum strategies worked remarkably well, beating both the equal allocation and market benchmarks by sizable margins. However, the factor momentum strategy didn’t work as well. It posted about the same return as a static equal allocation across the factor indexes.

All these strategies require high turnover, but it is possible to mitigate that without significantly reducing returns by updating the portfolios only once per quarter or applying a buffer rule. For example, the sector momentum strategy could be modified so that sectors are added to the portfolio only if they rank in the top three, but stay in the portfolio until they fall out of the top five. That adjustment would have slightly reduced the strategy’s return to 12.1% from 12.4%, but it would have cut turnover in half.

Where to Go From Here This analysis shows that tactical allocation across sectors using simple contrarian and momentum signals has a good chance to succeed. They can also be effective for tactical allocation across regions, but the results are sensitive to the inputs. It's probably best to apply these signals across at least a handful of portfolios. However, there isn't clear evidence that these signals work for tactical allocation across factors. That could be because factor indexes tend to have higher turnover than sector and broad-market indexes, which means new holdings may enter the portfolio that dilute the efficacy of signals about past performance.

The Stock Market Snapshot page at the end of the ETFInvestor newsletter provides all the data necessary to implement contrarian and momentum strategies across region, sector, or factor exchange-traded funds. While it may be tempting to wait until both signals point in the same direction, that doesn't happen often. It's best to pick one signal and stick with it.

Reference

1) De Bondt, W., & Thaler, R. 1985. “Does the Stock Market Overreact?” J. Finance, Vol. 40, No. 3, P. 793.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)