7 Funds for the Planet

Funds to ponder on Earth Day or any day.

With Earth Day on April 22 and sustainable investing increasingly becoming mainstream, it’s easier to find funds that build their strategies around a concern for the environment, in particular the changing landscape for energy and utilities companies.

At the same time, investors have to navigate the confusing and evolving lexicon of sustainable investing. For example, there has been a proliferation of funds that Jon Hale, Morningstar’s head of sustainability research, labels “ESG consideration” strategies, where environmental, social, or governance questions are a top factor that’s played in investment decisions but are not a central part of the process. That contrasts with the “ESG integration” label, which he applies to funds that have ESG factors as a key determining factor when including an investment.

In another division are “sustainable sector funds,” which focus on investments related to a transition to a green economy in areas like renewable energy, energy efficiency, environmental services, and water. Like other kinds of sector funds, these strategies will often have a relatively small universe of stocks to choose from, which in turn can lead to greater volatility than broadly diversified funds, and a tendency to have more concentrated portfolios.

(See Jon Hale’s “Taxonomy of Sustainable Funds” and his more recent piece on ESG consideration funds.

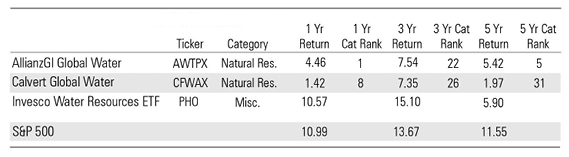

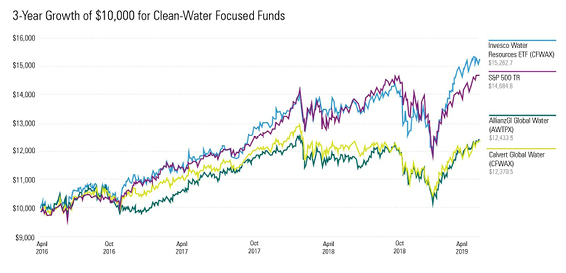

With this nuanced landscape in mind, for Earth Day we’ll highlight a group of sustainable sector funds, focused solely on environmental concerns. There are 38 funds in Morningstar’s sustainable universe; we narrowed the list down to seven, having eliminated those with track records of less than three years, less than $100 million in assets, and performance that trailed their Morningstar Categories. It happens that three of seven are focused on the same goal: clean water.

The $396 million Calvert Global Water fund (CFWAX) comes from socially responsibly investment pioneers Calvert Research and Management. It’s a passive strategy that tracks an index of companies that are significantly involved in water-related businesses and meet the characteristics of the Calvert Principles for Responsible Investment. The fund carries a Morningstar Sustainability Rating of 4 globes.

The investment thesis, as Calvert spells it out, is that technologies and infrastructure for delivering clean water around the globe is an intensifying need and a long-term investment opportunity. The fund not only invests in water-supply chain companies, it also invests in companies that actively work to reduce their water footprint.

“With the ongoing rollback of U.S. environmental regulations, some corporations may become more shortsighted in dealing with critical water issues in their operations and/or supply chains,” the fund’s managers wrote in their first-quarter outlook. “We view this as an opportunity for global corporations to demonstrate leadership in water efficiency and reuse, as they realize first hand the importance of a resilient supply chain and resource efficiency in the face of longer, and more severe, droughts and floods.”

The fund has a global remit, but less than half of its portfolio holdings are companies based outside the United States. As of the end of March, the top three holdings are U.S.-based: Ecolab (ECL), Xylem (XYL), and Idex (IEX). It’s a fairly diversified portfolio of 111 stocks, with the top 10 holdings accounting for less than 15% of assets as of March 31.

The fund’s track record goes back to 2008. Over the past year, the Calvert strategy ranks in the top 10% of the natural resources category with a 1.4% return. Looking longer term, the fund has returned an average of 7.4% for the past three years, landing it in the middle of the category.

Another water-focused fund with a long track record is the $580 billion AllianzGI Global Water (AWTPX). The fund, which carries a Morningstar Analyst Rating of Neutral and a 5-globe Sustainability Rating, had a stronger 2018 than the Calvert fund, gaining 4.5%. For the past three years it is up an average of 7.5%.

The firm says the fund “focuses on companies that look to improve water supply, efficiency, and quality, solving problems while supporting growth opportunities.“

The actively managed fund is more concentrated than the Calvert offering, with more than half its assets held among its 10 largest holdings. It’s top holding, American Water Works (AWK), accounts for 10.8% of the portfolio, followed by a 6% weighting in XYLEM.

A U.S.-focused water strategy is the $922 million Invesco Water Resources ETF (PHO). This 3-globe fund has been around since 2005 and is up 10.6% over the past year, 15.1% per year for the past three years, and 11.1% per year over the past decade. It shares many of its top holdings with the Calvert and Allianz strategies.

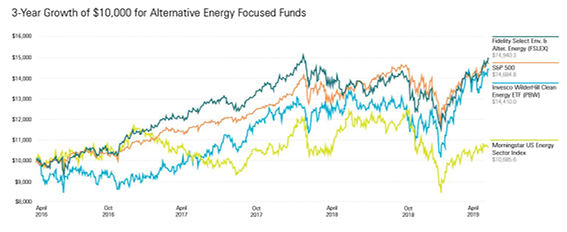

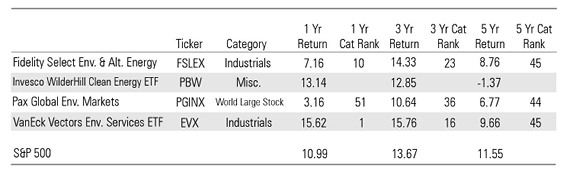

When it comes to alternative energy, two options are Fidelity Select Environment and Alternative Energy Portfolio (FSLEX) and Invesco WilderHill Clean Energy ETF (PBW).

The $189 million Fidelity fund is top-heavy, with about half of its assets concentrated in its top 10 holdings. They include the wide-moat industrials firms 3M (MMM) and Honeywell (HON). The fund has struggled in the past year, owing to both sector performance and a value tilt among its holdings. The Morningstar US Industrials Index was up only 7.7% for the year, and FSLEX behind with 7.2%; however, it edged above the index in the three-year period with 14.3% to the index’s 13.8%.

The WilderHill ETF tracks the WilderHill Clean Energy Index and follows the performance of global companies engaged in the advancement of clean energy and conservation. The fund has underperformed the broad U.S. equity market in the trailing one-, three-, and five-year periods. But, with a 34% stake in technology stocks, the ETF has outperformed the S&P 500 in the first quarter of 2019, with a 25% return compared to the S&P 500’s 13.7%. The two largest holdings, SunPower (SPWR) and Daqo New Energy (DQ), both semiconductor firms, saw first-quarter returns of 31% and 41.2%, respectively.

A more diversified environment-focused fund is Pax Global Environmental Markets (PGINX), spread across international markets and sustainable sectors: renewable energy, energy efficiency, water infrastructure, waste management, and sustainable agriculture. Run by ESG specialists Pax World Funds, the fund carries a 4-globe Sustainability Rating.

Although there’s some overlap in top holdings with Invesco Water Resources ETF and Calvert Global Water, Pax Global Environmental Markets differs by not being concentrated in one sector and one country’s market, which allows assets to be spread across a wider range of holdings.

This mitigated risk has served the fund well; it outperformed the MSCI All-Country World Index in strong markets, both in calendar year 2017 and the first quarter of 2019. The Pax fund is up 3.2% over the past year, landing it in the middle of the world-stock category. For the past three years it’s up an average of 10.6%, leaving it in the top half of the group.

VanEck Vectors Environmental Services ETF (EVX) tracks the NYSE Arca Environmental Services Index, following the performance of U.S.-based waste collection, disposal, and recycling service companies, an industry that VanEck assessed as growing because of increased population, industrialization, and increased government stringencies around appropriate waste management practices.

However, the fund carries a below-average ESG score, earning just 2 globes, owing to its focus on environmental service companies and the growth derived from the sector in general, as opposed to holding the best environmental performers within the sector.

In addition, roughly 73% of the fund’s assets are in the industrials sector, and its two top holdings--Waste Connections (WCN) and Waste Management (WM)--make up about 20% of the portfolio. Still, the fund earns a Morningstar Rating of 4 stars. It's been the top-performing fund in the industrials category for the past year, returning 15.6%. Over the past three years it is up an average of 15.8%, outpacing 84% of the funds in the category.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7JIRPH5AMVETLBZDLUSERZ2FRA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)