Uncovering Your Real Goals

A master list can identify your true financial goals.

What are your top investing goals? As investors, we all face this question at some point, and we generally have an answer. But have you ever looked at how stable or consistent your answers are, when you think about them in different contexts or at different times? It may surprise you, but researchers have found that we tend to answer with whatever is on our minds, which may not always be our true, long-term goals.

For example, let's say a friend recently read an article about vacation trips in Italy. When you ask about long-term goals, the responce might be: "I'd like to take exciting vacations," even though the person also cares deeply about leaving a legacy of charitable works. It's not that the person is insincere or that other goals aren't deeply held--it's just that is what's top of mind and easy to recall.

Changing the Way We Talk About Goals Tailoring your financial plan around your personal goals can both increase your total returns and motivate you to stay on track (Blanchett 2015; Locke et al. 1990). But the success of this technique depends entirely on having the right goals--which research suggests we, as investors, struggle to identify.

Thankfully, gaining a more thorough and considered understanding of your goals isn't difficult; it just takes a different approach. To understand how this works, try the technique yourself.

First, take out a notepad and write down your top three investing goals.

- Most important goal

- Second most important goal

- Third most important goal

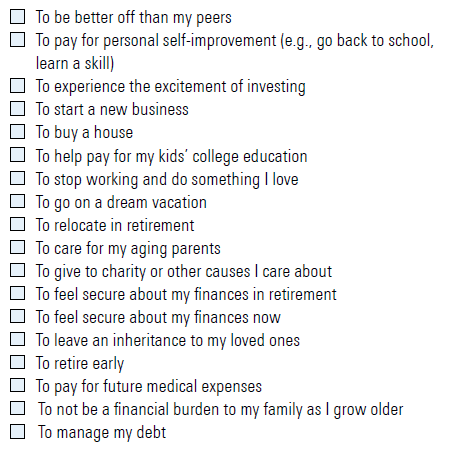

Now, take a look at list of common investing goals below. Are there any goals here that you consider important but didn't include in your initial list? If so, write them down.

Taking both your initial list and the list of common goals into consideration, think about your top three investing goals again and write them down. Has your list of top goals changed? If so, how?

A Simple but Effective Approach: Using a Master List If your goals changed, you're not alone. In a recent study conducted by Morningstar, our researchers tested two different ways of asking people about their goals. First, we asked people to simply list their top investing goals. Then we used the list above--a broad range of commonly identified goals, also known as a "master list"--and asked them to reselect their top goals, drawing from both lists. In other words, the second round included a prompt to help people remember other things that might be important to them.

In our study, 73% of people changed at least one of their top goals after seeing the master list. We found that, for many people, their final list of top investing goals was quite different from their initial list. After considering the master list, some people who initially thought in broad, vague terms about their goals began to formulate goals that were more specific and vivid. The master list also helped many respondents with initial goals that focused solely on financial outcomes, which tend to be impersonal and potentially unmotivating (Locke et al. 1990), to reframe their goals in terms of their emotional and personal value.

There's much more to learn from the study, and I encourage you to read it in full. The report also features a practical worksheet that takes you through the exercise explained previously. If there's one immediate lesson for investors and advisors it's this: Using a master list helps investors think broadly about the range of goals they may have for investing.

So, next time you are faced with this question, try using a master list to aid your decision. It can help make sure that you answer with your true goals, and not just ones that are top of mind.

References Blanchett, D. 2015. "The Value of Goals-Based Financial Planning." Journal of Financial Planning, Vol. 28, No. 6, PP. 42–50.

Locke, E.A. & Latham, G.P. 1990. A Theory of Goal Setting & Task Performance (Englewood Cliffs, N.J.: Prentice-Hall).

This study is part of the Investor Success Project; learn more about the series here.

/s3.amazonaws.com/arc-authors/morningstar/cc15194e-3c37-4548-9ca8-782ff113938c.jpg)

/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/cc15194e-3c37-4548-9ca8-782ff113938c.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)