Gender and Diversity Funds: Intentional or Not?

We examine if these funds are voting as they are named.

This article originally appeared in Morningstar Direct Cloud and Morningstar Office Cloud.

A prospectus or press release can state a fund’s support for gender-diversity initiatives, but their voting records show their conviction.

With this in mind, we took a closer look at the level of conviction behind the funds that Morningstar identifies as “gender and diversity intentional.” These are funds that seek to make a measurable impact, alongside financial return, by investing in companies with a record of measuring and improving gender and diversity or related initiatives.

Using Morningstar's holdings database and Morningstar's Fund Votes database, we were able to measure the level of a fund's intentionality in three ways: what funds buy, how funds vote, and how funds describe themselves. Morningstar's Fund Votes database includes mutual fund- and exchange-traded-fund proxy voting data on company resolutions and shareholder proposals, including proposals addressing environmental, social, and governance topics.

What we found suggested varying degrees of intentionality among gender-diversity funds. (The full report is available for Morningstar Direct clients here.)

Of the 458 U.S. funds categorized as Sustainable Investments, 15 equity mutual funds and ETFs are flagged as gender and diversity intentional. Based on their prospectus language, five funds are identified as having a primary focus on gender diversity: State Street’s SPDR SSGA Gender Diversity ETF SHE; Glenmede’s Women in Leadership US Equity GWILX; Pax Ellevate Global Women's Leadership Fund PXWEX; SerenityShares’ Impact ETF, which recently closed; and Impact Shares YWCA Women’s Empowerment ETF WOMN, which was launched in August 2018. (WOMN licenses a Morningstar index.)

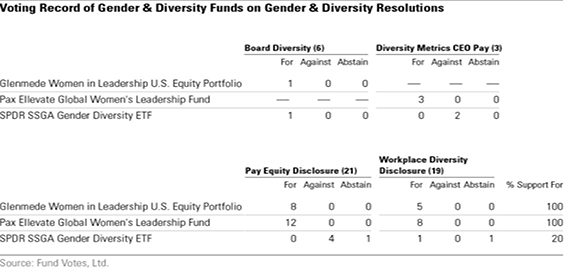

We took a closer look at the votes cast by the three gender-focused funds with a multiyear voting record--State Street’s SPDR SSGA Gender Diversity ETF, Glenmede’s Women in Leadership US Equity, and Pax Ellevate Global Women's Leadership Fund--to see how they voted across the 63 gender-related shareholder resolutions.

These three funds cast a total of 47 votes across 32 of the gender-related resolutions that came to a vote in 2016-18.

How the Funds Voted Pax Ellevate Global Women's Leadership Fund voted in support of all 23 gender and diversity resolutions on the ballots of portfolio companies over the past three years. Pax, a social-investment asset manager founded in 1971, has a voting history of strong support for shareholder resolutions addressing social and environmental issues. Pax World is itself a filer of social and environmental resolutions, including two of the gender-pay equity resolutions covered by this survey, occurring at Oracle and Mastercard, where it was one of the co-filers with Arjuna Capital.

Glenmede’s Women in Leadership US Equity voted affirmatively on all 14 gender and diversity resolutions it faced. Elsewhere across Glenmede’s portfolio of funds, 109 votes were cast on gender resolutions surveyed, with 53 cast for and 56 against. This suggests that the Women in Leadership portfolio votes separately from other Glenmede funds and that voting is guided by the fund’s stated objective to invest in companies with women in prominent roles.

Pax Ellevate Global Women’s Leadership Fund and Glenmede’s Women in Leadership US Equity both describe themselves in line with the way they vote.

Of the three gender diversity funds reviewed, the voting record for State Street's SPDR SSGA Gender Diversity ETF is the least supportive of shareholder resolutions addressing gender and diversity, which seems at odds with the investment objective stated in the fund's prospectus, namely, to invest in U.S. companies that "are leaders in advancing women through gender diversity on their boards of directors and in management." The March 2016 press release accompanying the index's launch went even further:

"SHE seeks to help address gender inequality in corporate America by offering investors an opportunity to create change with capital and seek a return on gender diversity."

State Street's campaign to promote board gender diversity was launched in March 2017 with the public placement of the "Fearless Girl" statue in New York and a call to companies in State Street's portfolios to increase the number of women on their corporate boards. The campaign has since been amplified by public statements around State Street's intention to use proxy voting power if companies fail to take action. State Street reports having engaged with a large number of companies over board diversity concerns and having voted against 581 companies' nominating committee chairs in 2018 where boards failed to add a female director.

Yet, State Street’s SPDR SSGA Gender Diversity ETF failed to support eight of the 10 gender and diversity shareholder resolutions voted on over the past three years, voting against six and abstaining on two. Notably, its SPDR SSGA Gender Diversity ETF failed to support any of the five pay equity disclosure resolutions--requesting boards to examine workforce gender-based pay gaps--and opposed both resolutions requesting the incorporation of senior management diversity metrics in CEO performance pay.

State Street applies the same voting policy to its Gender Diversity ETF as to its other funds. Across the suite of mutual funds and ETFs offered by State Street, excluding its Gender Diversity ETF, 891 votes were cast on the 63 gender-related resolutions that came to vote over the three-year period from 2016 to 2018. These were cast uniformly across all funds, supporting 12 resolutions, voting against 34, and abstaining on 17. As a firm, State Street voted in support of only 19% of the gender resolutions.

State Street's Gender Diversity ETF's trailing vote record can be attributed to State Street's stated preference for engagement over voting: "Our preference continues to be constructive engagement, and we only take voting action as a last resort," State Street Global Advisors CEO Cyrus Taraporevala wrote in 2018 on the company's web site.

Why Votes Matter Investment stewardship is the exercise, on behalf of fund beneficiaries, of the control rights inherent in investments. Under SEC rules, fund managers have a fiduciary duty to actively vote their proxies as part of this stewardship responsibility. Managers of mutual funds and ETFs are required to disclose these votes annually.

While good stewardship does not require that funds support every shareholder resolution, where the stated objective of a pool of funds is to promote gender diversity and equality, beneficiaries are likely to take a keener interest in proxy votes on resolutions such as those highlighted in this article.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click herefor a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/6f447f02-a11d-4e4f-90b0-42fa39383198.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7JIRPH5AMVETLBZDLUSERZ2FRA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/6f447f02-a11d-4e4f-90b0-42fa39383198.jpg)