30 Undervalued Stocks

Here are some of our analysts' best ideas across sectors.

What a difference one quarter can make: After a dismal close in 2018, the Morningstar U.S. Market Index was up more than 14% during the first quarter this year. As a result, bargains are harder to find today than they were just three months ago.

"From a bottom-up perspective, global equities are now only slightly undervalued," notes Dan Rohr, Morningstar's director of equity research for North America, in his quarter-end wrap-up. "The median stock across our 1,500-plus coverage now trades 4% below our fair value estimate compared with a 14% discount toward the end of 2018. Not surprisingly, we also see fewer compelling investment opportunities, with the number of 5-star stocks down by half since year-end."

Here are some undervalued stocks across sectors that are among our analysts' best ideas.

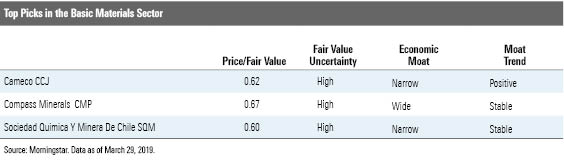

Basic Materials None of the stocks we cover in the basic materials sector are trading in 5-star range, notes sector director Andrew Lane in his quarterly update. Metals and mining and steel names are among the most overvalued pockets in the sector. The team is seeing some upside across its agriculture and building materials names, says Lane. A slowdown in new-home construction and existing-home sales has led to a sell-off in housing-related stocks, in particular.

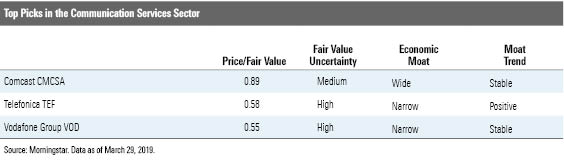

Communication Services Performance across the telecom sector has been uneven this year, reports sector director Mike Hodel in his quarter-end survey. Specifically, higher-yielding European names have taken it on the chin while lower-yielding firms elsewhere exhibited less volatility. "Despite this rocky performance, we continue to believe that Europe offers a particularly attractive hunting ground for value within our telecom coverage," asserts Hodel. Last, we think 5G wireless will be more evolutionary than revolutionary.

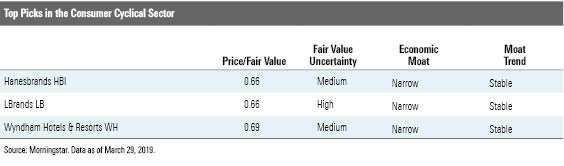

Consumer Cyclical The average consumer cyclical stock in our coverage universe trades at a 10% discount to our fair value estimate, say sector director Erin Lash and senior analyst Dan Wasiolek in their update. "Roughly 40% are 4- or 5-star-rated, with the auto, retail/apparel, travel and leisure, and entertainment industries trading at the most attractive valuations," they add. Specifically, we think firms exposed to e-commerce and China have an advantage going forward.

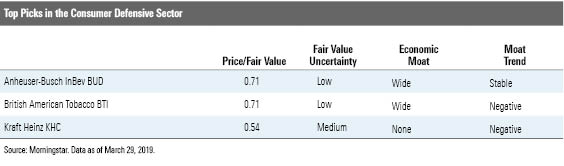

Consumer Defensive Despite concerns about heightened competition from large branded players, niche entrants, and private-label alternatives, the consumer defensive sector was about fairly valued at the end of the first quarter: The median stock was trading at just a 1% discount to our fair value estimate, reports sector director Lash in her quarter-end update. "We continue to view the tobacco industry as undervalued, with the entirety of our coverage remaining at a 4- or 5-star level as we think the market underappreciates opportunities in the heated tobacco space and has overreacted to the risk of a menthol ban in the U.S.," she adds.

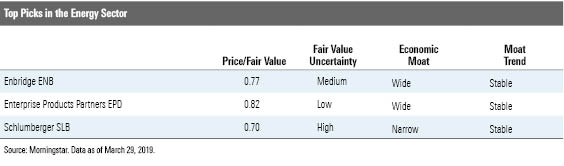

Energy Rising oil prices fueled the strength in energy stocks in the first quarter, says sector director Jeffrey Stafford in his quarterly commentary. Less than 2% of the energy stocks we cover are trading in 5-star territory. "With oil prices once again above our unchanged midcycle price of $55 per barrel, we see less value in oil-related stocks than we did at the beginning of the year," explains Stafford. We think the latest round of OPEC cuts will allow shale producers to increase production--and take market share.

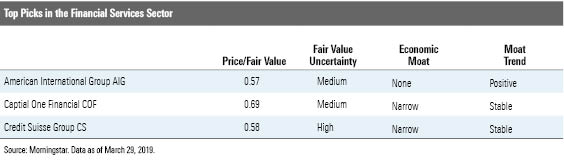

Financial Services In the financial-services sector, we're seeing the most value among banks, with about half of the names we cover trading in 4- and 5-star range, notes sector director Michael Wong in his review. "Compared with the previous quarter, we no longer see favorable risk-adjusted returns for asset managers," adds Wong. "There's 10% upside to the median price/fair value estimate of our asset management coverage after our coverage appreciated 11% in the previous three months."

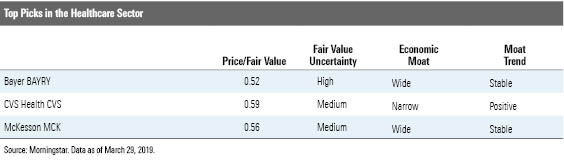

Healthcare The healthcare sector was fairly valued at the end of the first quarter, trading just 1% below our fair value estimate. Not surprisingly, there are few buys: Only 4% of our healthcare coverage universe is rated 5 stars, notes sector director Damien Conover in his update. Most of the 4- and 5-star names are drug manufacturers or healthcare providers. "In drug manufacturing, we believe the market is still ascribing too much valuation pressure on the industry due to potential negative drug pricing regulations," adds Conover.

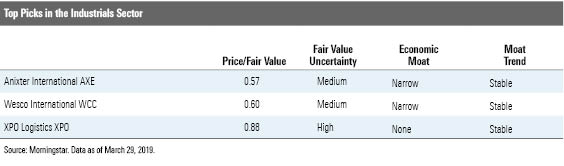

Industrials The industrials sector was trading at a slight 3% discount to our fair value estimate as of quarter-end, up from a 15% discount at the end of 2018, notes sector director Keith Schoonmaker in his quarterly review. The team is seeing upside in industrial distribution and logistics. "We expect distributors will leverage their selling, general, and administrative expenses to drive year-over-year operating margin improvements," he says. Moreover, most truckers are unlikely to match their rate gains in 2018, which has opened up opportunity as market valuations have corrected.

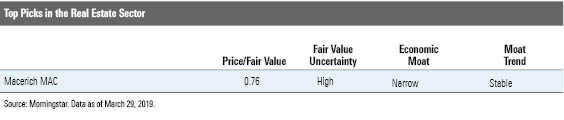

Real Estate Real estate is among the most fairly valued sectors today, with the average stock in our coverage universe trading at a 4% premium to our fair value estimate, says analyst Kevin Brown in his update. "Considering most of the names fall in the 3-star range, we see only a few attractively priced real estate companies and none trading at 5 stars," he notes.

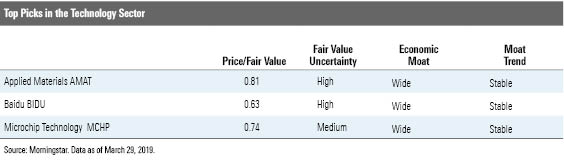

Technology Tech stocks snapped back in the first quarter after a dismal stretch in late 2018. As a result, the average tech stock in our coverage universe trades at just a 2% discount to fair value, says sector director Brian Colello in his latest update. "Despite the recent rally in tech and in semiconductors specifically, we still think semis are the most undervalued subsector in technology, as about 30% of our coverage is 4-star-rated or higher and the median chip stock is about 4% below our fair value estimate," he notes. The team also thinks online media is an attractive segment.

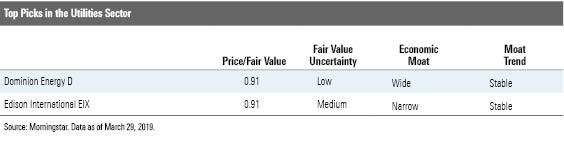

Utilities Trading at a 10% premium to our fair value estimate, the utilities sector is overpriced. Moreover, dividend yields remain near decade lows, points out sector strategist Travis Miller in his quarterly update. "For income investors, utilities' dividends have rarely looked so attractive," argues Miller. "U.S. utilities' 3.4% average yield is 90 basis points above the 10-year U.S. Treasury yield as of late March, a reliable buy signal." Further, we think these dividends are well-covered and set to grow more than 5% annually in the next three to five years, with some boasting dividend growth of 10% or more.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)