Do Tactical-Allocation Funds Deliver?

These funds haven't met performance expectations and are difficult to use in a broader portfolio.

A version of this article was published in the February 2019 issue of Morningstar ETFInvestor. Download a complimentary copy of Morningstar ETFInvestor by visiting the website.

Tactical-allocation funds aim to deliver better absolute or risk-adjusted returns than static allocation funds by deftly switching exposure among asset classes. Portfolio managers may evaluate the attractiveness of an asset class using signals such as relative valuations, price trends, economic indicators, sentiment analysis, or a combination of these metrics. Although this may seem like a fruitful area for active management, tactical allocation is hard, and most that try have failed. Sticking to a long-term strategic allocation is probably the most prudent course for most investors.

Tactical funds are tough to use because managers have wide discretion to change their asset allocations, which can lead to big fluctuations in their levels of risk. It is difficult to set risk/return expectations for a tactical fund and anticipate how it may behave relative to other funds. Ill-defined expectations can lead to bad behavior if investors add to funds after strong returns and take out money following poor returns.

According to Morningstar's Mind the Gap 2018 report, the average tactical fund's asset-weighted investor return lagged its total return by 1.96 percentage points annually over the 10 years through March 2018. The average return gap across all U.S. funds measured 1.37 percentage points over the same 10-year period.

In this article, I’ll examine the tactical fund landscape, see how performance has stacked up, and explore a do-it-yourself tactical-allocation strategy.

Tactical Fund Landscape To qualify for the tactical-allocation Morningstar Category, funds need to have exposure to stocks and bonds and demonstrate material shifts in sector and/or regional allocations over time. These funds resonated with investors after the financial crisis in 2008-09, as many investors believed they could offer better downside protection than traditional stock and bond strategies. Tactical-allocation category assets under management increased more than four-fold to $87.1 billion in April 2013 from $18.7 billion in February 2008, but that growth didn't last.

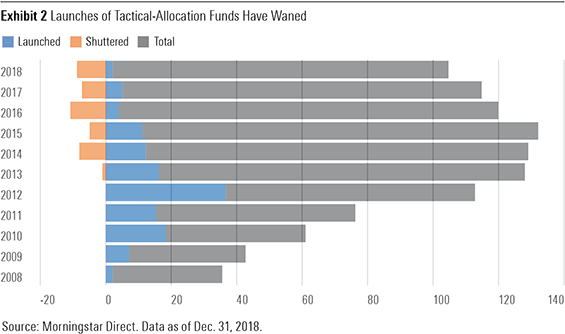

Easy Come, Easy Go The tactical-allocation category included 35 funds at the end of 2008. Asset managers launched more than 100 tactical-allocation funds in the United States between 2009 and 2015. They shuttered 57 funds between 2014 and 2018, and by the end of 2018, 103 funds remained in the category. The median shuttered fund lived for just 4.3 years.

Although the idea of having a team of managers expertly adjusting an asset allocation is a good story, these funds haven't delivered. I compared the returns of the tactical-allocation category average with Vanguard Balanced Index VBINX, which doesn't make tactical adjustments. This strategy allocates 60% of its assets to U.S. stocks of all sizes. It invests the remaining 40% in the Bloomberg Barclays U.S. Aggregate Float-Adjusted Bond Index, which represents the U.S. investment-grade bond market.

Over the past 15 years through December 2018, the average tactical-allocation fund returned 3.4 percentage points annually, lagging Vanguard Balanced Index by 3.2 percentage points per year with similar risk. This underperformance has been consistent, too. Vanguard Balance Index beat the tactical-allocation category average in every rolling three-year period during the trailing 12 years through December 2018.

The odds of finding a winner were low. Only 9% of tactical-allocation funds that were around at the end of 2008 went on to survive and outperform Vanguard Balance Index over the next 10 years.

Tactical funds didn't provide better downside protection either. During the 15 years through December 2018, the average fund in the tactical-allocation category tended to lose 5% more than Vanguard Balanced Index in months that the Vanguard fund posted negative returns.

Do-It-Yourself Tactical Timing Strategy Tactical funds haven't met performance expectations over the long haul. They're difficult to place in a portfolio and to stick with during turbulent markets. If the investing experts haven't been able to deliver results with tactical allocation, does the average retail investor stand a chance at tactically timing?

Finance professors Alan Moreira and Tyler Muir document a promising tactical strategy in a forthcoming paper in The Journal of Finance.[1] While the strategy works well on paper, it doesn't work as well without leverage, and trading costs may outstrip its benefits. The authors find that it pays to scale back exposure to the stock market during periods of turmoil because changes in volatility are not offset by proportional changes in expected returns. The idea is to move a portion of the investment in a fund to cash if its prior month's volatility is higher than its long-run average because you're not adequately compensated for shouldering the higher risk. If the volatility of the fund's returns during the prior month is lower than its average volatility, then stay fully invested in the fund.

The beauty of this tactical timing strategy is that it's simple to port across different funds and requires little data. In fact, Moreira and Muir show that this strategy works across a variety of strategies, from market-cap-weighted strategies to factor-based strategies like value or momentum. And it only requires daily fund prices to calculate daily returns and the volatility of those returns. The main drawback of this tactical timing strategy is that it works best when implemented with leverage to capitalize on low-volatility periods. Using leverage isn't realistic for most investors because the cost to borrow money to invest is steep.

I tested the tactical timing strategy using Vanguard Total Stock Market ETF VTI with and without leverage. VTI represents the investable U.S. stock market. Without leverage, the maximum position size for the tactical timing strategy is 100%. For the leveraged implementation, I set a maximum position size of 150%. I compared both tactical timing implementations with a buy-and-hold position in VTI.

From January 2004 through December 2018, the volatility-timed VTI strategy worked best when implemented with up to 150% leverage. Without leverage, the volatility timed VTI strategy offered slightly higher returns than the buy-and-hold VTI strategy with slightly less risk.

Another key consideration is that this back-test ignores the cost of borrowing money to leverage up the portfolio. For most investors, the leveraged option of this strategy isn't feasible. This performance data also ignores transaction costs and the tax implications of trading more frequently than a buy-and-hold strategy. After accounting for these real-world considerations, the edge from the nonleveraged volatility-timing strategy is likely wiped out.

Stop Tinkering Tactical funds haven't met performance expectations, are difficult to use in a broader portfolio, and may be tough to stick with during market rough patches. Do-it-yourself strategies that appear attractive on paper may not work as well in the real world after removing leverage and taking transaction costs (including taxes) into account.

Tactical investing is hard and most who try it fail. For most investors, the best bet is to stick to a suitable long-term asset allocation.

[1] Moreira, A. & Muir, T. 2016. "Volatility-Managed Portfolios." The Journal of Finance. https://ssrn.com/abstract=2659431

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/64dafa24-41b3-4a5e-aade-5d471358063f.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)