Tax-Deferred Retirement-Saver Portfolios for Minimalist Investors

Too busy to mind your portfolio? Three basic building blocks provide you with all the diversification you need.

Maintaining multiple investment accounts is a necessary evil for most of us—you might have IRAs, company retirement plans, and taxable accounts, and you can multiply those by two if your partner has accounts of their own. Within those accounts, however, it’s valuable to keep things as streamlined as possible. The key reason is to limit your oversight responsibilities to help you focus on the parts of your investment program that can really move the needle—namely, your savings rate and your asset allocation.

The most streamlined strategy of all is to employ a good-quality target-date fund and call it a day. Alternatively, you could employ simple index funds or exchange-traded funds as building blocks, as in the portfolios below. In contrast with an all-in-one fund strategy, employing multiple funds allows you to exert some control over your asset allocation, customizing your portfolio’s risk level to suit your situation. Employing very cheap products will help reduce your portfolio’s costs to the bare minimum and enhance your take-home return. And by using just a few funds that provide broadly diversified market exposure in a single shot, you can readily see where you need to make adjustments.

About the Portfolios

The portfolios below are designed to show investors how they might invest their tax-deferred accounts (for example, their IRAs and company retirement plan assets) in a way that’s diversified but also streamlined. Because they’re geared toward investors’ tax-sheltered accounts, they’re managed without regard for tax efficiency.

The portfolios’ allocations are loosely based on Morningstar’s Lifetime Allocation Indexes. I’ll employ a strategic (that is, long-term and hands-off) approach to asset allocation; I’ll make changes to the holdings only when individual holdings encounter fundamental problems or changes, or if they no longer rate as Morningstar Medalists.

How to Use Them

My key goal with these model portfolios is to depict sound asset-allocation and portfolio-management principles rather than to shoot the lights out with performance. That means that investors can use them to help size up their own portfolios’ asset allocations and sub-allocations. Alternatively, investors can use the portfolios as a source of ideas in building out their own portfolios.

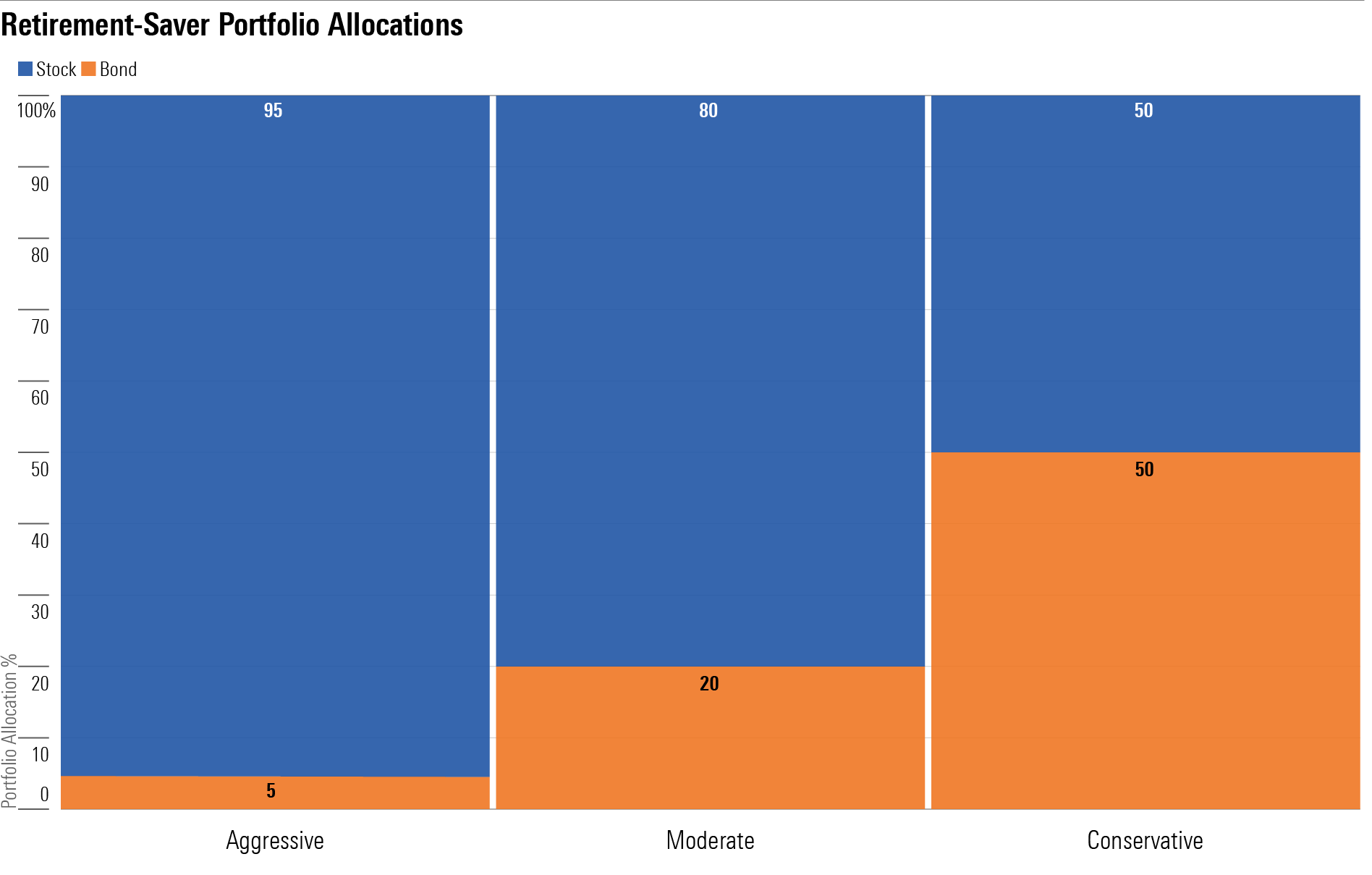

The portfolios vary in their amounts of stock exposure and, in turn, their risk levels. The Aggressive Portfolio is best suited to a younger investor with many years until retirement, whereas the Conservative portfolio is geared toward still working individuals who expect to retire within the next few years. The Moderate portfolio falls between the two.

Investors should bear in mind their own risk tolerances as well as their proximity to retirement when selecting an allocation mix. Young investors who are risk-averse and haven’t yet lived through a major equity downdraft may prefer to use the Moderate portfolio. Meanwhile, older investors who know they can handle some volatility and will be able to rely on a pension for most of their living expenses could reasonably use the Moderate or even Aggressive portfolio, even if retirement is close at hand.

Retirement-Saver Portfolio Allocations

Aggressive Tax-Deferred Retirement-Saver Portfolio for Minimalist Investors

Anticipated Time Horizon to Retirement: 35-40 years

Risk Tolerance/Capacity: High

Target Stock/Bond Mix: 95/5

- 55% Vanguard Total Stock Market Index VTSAX, VTI

- 40% Vanguard Total International Stock Market Index VTIAX, VXUS

- 5% Vanguard Total Bond Market Index VBTLX, BND

Moderate Tax-Deferred Retirement-Saver Portfolio for Minimalist Investors

Anticipated Time Horizon to Retirement: 20-25 years

Risk Tolerance/Capacity: Moderate

Target Stock/Bond Mix: 80/20

- 48% Vanguard Total Stock Market Index VTSAX, VTI

- 32% Vanguard Total International Stock Market Index VTIAX, VXUS

- 20% Vanguard Total Bond Market Index VBTLX, BND

Conservative Tax-Deferred Retirement-Saver Portfolio for Minimalist Investors

Anticipated Time Horizon to Retirement: 2-5 years

Risk Tolerance/Capacity: Low

Target Stock/Bond Mix: 50/50

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)