11 Exceptional Small-Cap Funds

These Gold-rated mutual funds and ETFs provide exposure to the strongest-performing part of the equity market this year.

Small-company stocks are flying higher than Captain Marvel.

The Morningstar US Small Cap Core Index is ahead of its large-cap counterpart for the year to date by 4 percentage points as of this writing. Large caps pull ahead over the trailing three- and five-year periods, though. That longer-term outperformance may suggest that small caps have more catching up to do.

We're not suggesting everyone adds a small-cap fund to their portfolios, though. In fact, you may already have plenty of exposure to small-company stocks through your core equity fund holdings; Morningstar's Instant X-Ray feature can help you determine your portfolio's current small-cap stake. While there's no "right" allocation to small-company stocks, Morningstar's Lifetime Allocation Indexes (which you can use to benchmark your asset allocation) suggest up to an 11% position in domestic small caps, depending on your life stage.

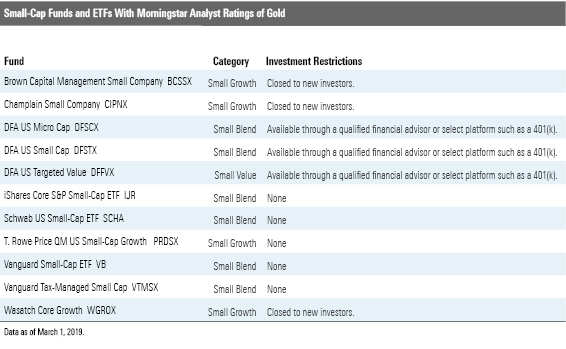

But if you are in the market for small-cap exposure--either because you’re light in the area or you think small caps have momentum--we have some ideas for you. We’ve screened for mutual and exchange-traded funds that earn our top Morningstar Analyst Rating of Gold. We expect these funds to outperform over a full market cycle. Eleven funds make the grade.

- source: Morningstar

Several mutual funds on the list are closed to new investors. That’s not uncommon among actively managed small-cap funds: In order to be able to continue to invest effectively in this part of the market, active funds focusing on smaller fare sometimes limit their asset sizes. Those interested in open, actively managed small-cap funds will need to look beyond our highest rating to Silver- and Bronze-rated options. Morningstar Premium Members can gain access to a complete list of all Morningstar Medalist mutual funds in the small-cap category

. And

’s where Premium Members can find a list of all medalist ETFs.

Here’s a little bit about three of the funds from the Gold-rated list that are widely available.

T. Rowe Price QM US Small-Cap Growth Equity

PRDSX

"Quantitatively driven T. Rowe Price QM U.S. Small-Cap Growth Equity is an excellent option for investors seeking low-priced exposure to the MSCI U.S. Small Cap Growth Index. Portfolio manager Sudhir Nanda has been a member of T. Rowe’s quantitative equity group since 2000. He brings a wealth of experience to the strategy and is further supported by nine quantitative analysts and a five-member dedicated IT team. The team is expected to grow in the near term as it has taken on additional responsibility. Additionally, T. Rowe’s group of fundamental analysts can be used as needed. Resources are sufficient at this strategy and have scaled well in response to a growing product lineup.

"The strategy uses a disciplined approach that systematically ranks names within the fund’s investable universe based on three broad metrics: valuation, profitability coupled with capital allocation and earnings quality, and momentum. Valuation accounts for 40%-45% of the score, quality 35%-40%, and the remainder in momentum. Given the relatively low emphasis on momentum, the fund’s resulting turnover is well below the small-growth Morningstar Category peer average, which is a positive for investors. Further, the team typically invests in about 300 names. The diverse portfolio, coupled with a low-turnover approach, afford this strategy greater capacity than its typical peer.

"The fund has been remarkably consistent from October 2006 through March 2018. It outperforms its peers 100% of the time based on rolling three-, five-, and 10-year returns. The team’s ability to outperform on an absolute basis while taking on less risk than its bogies can be attributed to their thoughtful approach. Specifically, security selection has driven performance, and the disciplined portfolio construction process has helped keep risk in check.

"Finally, fees are low, which means the team faces a lower hurdle to produce alpha for investors. For investors seeking small-cap exposure, this is a great option that we expect will continue to deliver over the long term; it is deservedly upgraded to a Morningstar Analyst Rating of Gold."--Linda Abu Mushrefova, Analyst

Schwab US Small-Cap ETF

SCHA

"Schwab U.S. Small-Cap ETF is among the best U.S. small-cap funds available. This well-diversified, market-cap-weighted exchange-traded fund maintains an edge over its Morningstar Category peers by efficiently tracking a well-constructed index at a low fee. It earns a Morningstar Analyst Rating of Gold.

"The fund targets U.S. small-cap stocks by tracking the market-cap-weighted Dow Jones U.S. Small-Cap Total Stock Market Index. This index represents the smallest 15% of U.S. stocks by market cap and accurately represents its peers' opportunity set. Small-cap stocks offer diversification benefits and greater potential returns than large-cap stocks, but are also riskier. The fund's broad reach and market-cap-weighting approach help it effectively diversify risk while keeping costs down by mitigating turnover, which has consistently been among the lowest in the category.

"By using market cap to weight its holdings, the fund relies on the cumulative knowledge incorporated in stock prices to size its positions. While market participants have done a good job valuing stocks over the long term, the market has gone through episodes of mania and panic. But this risk is worth the cost advantage gained from market-cap-weighting. Market-cap-weighted index funds are cheaper to run than most actively managed funds because they require fewer investment personnel and their low turnover translates to low transaction costs.

"The index that the fund tracks augments its cost advantage. Because there is less money tied to it, the trading impact on the price of the stocks it adds or removes during reconstitution is lower than price impact of more-popular indexes like the Russell 2000 Index. And unlike the Russell 2000 Index, this index uses buffer rules to mitigate unnecessary trades and transaction costs.

"From its November 2009 inception through June 2018, the fund topped the category average by 1.5 percentage points annually with similar risk. Much of this outperformance can be attributed to the fund's low-cost advantage. Because this index fund is always fully invested, it will suffer the full brunt of market downturns, but its smaller cash drag will pay off during bull markets."--Adam McCullough, CFA, Analyst

Vanguard Small-Cap ETF

VB

"Vanguard Small-Cap ETF VB is one of the best U.S. small-cap funds available. This well-diversified fund generates a sustainable edge over its category peers by efficiently tracking a soundly constructed benchmark at a low fee. It earns a Morningstar Analyst Rating of Gold.

"The fund tracks the CRSP U.S. Small Cap Index, a market-cap-weighted index that targets U.S. stocks that fall between the smallest 85%–98% as ranked by market cap and accurately represents the small-cap segment. Most of these small-cap names haven’t established durable competitive advantages and tend to be riskier than their large-cap counterparts. But this fund’s broad reach helps it effectively diversify firm-specific risk. Market-cap weighting relies on the information aggregated in stock prices to weight its holdings. Most of the time, the risks of portfolio concentration that may sully index funds are more than offset by the cost advantage and efficiency gained from market-cap-weighting.

"The fund layers two more advantages on top of the inherent efficiency of market-cap weighting that reduce its transaction costs. It invests in larger stocks than many of its category peers. These stocks tend to be more liquid and less expensive to trade than their smaller counterparts. And its index employs generous buffering rules, waiting until stocks are solidly in an adjacent size segment before trading them. It moves only half of the position at a time and spreads the trade across five days to further reduce market impact costs. The fund’s average 10-year turnover of 15% is less than a fourth of the turnover for the average fund in the small-cap blend Morningstar Category.

"During the trailing decade through June 2018, this fund bested the category average by 2.4 percentage points per year with similar volatility. Much of this relative outperformance can be attributed to the fund's cost advantage and the efficiency of market-cap weighting. Because this index fund is always fully invested, it suffered a larger drawdown than the category average during the financial crisis. But its smaller cash drag pays off during bull markets."--Adam McCullough, CFA, Analyst

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)