Communication Services: 5G Wireless Will Prove More Evolutionary Than Revolutionary

Hefty yields permeate European telecom stocks.

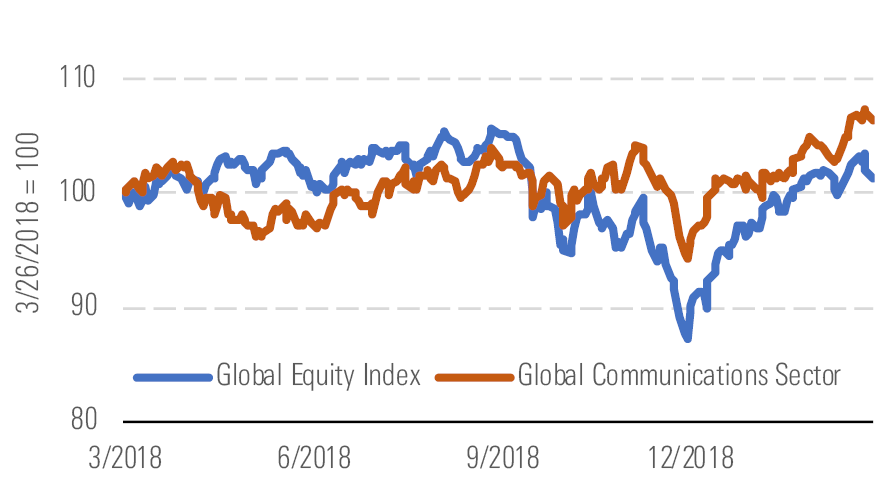

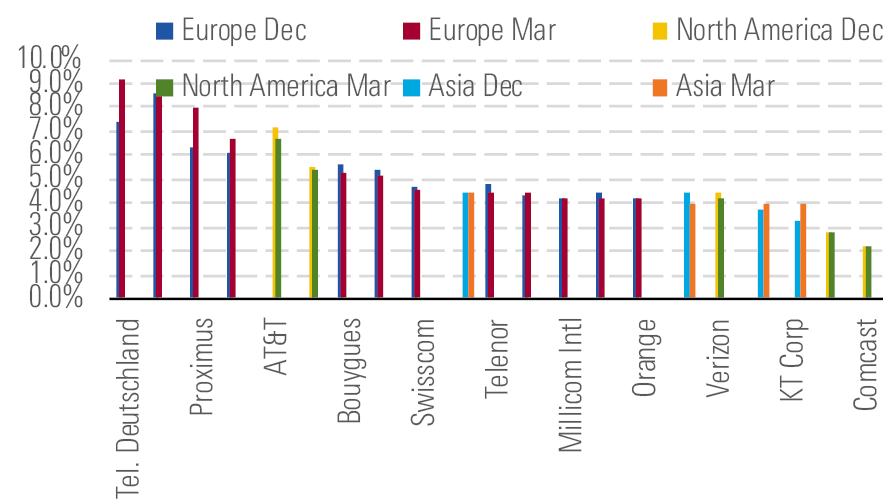

After faring far better than the broader stock market during the sharp sell-off in late 2018, the Morningstar Global Communications Index has increased only about 10% so far during the first quarter, similar to the 11% return of the market in the same period. Performance across the telecom sector has been uneven, though, as a handful of high-yielding European stocks declined significantly and firms elsewhere, with generally lower yields, showed less volatility. Despite this rocky performance, we continue to believe that Europe offers a particularly attractive hunting ground for value within our telecom coverage.

In choppy markets, telecom generally offers a smoother ride - source: Morningstar Analysts

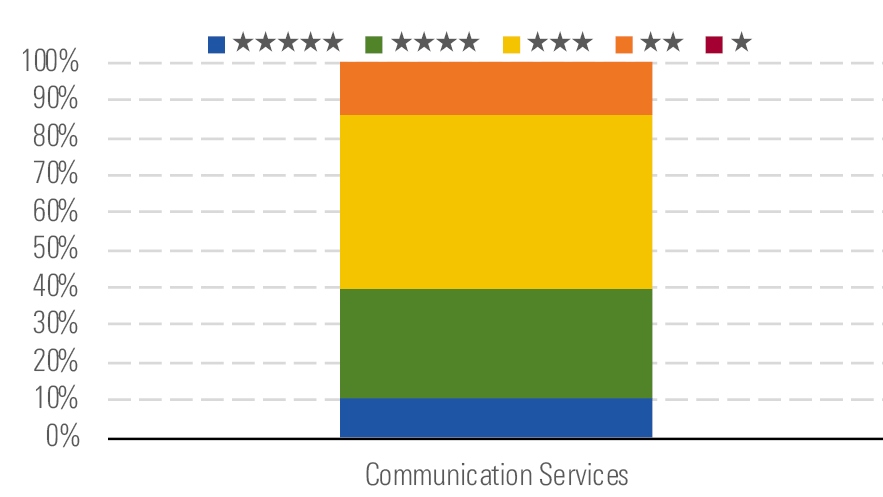

Complexity and minimal 5G hype have created opportunities in Europe - source: Morningstar Analysts

Excitement around 5G wireless technology has steadily built in recent months, with the first 5G-capable mobile devices hitting the market and initial in-home wireless broadband trials, notably at Verizon, ramping up. We remain 5G skeptics. Most carriers globally, including those in the U.S., plan to deploy 5G within the scope of their current capital spending budgets. We believe this means that true high-capacity 5G coverage will be limited primarily to those areas where carriers happen to have infrastructure today or in extremely dense pockets of network demand, like urban cores.

Verizon’s 5G relies heavily on very-high-frequency millimeter wave spectrum, which allows signals to travel only short distances. Thus, building high-capacity fiber-optic networks to increase the density of wireless base stations is critical. Verizon plans to have built 25,000 miles of fiber by the end of 2019, but this pales in comparison to the density of a traditional fixed-line network. Comcast, for example, claims to have 150,000 miles of fiber and 650,000 miles of total plant in its network, which primarily serves residential areas and covers less than half the country.

In the U.S., in particular, we expect 5G will allow carriers to meet growing network demand and add incremental uses for the wireless network, but we don’t expect a revolution in the wireless business. To truly capture the benefits of 5G, we believe integrated fixed-line and wireless operations have the most promise. On this front, several carriers in Europe are well ahead of their U.S. counterparts.

Several of the highest dividend yields have headed higher still - source: Morningstar Analysts

Top Picks

Telefonica TEF

Star Rating: 5 Stars

Economic Moat: Narrow

Fair Value Estimate: $14.50

Fair Value Uncertainty: High

Telefonica is leading the European communications market into converged services. Additionally, it is laying extensive amounts of fiber to better compete with cable operators in providing fixed broadband services. It acquired E-Plus in Germany and GVT in Brazil, which strengthens its position in both countries and provides lots of opportunities for cost savings. We don't believe the market appreciates how well the firm is positioned or its margin expansion opportunities, which has caused its stock to trade at a wide discount to our fair value estimate.

Vodafone Group VOD

Star Rating: 5 Stars

Economic Moat: Narrow

Fair Value Estimate: $33

Fair Value Uncertainty: High

Vodafone is one of the largest wireless carriers in the world. While the firm has had issues in some countries, such as India and Italy, it is increasing local-currency revenue in most markets. The company has been focused on moving from a wireless-only provider to a converged operator. In Europe, fixed-line telecom services now account for about 30% of revenue. On the wireless side, Vodafone continues to transition customers to smartphones and 4G technology, both of which generally lead to higher data usage and higher revenue. The stock yields more than 8%, and we believe the dividend is safe.

Comcast CMCSA

Star Rating: 4 Stars

Economic Moat: Wide

Fair Value Estimate: $45

Fair Value Uncertainty: Medium

We believe Comcast is very well-positioned competitively thanks to the strength of its core cable networks and its solid media franchises. The firm has been able to steadily increase data speeds and capacity over the past decade with very modest network investment. We expect technology evolution will allow Comcast to continue meeting customer needs and gradually expand into the wireless market over the next several years. The television business will continue to evolve, but we believe a strong broadband business and solid content creation capabilities at NBC Universal will enable Comcast to meet this challenge.

/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)