Stock Market Outlook: Scarce Opportunities, but Pockets of Value Remain

The financial services sector is the most undervalued, with banks offering particularly attractive opportunities.

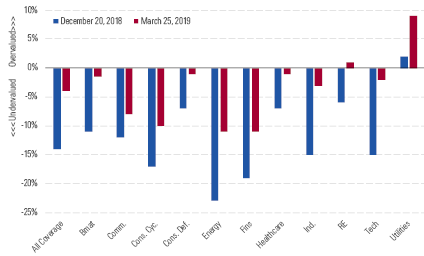

The Morningstar Global Markets Index climbed 11% in the first quarter to March 25, recovering nearly all the ground lost in the fourth quarter of 2018. From a bottom-up perspective, global equities are now only slightly undervalued. The median stock across our 1,500-plus coverage now trades 4% below our fair value estimate compared with a 14% discount toward the end of 2018. Not surprisingly, we also see fewer compelling investment opportunities, with the number of 5-star stocks down by half since year-end.

- The growing scarcity of strong buys is particularly evident in technology, following the sector's 16% year-to-date gain. As of March 25, no technology sector stocks carry our 5-star rating.

- Opportunities are comparably abundant in technology's sister sector, communications services. Europe is a particularly attractive hunting ground for value in this sector.

- Financial services ranks among the most undervalued sectors. Valuations are especially attractive in banking. The median bank trades at roughly 15% below our fair value estimate, with discounts generally greater outside the United States.

Opportunities Are Scarcer, but Pockets of Value Remain - Source: Morningstar. Data as of March 25, 2019.

Full Quarter-End Coverage

Communication Services: 5G Wireless Will Prove More Evolutionary Than Revolutionary

Technology: Semiconductors the Most Attractive Tech Subsector

Financial Services: Interest-Rate Expectations Have Pressured Performance

Energy: Stocks, Oil Prices Have Rebounded, but Some Opportunities Remain

Healthcare: Stock-Picking Increasingly Important

Industrials: Attractive Opportunities in Industrial Distributors

Utilities: Valuations Near Peak, but Dividend Yield, Growth Are Tough to Pass Up

Consumer Defensive: Brand Investments Are Key

Consumer Cyclical: Firms Exposed to E-Commerce, China Have Advantage

Basic Materials: Few High-Upside Investment Opportunities

Real Estate: Firms Sensitive to Interest Rates in Short Term, but Less So in Long Term

/s3.amazonaws.com/arc-authors/morningstar/ecf6f262-5697-406a-a91d-cd20ff52a617.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ecf6f262-5697-406a-a91d-cd20ff52a617.jpg)