Healthcare: Stock-Picking Increasingly Important

Drug manufacturers and healthcare providers offer the most upside.

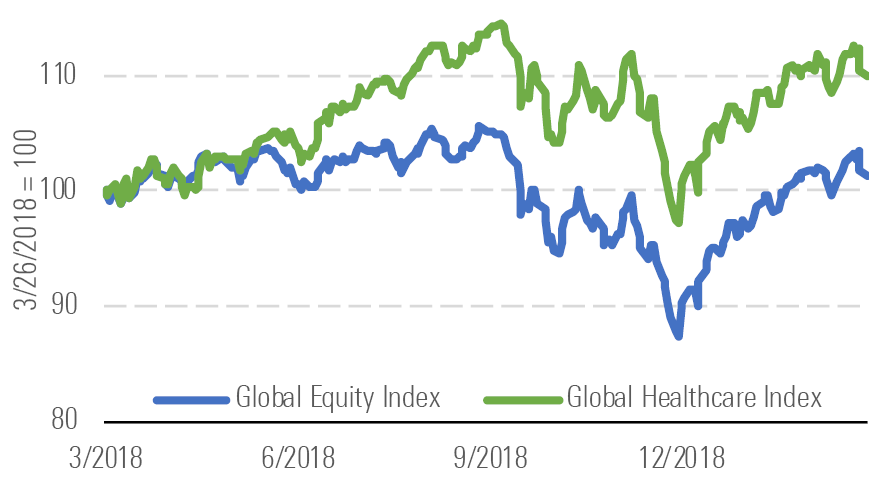

Morningstar's Global Healthcare Index has increased 10% over the trailing 12 months amid diminishing market concern around healthcare pricing pressures, outperforming the broader global equity market performance of 1%. Also, as overall concern about the strength of the global economy has risen, healthcare is generally viewed as a safer sector, potentially adding to its relative outperformance.

Healthcare sector index vs. market index - source: Morningstar Analysts

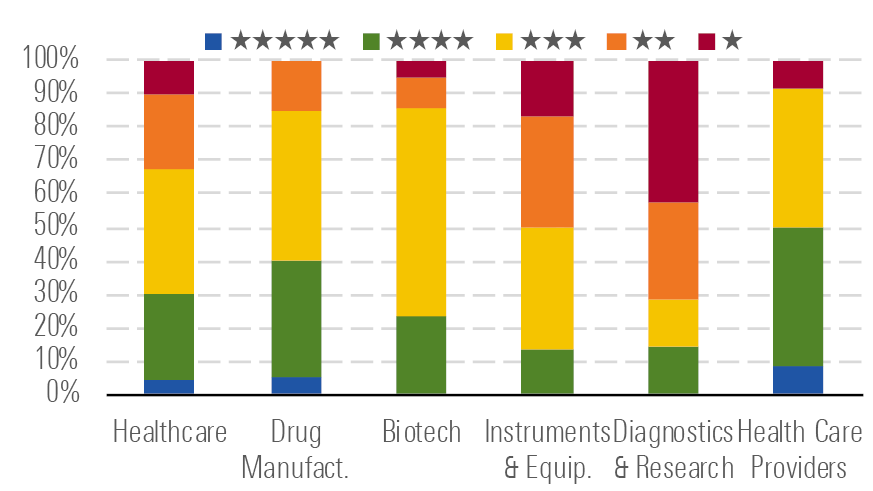

Overall, we view the healthcare sector as fairly valued. Our coverage trades in line with our overall estimate of intrinsic value, with the median price/fair value at 0.99. Given the current fair valuation in the space, we only see a few buys, with only 4% of our coverage rated 5 stars.

Most 4- and 5-star healthcare stocks reside in the drug manufacturing and healthcare provider industries. In drug manufacturing, we believe the market is still ascribing too much valuation pressure on the industry due to potential negative drug pricing regulations.

Star rating distribution and average P/FV for sector and key industries - source: Morningstar Analysts

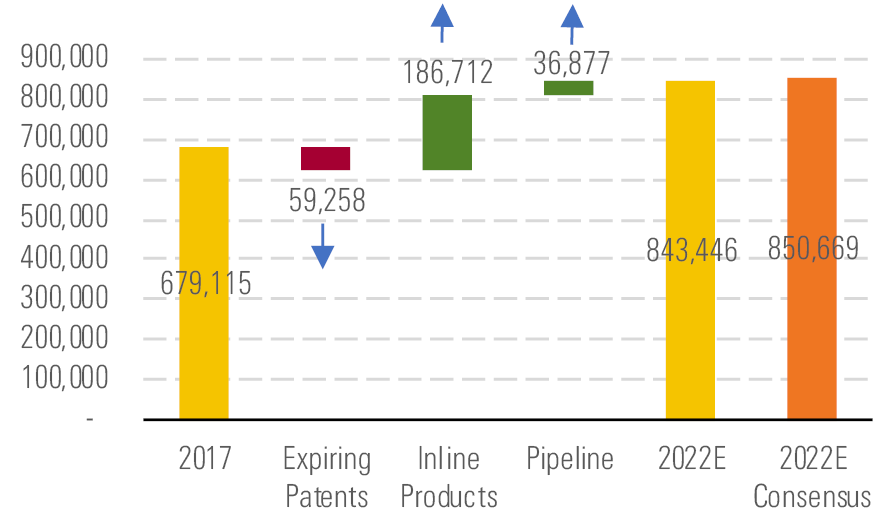

In looking at our projected sales outlook for the Big Pharma and biotech companies, we expect recently launched in-line products and new pipeline drugs will more than offset drug sales lost to generic competition. Overall, we expect the similar modest overall drug pricing pressures of the recent past to continue, but innovative drugs should continue to secure steady pricing power.

Big Biotech and Big Pharma growth outlook through 2022E ($ millions) - source: Morningstar Analysts

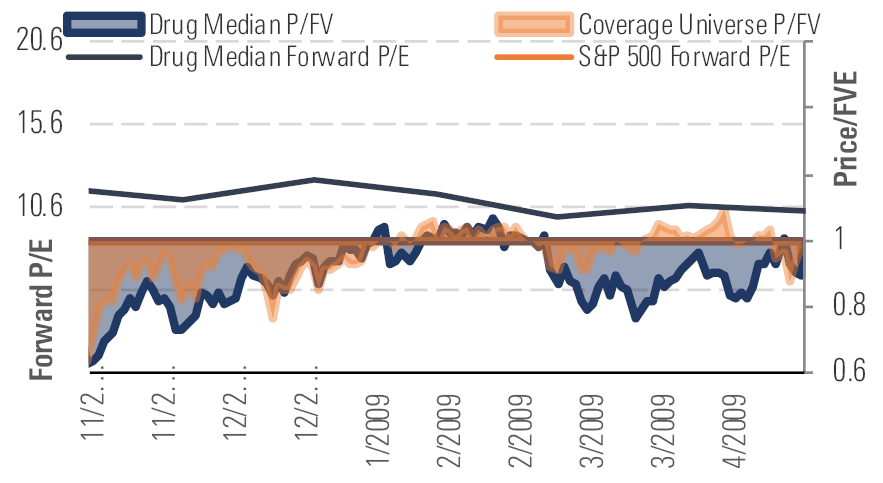

All our valuations are based on discounted cash flow analysis, but looking at a P/E trend, the drug stocks look more expensive than the bargain basement prices of 2010, but less expensive than 2014 (before pricing pressures became more of a concern).

Valuation versus the P/E multiple over the last 10 years - source: Morningstar Analysts

We think the healthcare provider market is overly concerned about potential regulatory changes to pricing. This is especially true in the dialysis industry, where we expect pricing to hold up and drive increased valuations for the leading companies.

Consolidation continues as a major theme, and we expect further deals to emerge over the remainder of the year. The increasing importance of scale on the service side and the need for continued innovation on the drug and device side are driving many acquisitions, a trend that should continue for several years.

Top Picks Bayer BAYRY

Star Rating: 5 Stars

Economic Moat: Wide

Fair Value Estimate: $31

Fair Value Uncertainty: High

Despite increasing concern about litigation against Bayer's glyphosate business, we believe the company will navigate the legal challenges with much less damage than the market expects. We believe the support by key regulatory agencies and a large amount of scientific studies showing no causal relationship between glyphosate and cancer will lead to Bayer prevailing in the legal cases. Further, largely on the basis of the strong competitive advantages of the healthcare group and to a lesser extent on the crop science business, we believe Bayer has created a wide economic moat that supports steady cash flows that will drive valuation.

CVS Health CVS

Star Rating: 5 Stars

Economic Moat: Narrow

Fair Value Estimate: $92

Fair Value Uncertainty: Medium

CVS' ownership of the largest national pharmacy benefit manager provides it substantial negotiating leverage and cost advantages in claims processing, allowing for best-in-class operating costs per claim. Further, its combination with Aetna should put it in a much more attractive competitive position as the industry shifts toward more integrated offerings. Last, investors should benefit from meaningful cost and selling synergies associated with the combination of a leading medical benefits business with the largest PBM and retail pharmacy network in the country.

McKesson MCK

Star Rating: 5 Stars

Economic Moat: Wide

Fair Value Estimate: $210

Fair Value Uncertainty: Medium

McKesson should remain an essential link in the pharmaceutical supply chain despite several headwinds pressuring the firm's operations and stock. The loss of material volume as a result of customer consolidation, slowly branded drug price inflation, a mix shift toward specialty drug products that are costlier to distribute, and increased competition for small/independent pharmacy market share have created significant near-term uncertainty for the drug distributor. However, we believe these are near-term issues that McKesson can offset with its strong positioning in the drug supply chain.

MORN DODFX VINIX VWILX TSVA EGO WU Brightstart429plan MRO VZ MOAT T NKE CMCSA GOOG

/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BC7NL2STP5HBHOC7VRD3P64GTU.png)