Financial Services: Interest-Rate Expectations Have Pressured Performance

About half of our banking coverage is trading at 4 or 5 stars.

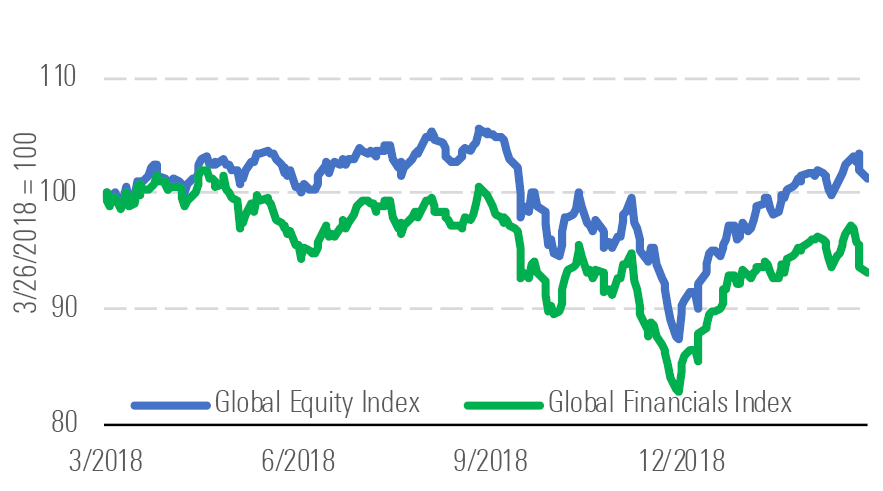

The Morningstar Global Financial Services Index has underperformed the Morningstar Global Markets Index over the previous year (negative 7% compared with 1%) and has underperformed in the previous three months (8% compared with 11%). We attribute most of the underperformance in the financial sector over the past year to moderating expectations for higher interest rates, which primarily affects banks and companies that earn interest on securities portfolios, and the general decrease in asset prices, which affects companies that have fee-based assets, like asset managers and wealth management firms.

Lower rate expectations and asset prices are to blame - source: Morningstar Analysts

Currently, we see the most value in the banking industry, with around half of our banking coverage trading at 5 or 4 stars. The median bank that we cover has approximately 15% upside to its fair value estimate, and we believe that European and Asia-Pacific banks are trading at more attractive valuations than North and South American banks. Compared with the previous quarter, we no longer see favorable risk-adjusted returns for asset managers. There's 10% upside to the median price/fair value estimate of our asset management coverage after our coverage appreciated 11% in the previous three months.

Banks look the most attractive - source: Morningstar Analysts

Expectations for rising interest rates have dramatically moderated. CME Group's FedWatch tool suggests around a 70% probability that the target U.S. federal-funds rate won't change in 2019 and a 30% probability that there will be a rate cut. This compares with an over 50% probability of a target rate higher than its current range of 2.25% to 2.5% as recently as November 2018.

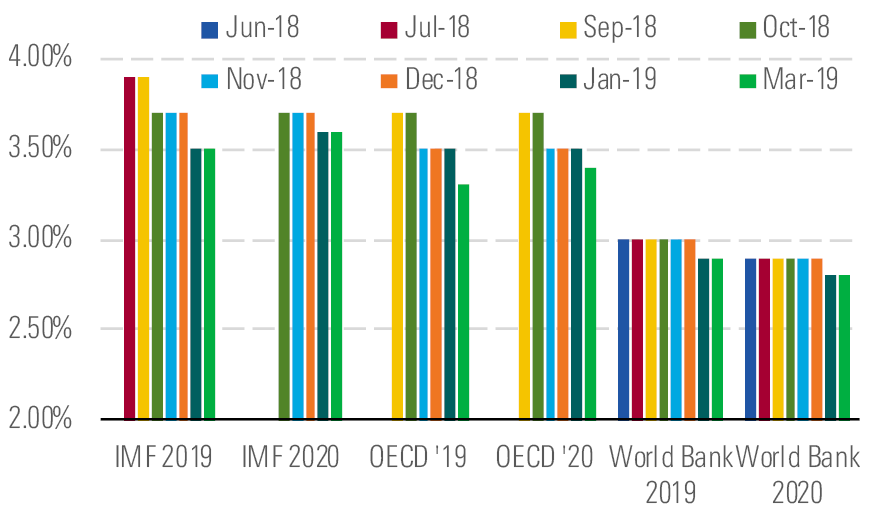

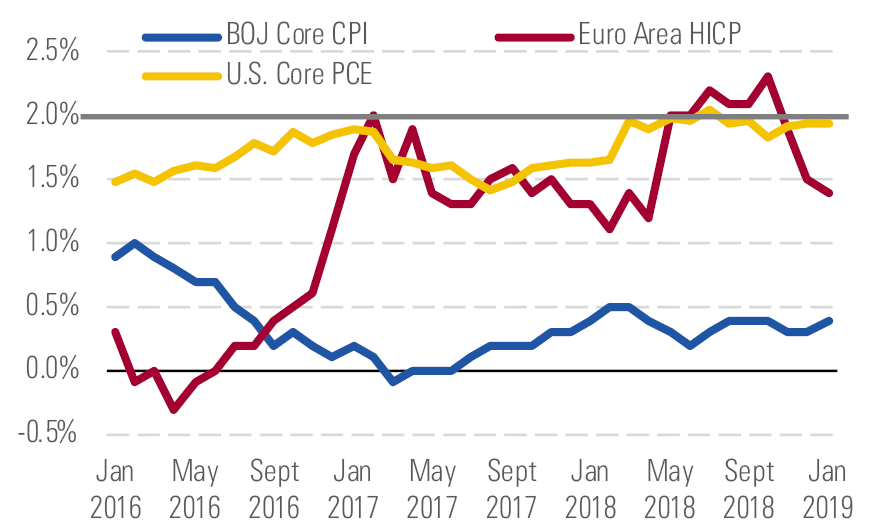

Amid a softer and more uncertain economic backdrop, central bankers have generally enumerated a data-dependent stance to raising interest rates and a concern for external factors, such as shocks from a potential trade war. Global GDP forecasts have trended lower and inflation remains under 2% across major developed markets, which forestall the need to raise interest rates to address an overheating economy.

Global GDP forecasts have been trending downwards - source: Morningstar Analysts

Inflation is below the 2% target in multiple major markets - source: Morningstar Analysts

Top Picks American International Group AIG

Star Rating: 5 Stars

Economic Moat: None

Fair Value Estimate: $76

Fair Value Uncertainty: Medium

We believe CEO Brian Duperreault is a good fit for solving AIG's main operational issue: commercial property-casualty insurance underwriting. He was a primary architect behind peer Chubb's strong franchise that has generated industry-leading underwriting margins, and he has pledged that AIG will generate an underwriting profit in 2019. We see no structural issues in its core operations, and AIG is gradually trending toward peer results. The current market price equates to about 0.65 times book value, a level that implies a long period of very poor returns, which is more of a worst-case scenario.

Capital One Financial COF

Star Rating: 5 Stars

Economic Moat: Narrow

Fair Value Estimate: $119

Fair Value Uncertainty: Medium

Investors seem to be concentrating on the recent decline in interest rates and fears surrounding economic growth and applying it across all banks regardless of interest-rate sensitivity or growth prospects. Though economic growth would weigh on Capital One, investors should take comfort that the company’s open-source software strategy should help the company win market share. Capital One’s victory in winning Walmart is important. To us, it signals that businesses are looking at a bank’s technological competency when deciding financial institutions with which to partner. We believe Capital One is years ahead of its competitors.

Credit Suisse Group CS

Star Rating: 5 Stars

Economic Moat: Narrow

Fair Value Estimate: $20

Fair Value Uncertainty: High

Narrow-moat Credit Suisse is one of the few European banks that we believe can generate a midcycle level of profitability in excess of its cost of capital. It has a strong presence in the lucrative ultra-high-net-worth investor market. We believe that the high-touch service and complex needs of ultra-high-net-worth individuals lead to high switching costs.

/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ROHC7ZXJXZU7LIKGTTYJTD667I.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)