Consumer Defensive: Brand Investments Are Key

Tobacco stocks present an underappreciated opportunity.

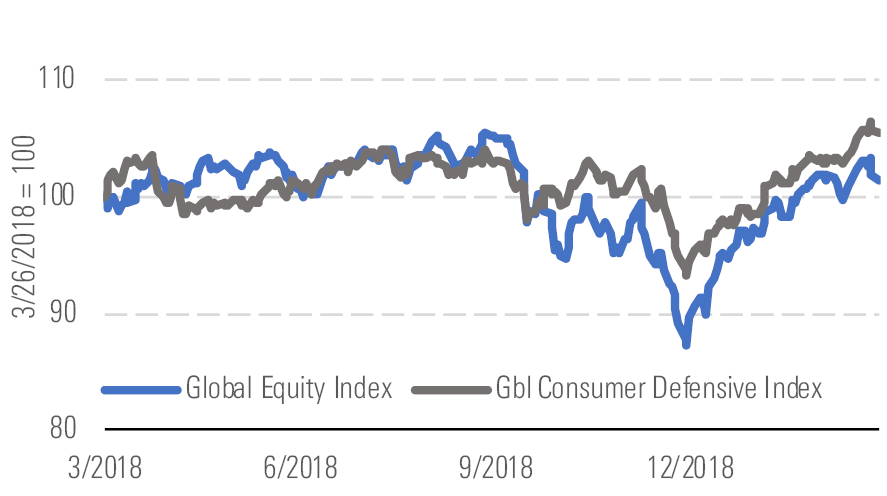

The Morningstar Global Consumer Defensive Index has recovered in line with the global equity market, up 10% in 2019 versus a nearly 11% increase for the broader market, despite concerns about heightened competition from large branded players, niche entrants, and private-label alternatives. The 5.5% return on consumer defensive shares over the last year compares favorably to the 1.4% increase in the overall market.

Sector performance has lagged the market - source: Morningstar Analysts

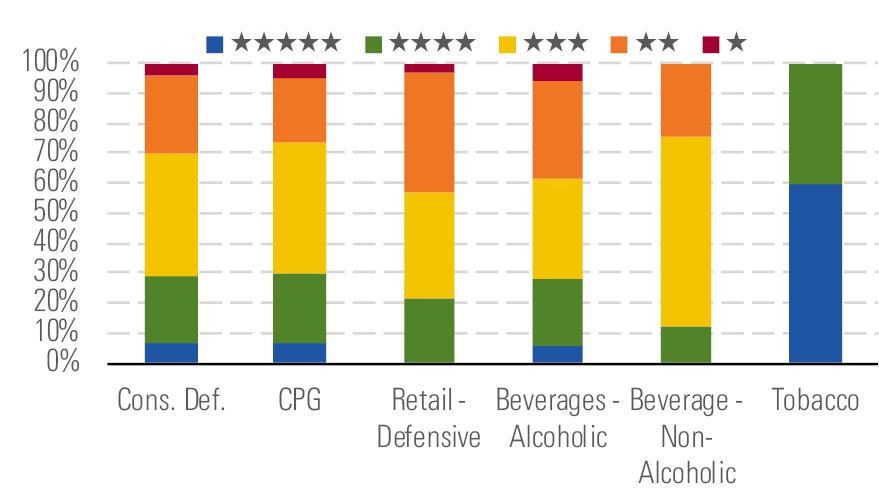

The median stock we cover trades at just a 1% discount to our valuation, but we continue to view the tobacco industry as undervalued, with the entirety of our coverage remaining at a 4- or 5-star level as we think the market underappreciates opportunities in the heated tobacco space and has overreacted to the risk of a menthol ban in the U.S.

Tobacco stocks remain discounted as uncertainty persists - source: Morningstar Analysts

We also see some attractive opportunities in the consumer packaged goods category, with 30% of our coverage trading in 4- or 5-star territory. In contrast, the retail defensive space remains more fully valued, with just 21% of our coverage trading at an attractive entry point.

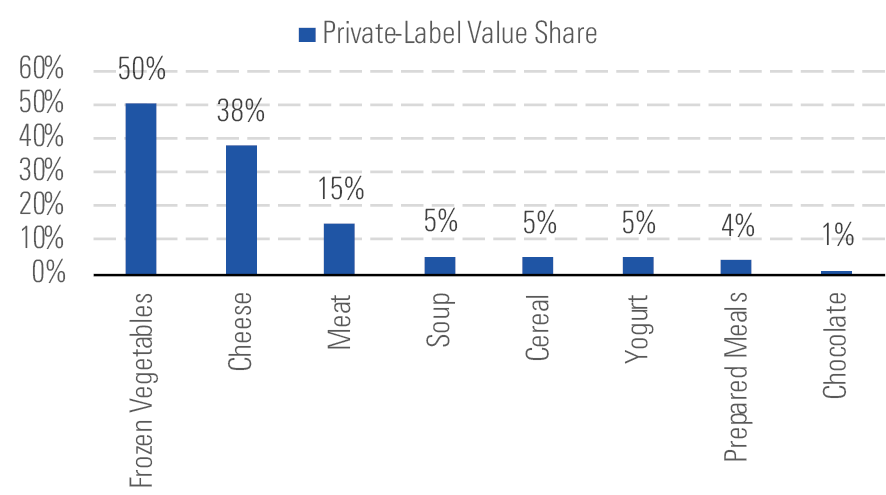

Private-label penetration has been viewed as a threat to CPG firms' pricing power, but we think consumers will continue to pay up for value-added innovation. As evidence, private-label penetration has been the most pronounced in categories with limited differentiation, like frozen vegetables, cheese, and meat. In contrast, private-label penetration has held steady at a mid-single-digit percentage of sales in categories like soup, cereal, and yogurt, where branded operators have been able to launch new products that offer a compelling value to consumers.

Private-label threat looms, especially for more commoditized fare - source: Morningstar Analysts

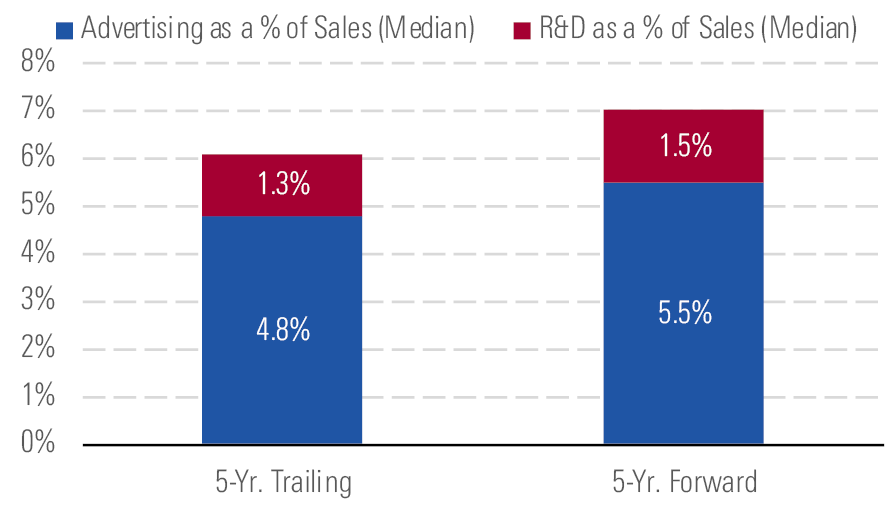

We contend that firms across the CPG space will need to bolster their investments behind their brands to support price gaps over private-label fare. We estimate that CPG firms have spent about 6% of sales on advertising and research and development over the past five years. We forecast this proportion will expand to 7% of sales over the next five years, as competitive pressures remain elevated, but industrywide cost-saving initiatives should free up the funds these companies need to reinforce their brand spending.

CPG firms boosting spending to withstand competitive pressures - source: Morningstar Analysts

Top Picks Anheuser-Busch InBev BUD

Star Rating: 5 Stars

Economic Moat: Wide

Fair Value Estimate: $118

Fair Value Uncertainty: Low

We think AB InBev’s stock offers material upside. Following its dividend cut, management has removed an overhang that concerned investors. We estimate the incremental $4 billion to $5 billion in free cash flow will deleverage the balance sheet to 3 times net debt/EBITDA by 2022. While developed markets remain a drag, as industry volume is pressured by consumer migration to wine and higher-quality beer, we think Africa and Latin America offer attractive opportunities for growth. Further, any slowdown in craft beer growth could stabilize volumes in mainstream price segments and act as a catalyst for the stock.

British American Tobacco BTI

Star Rating: 5 Stars

Economic Moat: Wide

Fair Value Estimate: $59

Fair Value Uncertainty: Low

British American has declined along with the rest of the group this year after a sequence of bad news. First, heated tobacco slowed in Japan, causing investors to rethink the assumption that it would support volume trends over the medium term. Then, the U.S. Food and Drug Administration announced that it would seek to ban menthol in cigarettes. Having doubled down on the U.S. market, an attractive market in our view, with plenty of headroom for pricing, British American would be hit hardest by such a measure. Nevertheless, a worst-case scenario appears to be priced in to the stock, and we see long-term upside.

Kraft Heinz KHC

Star Rating: 5 Stars

Economic Moat: None

Fair Value Estimate: $60

Fair Value Uncertainty: Medium

Kraft Heinz's shares have tumbled from myriad unfavorable developments, including profit contraction, an SEC investigation into its procurement accounting, and a reduction in its quarterly dividend. But management is taking action by parting ways with less profitable, noncore brands to focus its resources on the highest-return opportunities while also reducing its significant leverage. Further, we believe efforts to ratchet up spending behind its brands and capabilities (including category management and e-commerce) are favorable. Even in the face of these challenges, we believe the shares offer upside at current levels.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)