Technology: Semiconductors the Most Attractive Tech Subsector

Online media also looks like a compelling value.

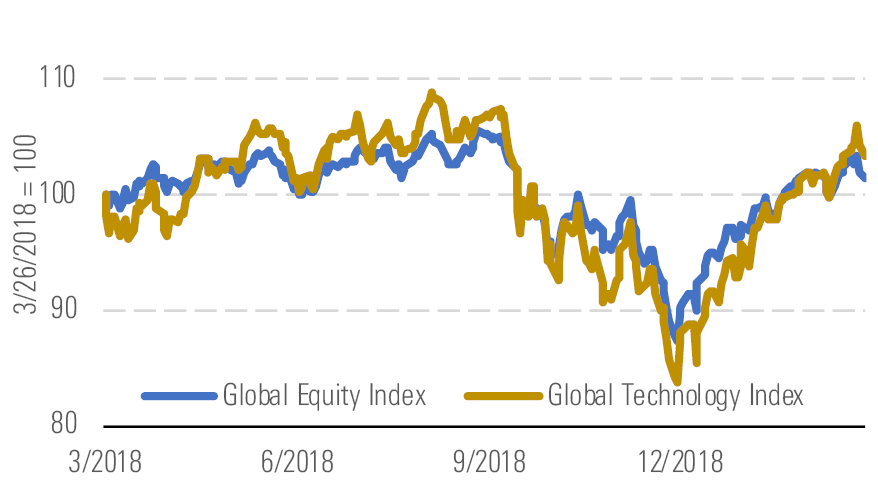

The Morningstar Global Technology Index is up 16% year to date in 2019 and outperformed the global equity market, which rose 11% over the same period. Technology snapped back nicely in early 2019 with some optimism that the U.S. and China can reach trade agreements and avoid a full-blown trade war, an issue that caused the markets and the tech sector to fall in the fourth quarter. We continue to believe that tariffs and/or the lack of a trade deal may weigh on the health of the Chinese consumer and disrupt a highly interwoven tech supply chain that would be quite difficult for the U.S. and China to unwind.

Tech stocks have outperformed the global markets - source: Morningstar Analysts

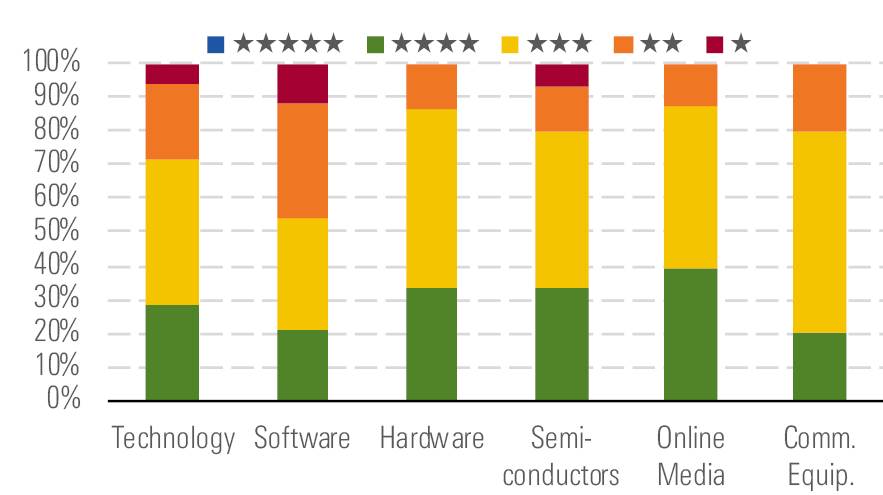

The median technology stock is roughly 2% below our fair value estimate today compared with a 15% discount toward the end of the fourth quarter. Despite the recent rally in tech and in semiconductors specifically, we still think semis are the most undervalued subsector in technology, as about 30% of our coverage is 4-star-rated or higher and the median chip stock is about 4% below our fair value estimate. Online media is also an attractive segment, as the median online media stock within our global coverage is about 12% undervalued.

Semiconductors is the most attractive subsector of tech - source: Morningstar Analysts

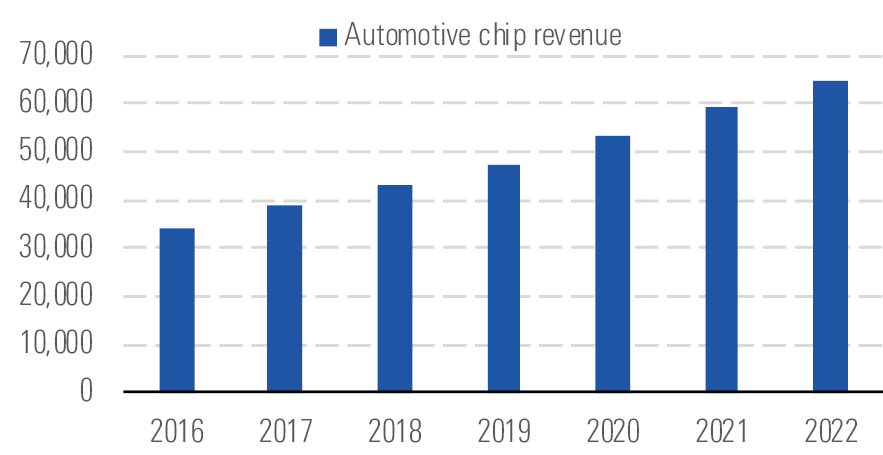

Admittedly, the near-term picture in semis is relatively weak after a couple of years of tremendous growth. However, a good portion of the bounce-back in semis in the first quarter came from optimism about easing trade tensions between the U.S. and China, as well as some commentary suggesting that the March quarter will be a bottom for chip demand. Although we're not expecting strong car sales in 2019, we foresee no slowdown in demand for more processing power, connectivity, and sensing capabilities in a wide variety of cars in order to enable more advanced infotainment and active safety applications, all of which bodes well for long-term chip demand.

We see no signs of automotive chip revenue slowing down - source: Morningstar Analysts

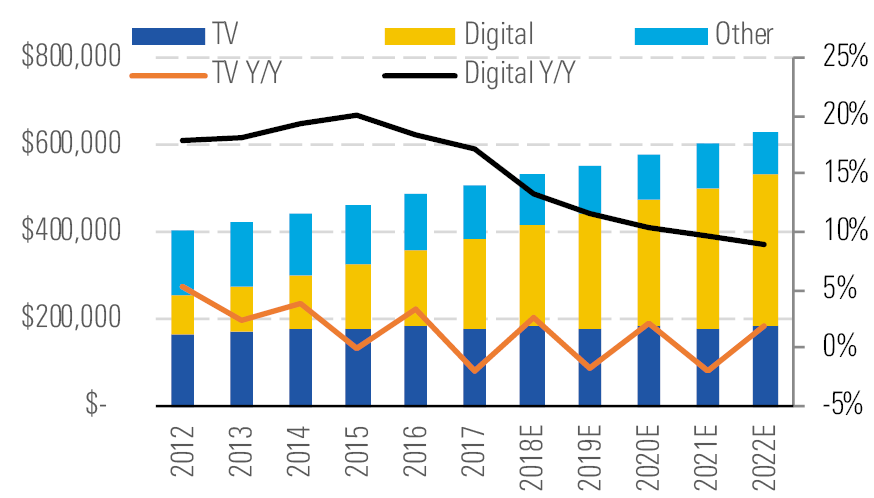

Online media stocks are also cheap. In the U.S., bellwethers like Alphabet and Facebook face data privacy issues, while concerns about the health of the Chinese consumer have made regional champions like Baidu undervalued as well. Ultimately, we still foresee tremendous growth in global digital advertising in the years ahead, outpacing growth in TV and other media vehicles.

Digital advertising growth continues to outpace traditional - source: Morningstar Analysts

Top Picks Baidu BIDU

Star Rating: 4 Stars

Economic Moat: Wide

Fair Value Estimate: $262

Fair Value Uncertainty: High

We believe that Baidu is an undervalued, wide-moat name. Although weaker economic growth in China remains a concern, Baidu is still the largest Internet search engine in China and has built an ecosystem around search and shifted to mobile Internet by releasing various well-received mobile apps, such as Mobile Baidu Search and Baidu Map. Baidu has been evolving from a mobile-first to an artificial-intelligence-first company. In the near term, margins will remain under pressure because of aggressive content spending and talent acquisition costs for AI personnel, but we foresee strong revenue growth for the company thereafter.

Microchip Technology MCHP

Star Rating: 4 Stars

Economic Moat: Wide

Fair Value Estimate: $112

Fair Value Uncertainty: Medium

We view wide-moat Microchip Technology as one of the highest-quality firms in our semiconductor coverage. It remains a leading supplier of the "brains" needed for a variety of smart devices categorized as the "Internet of Things." We find Microchip under the hood (figuratively and often literally) of the latest cars with the most advanced electronics and think it is poised to profit from rising chip content per vehicle. Microchip is adept at navigating the various industry cycles and, at this point, appears poised to recover well from the downturn in late 2018.

Applied Materials AMAT

Star Rating: 4 Stars

Economic Moat: Wide

Fair Value Estimate: $49

Fair Value Uncertainty: High

We believe wide-moat Applied Materials' shares are trading at an attractive discount. The company has benefited greatly from the sharp rise in spending by memory and display chipmakers over the past few years, though recent customer commentary suggests a near-term pullback in spending for each subsegment (especially in 3D NAND memory and OLED displays). Although we think total wafer front end spending will be modestly lower in 2019, we foresee Applied leveraging the breadth of its product portfolio and services business to navigate this softer demand.

/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)