The Biggest Mutual Fund Companies Have Indeed Been Better

Over the past decade, the largest funds from the largest fund companies have performed well

The Big Three Ten years ago, Vanguard, American Funds, and Fidelity were the largest mutual fund companies, controlling 40% of the industry's assets. After those firms, there was a significant drop, with PIMCO placing fourth with 5% market share, most of which rested in a single fund ( PIMCO Total Return PTTRX).

The Big Three's ascendancy was logical. In aggregate, their funds had posted above-average performance, with below-average expense ratios (significantly below, in the case of Vanguard and American Funds). But, as the industry's disclaimer states, "past performance is no guarantee of future results." Perhaps investors had erred. Perhaps they owned funds that had once thrived, but no longer would.

Happily, that did not prove to be the case. Overall, the biggest funds from the three biggest mutual fund organizations have enjoyed solid results since stocks bottomed in March 2009. To be sure, most of the giant funds have been roughly average; it is not as if one could blindly have selected a huge fund from Vanguard, American Funds, or Fidelity 10 years ago and then received category-leading gains. On the other hand, none of the funds flopped, and several were excellent. The overall track record is impressive.

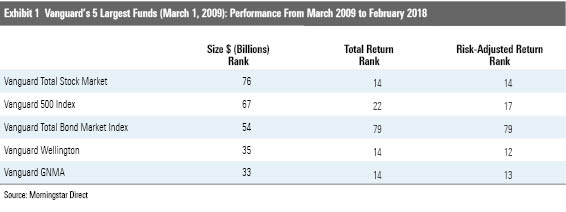

The exhibits that follow list the five largest stock, bond, or allocation mutual funds from the big three, as of March 1, 2009. In theory, these tables include expired funds that didn't last through the next 10 years, because their parents merged or liquidated them. Of the 7,000 funds that started the period, only 4,300 finished it. However, each of the five biggest funds from Vanguard, American Funds, and Fidelity continues to exist. Fifteen cases, 15 survivals.

In addition to the funds' March 1, 2009, asset size, the tables depict two flavors of category rankings, calculated from March 2009 through February 2018: 1) total return only and 2) risk-adjusted total return (as calculated by Morningstar's risk measure). In each case, 1 represents the highest score and 100 the lowest.

Vanguard: Extending the Lead

It should come as no surprise that Vanguard has two large-company domestic-stock index funds on its list and that both performed well. (Indeed, Vanguard had a third such fund among its five largest in March 2009, Vanguard Institutional Index VINIX, but I skipped it because effectively the fund is just another share class of Vanguard 500 Index VFIAX.) Also to be expected, for those who have followed Vanguard closely, are the strong results for its two actively run funds, Vanguard Wellington VWELX and Vanguard Windsor II VWNFX.

The one seeming disappointment was Vanguard Total Bond Market Index VBTLX, which placed just outside the bottom quintile for both return and risk-adjusted return. But appearances are deceiving here. As an indexer, the fund invests almost half its assets in the huge U.S. government marketplace, which is about double the weighting of the average competitor. That position has held fund back during the long expansion, but it will benefit it when the economy turns.

In addition to the table's five funds, Vanguard placed eight more funds on 2009's 50 Largest list. Seven of those eight scored risk-adjusted returns that were above their category's average. The only exception was Vanguard Total Bond Market II Index VTBIX (which shouldn't really be counted at all, as it is a clone of the original Vanguard Total Bond Market Index).

American Funds: Hanging In

After 2009, American Funds spent several years being the most heavily redeemed mutual fund company. From the sales numbers, one would have thought the organization's funds were struggling. Not so. As the table shows, the company's largest funds posted roughly average returns over the ensuing 10 years, with American Funds Capital Income Builder CAIBX outgaining most of its rivals and American Funds Income Fund of America AMECX looking good on a risk-adjusted basis.

To be sure, those results were relatively weak by American Funds' standards, which helps explain why shareholders reacted as they did. (The company's disappointing 2008, when its funds failed to resist the bear market, also had an effect.) They were not ill-served, but they had expected to do better.

Shareholders' frustration is understandable; American Funds earned those redemptions. That said, the company's funds performed respectably when compared with other surviving funds, and clearly above the norm, when the 40% of funds that expired are considered. Better to have been in American Funds Growth Fund of America AGTHX than in an anonymous fund that couldn't go the distance.

Fidelity: Hoping for More

Fidelity Diversified International FDIVX and Fidelity Magellan FMAGX were sluggish but acceptable. In addition, after many years of excellent total returns, Fidelity Contrafund FCNTX and Fidelity Low-Priced Stock FLPSX regressed to the mean. (The latter, in particular, was handicapped by the size of its asset base, which pushed the fund away from the thinly traded stocks that had made its reputation.) These two funds enjoyed more success on a risk-adjusted basis.

On the bright side, none of Fidelity's five largest funds placed in the bottom quartile for their category, while Fidelity Growth Company FDGRX emphatically landed near the top. Its victory was not defensive, either. Demonstrating that giant funds can run with the best of them, Fidelity Growth Company notched a 20% annualized 10-year gain, which made for a cumulative total of more than 500%. Few offerings from smaller companies were able to match that result.

The performances of Fidelity's leading funds will not have satisfied that firm's management. As with American Funds, none of Fidelity's five largest funds performed badly, and (unlike with American Funds) one fared very well indeed, but expectations are high for fund-industry leaders. Their shareholders aren't satisfied with "competitive" and "pretty good." They seek excellence.

Which, as this column illustrates, is not an unreasonable demand. The bigger funds from the bigger providers have tended to be better. Investors should indeed hold such funds to a higher standard.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)