Your U.S. Equity Fund Is More Global Than You Think

We examine the revenue exposure by region of five of the most popular U.S. index-tracking ETFs.

Just how “made in America” are U.S. stock funds? It turns out there’s not as much as apple pie and baseball in some of those portfolios as investors might think.

When it comes to assessing the asset-allocation characteristics of a mutual fund, some information, such as market capitalization, isn’t difficult to measure. But when it comes to geographical allocations, investors have been depending on a potentially flawed approach, such as relying on where a company is headquartered or incorporated or where the stock is listed.

For example, Aflac AFL, which is headquartered and listed in the United States and is known for the Aflac duck, generates 69.8% of its revenue in Japan. In the short term, Aflac shares may fluctuate more in tandem with the U.S. stock market. But over the long term, its business prospects are much more closely linked to Japan.

With the aim of producing a more accurate picture of a portfolio's geographic allocation, Morningstar has rolled out proprietary global geographic segment data that enables investors to assess a fund's geographic exposure based on the revenues streams of the companies it holds. A recent white paper (available to Morningstar Direct clients) and methodology documents provide more details. (Sign up for a free demo of Morningstar Cloud.)

In this article, we dive into five of the most popular U.S. index-tracking exchange-traded funds with the goal of highlighting the differences between basing asset allocation on revenue exposure by region data versus “business country” factors such as where a company is headquartered.

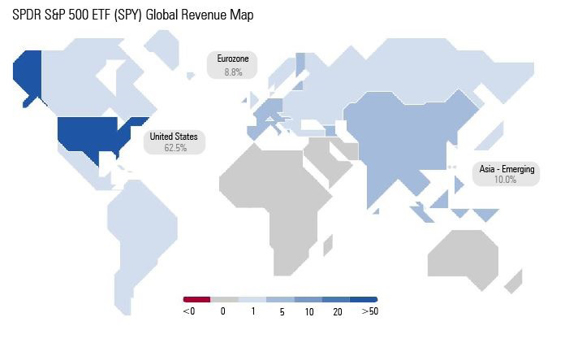

SPY We'll start off with SPDR S&P 500 ETF SPY, which has a Morningstar Analyst Rating of Gold. The S&P 500 is the most widely followed U.S. equity benchmark, and the fund's portfolio has essentially all of its assets listed with the United States as its business country. But when viewed through the prism of revenue by region, the map looks decidedly different.

- source: Morningstar

Only 62.5% of revenue from the companies in SPY originates in the United States. SPY has about 10.0% of revenue generated from Asia-emerging markets, which include mainland China and India. Another 8.8% comes from eurozone countries.

- source: Morningstar

The recent Morningstar white paper by authors Tom Whitelaw, Alec Lucas, and Robby Greengold noted that geographical revenue diversity can vary significantly across sectors, which in turn aggregates to the overall fund-level picture. For example, the technology sector is the most multinational, while utilities, real estate, and financial services are the most domestically focused. And larger companies tend to be more multinational than small-company stocks.

With SPY, three of the top five holdings are tech stocks: Microsoft MSFT, Apple AAPL, and Facebook FB. Taken together, these firms are main drivers of the fund’s eurozone and Asia-emerging exposure.

- source: Morningstar

That said, there are still plenty of U.S.-based holdings in SPY that have revenue streams mainly in the United States, such as the fourth-largest holding, Berkshire Hathaway BRK.B, with 87.1% of revenue based domestically. The 16th-largest position as of Feb. 27, UnitedHealth Group UNH, has 96% of its revenue from the United States.

VTI Gold-rated Vanguard Total Stock Market ETF VTI posts similar revenue-by-region metrics. The fund tracks the CRSP U.S. Total Market Index and, like the S&P 500, is market-cap-weighted. Similar to SPY, VTI's top holdings include Microsoft, Amazon.com AMZN, Apple, and Facebook. Again, those names are significant contributors to the fund's revenue base in Asia-emerging and eurozone countries.

- source: Morningstar

Although revenues in financial-services companies are primarily produced domestically, Citigroup C and Goldman Sachs Group GS buck that trend.

Citi, while headquartered in the U.S., only has about half of revenue generated domestically at 47.9%, Japan contributes 20.2%, and Latin America 13.3%. Goldman similarly has 45.4% of revenue from the U.S., with 15% coming from Australasia, eurozone 12%, and Latin America 11%.

QQQ With the Neutral-rated Invesco QQQ Trust QQQ tracking the Nasdaq 100 Index and its major weightings in large multinational technology companies, the ETF barely cracks the 50% mark in revenue from the United States.

- source: Morningstar

Although QQQ’s top holdings are the same as SPY and VTI--Microsoft, Apple, Amazon, and Facebook--this fund is more concentrated among those stocks. The fund has about 33.3% of assets in these four holdings, while they comprise only about one tenth of the assets in SPY and VTI.

Another top QQQ holding, at 1.4% of assets as of Feb. 27, is Broadcom AVGO, which gets only 7.2% of its revenue from the U.S. but generates 57.2% from Asia-emerging countries and 11.4% from eurozone countries. Booking Holdings BKNG, while the 19th-largest holding in the fund, is a major source of QQQ’s eurozone revenue base. Nearly 78% of Booking’s revenue is generated in the region.

- source: Morningstar

Other large multinational tech positions include Intel INTC with 20% of revenue from the U.S., 40.9% in Asia-developed, and 24.6% in Asia-emerging countries. Adobe ADBE has about half its revenue from the U.S., while 13.3% comes from the eurozone and 7.2% from Japan.

VIG For Gold-rated Vanguard Dividend Appreciation ETF VIG, the largest holdings are in the consumer products and retail sectors. Some of these companies primarily generate revenue in the U.S. They includes Walmart WMT and Costco Wholesale Corp COST, which respectively generate 76.1% and 72.2% of revenue domestically.

- source: Morningstar

Still others have larger overseas sales, such as McDonald's MCD, with only 35.1% of revenue in the U.S. but 22.3% in eurozone and 16.3% in Asia-emerging countries. Nike NKE pulls 37.4% of revenue from the U.S., 21.3% from Asia-emerging, and 13.4% from eurozone countries. 3M MMM generates strong shares of revenue across eurozone, Asia-emerging, Japan, and Latin American countries.

IWM Investors tend to view the Russell 2000 as the broad market benchmark most closely linked to the U.S. economy. While that's true compared with the other indexes in this article, Bronze-rated iShares Russell 2000 ETF IWM still barely tops the three-fourths mark when it comes to U.S. revenue exposure.

- source: Morningstar

Individual positions in IWM are small, with the largest holding accounting for only 0.41% of total assets. Therefore, the revenue exposure picture isn’t as tilted by individual names as the other funds.

Still, IWM’s two largest holdings are domestic retailers, Five Below FIVE and Etsy ETSY, which have 100% and 72%, respectively, of revenue generated in the U.S. Another top holding is Planet Fitness PLNT with 98.4%. But then there is Integrated Device Technology IDTI, which only has 8.4% of revenue generated in the U.S., while 46.8% is from Asia-developed countries and 21.1% from Asia-emerging countries.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)