A Taxonomy of Sustainable Funds

Funds in the ESG integration and impact groups have the most comprehensive take on sustainable investing.

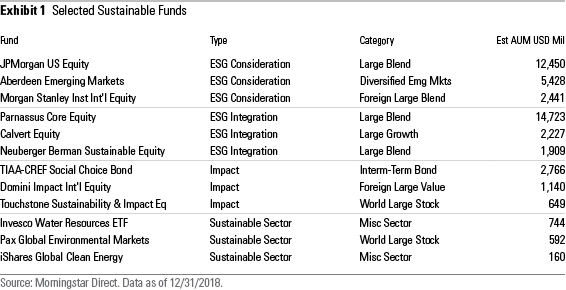

In my recent report on sustainable funds in the United States, I grouped the 351 open-end and exchange-traded funds into four types: ESG consideration, ESG integration, impact, and sustainable sector. (Morningstar Direct clients can find the report here.)

ESG consideration funds are those that refer to ESG criteria in their prospectuses as one set of factors that are considered in their investment process. Many of the 81 ESG consideration funds are older funds that have recently added ESG to their prospectuses.

ESG integration funds, by contrast, are those that make sustainability factors a featured component of their processes for both security selection and portfolio construction. At 171 funds, this group is the largest, and the funds in it tend to be active owners, engaging with companies and supporting--and sometimes sponsoring-- ESG-related shareholder resolutions.

A third group, impact funds, focuses on broad sustainability themes and on delivering social or environmental impact alongside financial returns. This rapidly growing group numbered 60 in the report.

The fourth group consists of sustainable sector funds, which focus on investment opportunities that contribute to, and aim to benefit from, the transition to a green economy in areas like renewables, energy efficiency, environmental services, water, and green real estate. This group totaled 39 in the report.

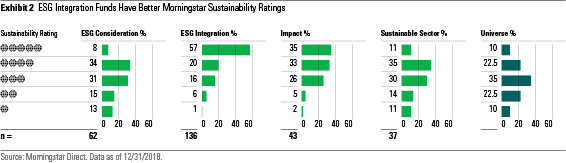

To further delineate the differences in these groups, I now turn to several Morningstar sustainable investing metrics. The Morningstar Sustainability Rating evaluates the ESG characteristics of fund holdings over the past year and compares them against funds' global Morningstar Category peers. Globes are awarded based on a normal distribution within each category. Because ESG integration funds are the most explicit about using ESG to evaluate securities and build portfolios, we would expect them to have better Sustainability Ratings than the other fund types. As seen in Exhibit 2, that is indeed the case. Nearly 60% of ESG integration funds have 5-globe ratings (versus 10% in the overall universe of funds), and more than 75% have 4- or 5-globe ratings (versus one third in the overall universe). Only 7% have 1- or 2-globe ratings (versus one third in the overall universe).

By contrast, the distribution of globes for ESG consideration funds is much closer to that of the fund universe, with only a slight skew toward better ratings. Among these funds, 42% earn 4 or 5 globes, while 28% earn 1 or 2 globes. The lower overall globe ratings illustrate the lesser role that ESG plays in their investment processes. While many impact funds use ESG criteria as ESG integration funds do, others focus exclusively on impact. As a result, the globe ratings of impact funds do skew positive but not as much as those of ESG integration funds. Similarly, the globe ratings of sustainable sector funds skew positive, but not all these funds are broadly focused on ESG criteria.

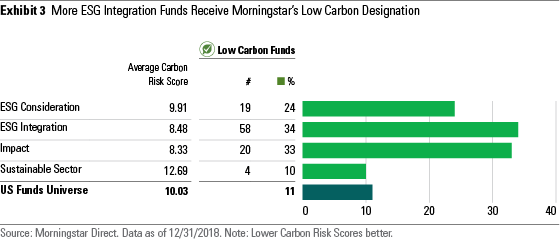

Last year, Morningstar introduced the Low Carbon designation for funds that have low levels of carbon risk and low exposure to fossil fuel in their portfolios. ESG consideration, ESG integration, and impact funds were 2 to 3 times more likely to receive the Low Carbon designation than conventional funds. One third of ESG integration and impact funds earned the Low Carbon designation, as did nearly a fourth of ESG consideration funds. Only 10% of sustainable sector funds earned the designation because many funds in that group do invest in companies with exposure to fossil fuel even though those same companies may also be involved in developing and using renewable energy.

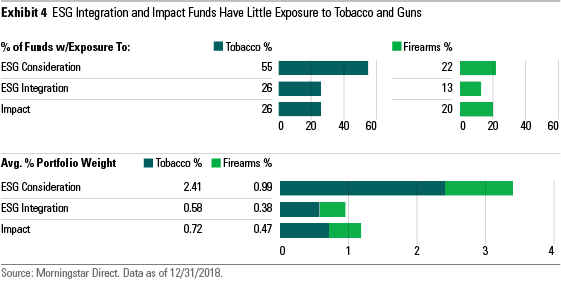

While exclusions do not play as prominent of a role in sustainable investing as they have in the past, many sustainable investors still wish to avoid certain products or types of businesses. Based on Exhibit 4, we see that ESG integration funds have less exposure to guns and tobacco than do the other groups, with ESG consideration funds having the most exposure. That is especially true of tobacco: More than half of the 81 ESG consideration funds have tobacco exposure, with an average portfolio weighting of 2.4%, nearly 5 times higher than that of ESG integration funds.

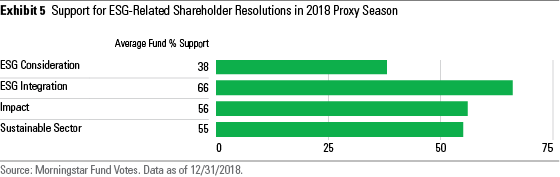

Investment stewardship is an important facet of sustainable investing. It includes engagement with companies through dialogue, proxy voting on ESG-related issues, and willingness to sponsor or cosponsor ESG-related shareholder resolutions. Using Morningstar's Fund Votes database, Exhibit 5 shows how often each type of sustainable fund voted for ESG-related shareholder resolutions during the 2018 proxy season. ESG integration funds supported these resolutions at a higher rate than did the other groups, especially ESG consideration funds. The average ESG integration fund supported 66% of the ESG-related shareholder resolutions on which it cast a vote. Impact and sustainable sector funds, on average, also supported a majority of the resolutions on which they voted. ESG consideration funds' average support was 38%.

Overall, ESG integration funds get better Morningstar Sustainability Ratings, more Low Carbon designations, have less exposure to guns and tobacco, and support ESG-related shareholder resolutions to a greater degree than the other fund types. ESG consideration funds do least well in each of those areas compared with the other three groups, reflecting the fact that ESG consideration funds have less of an overall commitment to sustainable investing.

Some impact funds do as well as ESG integration funds on these measures and essentially should be considered "ESG integration + impact" funds. But other impact funds may focus on a specific theme rather than taking a more comprehensive approach. A low-carbon impact fund, for example, may not consider other ESG issues or avoid tobacco. A gender-equality fund may not consider carbon or have any other product exclusions. A general impact fund may focus entirely on a specific impactful outcome or on issuers that are producing new sustainable products without regard to company ESG performance or exclusions. For their part, sustainable sector funds also span a range of commitment to sustainable investing. Some are content to provide exposure to their areas of focus without evaluating the companies for their overall ESG performance and without supporting ESG-related shareholder resolutions.

Sustainable funds come in several types. The recent growth in the number of ESG consideration funds reflects the growing number of asset managers who are now formally considering sustainability issues as part of their investment process. By contrast, ESG integration funds are those that take a more thorough approach, building portfolios that reflect sustainability factors and often include some exclusions, and engaging with issuers about ESG issues. Impact funds are growing as vehicles for achieving measurable social and environmental impacts alongside financial return, while sustainable sector funds focus on the growing green economy. Going forward, I expect more conventional funds to move into the ESG consideration group, and more ESG integration funds to move toward impact. Sustainable sector funds should also experience growth as more investors see opportunities in the low-carbon transition to a green economy.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)