12 High-Quality Foreign Stocks on Sale

These wide- and narrow-moat international stocks are trading well below our fair value estimates.

Moats aren't an exclusive feature of U.S.-based companies. Rather, firms around the globe have carved out sustainable advantages that should allow them to fend off competitors for years to come. And given how far the U.S. market has risen already this year, some investors may be looking abroad to find high-quality opportunities. Moreover, many of the forecasts included in our annual roundup expect higher returns for non-U.S. stocks versus U.S. equities over the next decade.

Today we're turning to one of Morningstar's indexes to find high-quality investing ideas around the globe. The Morningstar Global ex-US Moat Focus is a subset of the Morningstar Global Markets ex-US Index, which is a broad index representing 97% of developed (ex-US) and emerging-markets market capitalization. We rank the wide- and narrow-moat stocks in the broad index by lowest price/fair value to find the 50 cheapest wide- and narrow-moat stocks. These 50 stocks represent the most compelling values among the global moat universe, according to Morningstar analysts.

The Global ex-US Moat Focus Index invests in securities in their local currencies, on their local exchanges. For purposes of this article, we focused on companies from the index that also have shares listed on U.S. exchanges. As such, these stocks are readily available to U.S. investors.

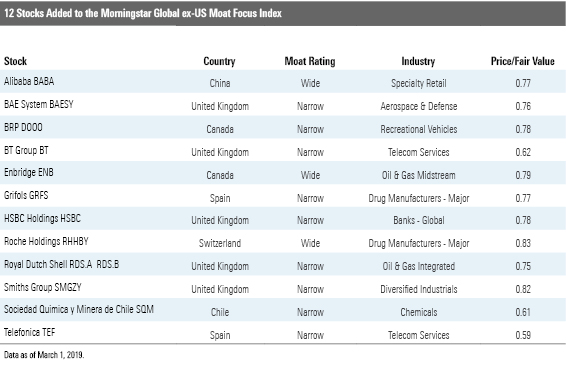

Here are 12 stocks that were added to the index during its December reconstitution that are available to U.S. investors and are trading below our fair value estimates.

Here’s a closer look at a few names from the list.

Telefonica

TEF

The incumbent telephone operator in Spain and one of two dominant operators in Latin America (it also has operations in Germany and the United Kingdom), Telefonica earns a narrow economic moat thanks to cost advantages and efficient scale. The firm boasts total fixed and wireless telephony, Internet, pay-television, and wholesale access of nearly 344 million, reports senior analyst Allan Nichols. Moreover, the firm continues to improve its convergent position.

Currency weakness hurt Telefonica’s 2018 results: Reported revenue fell 6% year over year, but revenue did grow 2% on an organic basis, says Nichols. We think shares are significantly undervalued as of this writing, trading at a 41% discount to our fair value estimate. In fact, it’s the most-undervalued stock on our list.

“Telefonica is well positioned, and we don't see this changing,” he concludes.

BAE Systems

BAESY

Among the biggest defense contractors in the world, U.K.-based BAE is one of the largest suppliers to the U.S. Department of Defense. It earns a narrow economic moat rating because of switching costs and intangible assets, notes director Denise Molina. In particular, the firm’s strong relationship with the British government is an intangible asset.

“The United Kingdom promotes BAE as a national champion in crucial areas such as aircraft carriers, naval vessels and submarines, armoured fighting vehicles, general munitions, and network-enabled capability,” explains Molina. “As the dominant--and, in many instances, the only--player in these markets, BAE enjoys an unbeatable advantage.”

Shares are trading 24% below our fair value estimate.

Sociedad Quimica Y Minera De Chile

SQM

Chile's SQM is a large, low-cost producer of lithium, iodine, and nitrates used in specialty fertilizers. The company earns a narrow economic moat rating because of its cost advantages in production stemming from its salt brine and caliche ore assets in northern Chile, says analyst Seth Goldstein.

“SQM’s crown jewels are its geologically advantaged lithium and caliche ore assets,” explains Goldstein. “SQM’s low-cost lithium deposits in the Salar de Atacama boasts the highest concentration of lithium globally and benefits from high evaporation rates in the Chilean desert. As electric vehicle penetration increases, we expect mid-double-digit annual growth for global lithium demand, one of the best growth profiles among commodities.”

Shares are trading 39% below our fair value estimate.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZM7IGM4RQNFBVBVUJJ55EKHZOU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_d910b80e854840d1a85bd7c01c1e0aed_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)