How to Uncover an Investor's Real Goals

A simple behavioral nudge can help people discover what they truly want.

Goals-based investing relies on a simple and powerful premise: identify what the investor truly seeks to accomplish and then use that knowledge to generate an appropriate portfolio and improve the investor’s peace of mind. In fact, there’s good reason to believe that focusing on an investor’s goals can both increase total returns and help motivate the investor for the long haul (Blanchett 2015; Locke et al. 1990).

But there’s a catch. It all depends on the goals. If the goals used in the planning process were meaningful and durable, great. But what if they weren’t? What if the goals that an investor reported to his or her advisor weren’t real? This can be a disconcerting prospect—both for advisors who explicitly conduct goals-based investing, as well as for those who incorporate that information as part of a more general investing process.

In a recent study that my team conducted, we found that when we simply ask people what their highest priority investing goals are, the response we receive often isn’t the definitive answer we think it is. It’s probably a reflection of what the person happens to be thinking about at the moment, rather than a strong statement about his or her durable, long-term goals. In other words, the answers aren’t necessarily real. Thankfully, gaining a more thorough and considered understanding of a person’s goals isn’t difficult; it just takes a different approach.

Asking About Goals In our study, researchers Ray Sin, Ryan Murphy, and Samantha Lamas tested two different ways of asking people about their goals. First, they asked people to simply list their top investing goals. Second, they asked people to review a list of common goals other investors have and asked them to reselect their top goals, drawing from both their initial list and those common goals. In other words, the second round included a prompt to help people remember other things that might be important to them.

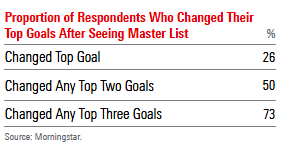

If people could remember and accurately self-report their own top investing goals, then there should be no difference between the two rounds. As you’ve probably guessed by now, that’s not what happened. The results were striking:

1. On average, 26% of participants changed their highest priority goal after seeing the list of common goals.

2. Approximately 73% of participants changed at least one of their top three goals.

This means that only 27% of the participants didn’t change one of their top three goals. All the others changed their minds when prompted with a basic reminder. Our results highlight a flaw in the traditional goal-setting approach used by financial professionals.

Master List Approach The second approach is known as a "master list," and researchers have found that it similarly helps people identify their goals in contexts outside of investing (Bond et al. 2008; Keeney 2013). To the best of our knowledge, ours was the first study showing this problem—and its solution— in the context of investing.

Our team ran additional analyses as part of this study. For example, they ran the study twice, just to be sure; the results remained the same in both cases. They also looked at how some people initially thought in broad, vague terms about their goals—and how the master list helped them become more specific and vivid. Many respondents also started out by focusing on financial outcomes and upon further prompting reframed their goals in terms of their emotional and personal value.

There’s much more to learn from the study, and I encourage you to read it in full. A seven-page white paper is available on our website (see the link below), and the full academic paper is under review for publication. If there’s one immediate lesson for practitioners, however, it’s this: Use a master list that prompts investors to think broadly about the range of goals they may have for investing.

You can find a practical worksheet at the end of our white paper, showing how to use a master list with your clients. We hope you find it valuable to help your clients better focus on the durable goals that make goals-based investing meaningful and relevant to their lives.

References Blanchett, D. 2015. "The Value of Goals-Based Financial Planning." Journal of Financial Planning, Vol. 28, No. 6, PP. 42–50.

Bond, S.D., Carlson, K.A., & Keeney, R.L. 2008. “Generating Objectives: Can Decision Makers Articulate What They Want?” Management Science, Vol. 54, No. 1, PP. 56–70.

Keeney, R.L. “Identifying, Prioritizing, and Using Multiple Objectives.” 2013. EURO Journal on Decision Processes, Vol. 1, No. 1–2, PP. 45–67.

Locke, E.A. & Latham, G.P. 1990. A Theory of Goal Setting & Task Performance (Englewood Cliffs, N.J.: Prentice-Hall).

Note To learn more about the study, and the implications for financial professionals, see https://www.morningstar.com/lp/mining-for-goals.

This study is part of the Investor Success Project; more information about the series can be found at https://www.morningstar.com/company/investor-success.

This article originally appeared in the Spring 2019 issue of Morningstar magazine. To learn more about Morningstar magazine, please visit our corporate website.

/s3.amazonaws.com/arc-authors/morningstar/cc15194e-3c37-4548-9ca8-782ff113938c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/cc15194e-3c37-4548-9ca8-782ff113938c.jpg)