The Upside of a Lower Tax Refund

It may be an unpleasant surprise, but a lower refund might not be a bad thing.

Question: My tax refund is a lot smaller than it was last year. Please tell me how I am paying less in taxes.

Answer: Not knowing the specifics of your situation, my guess is that it's probably because your employer withheld less tax on your behalf, which is a good thing. I know as I write this many readers won't like that answer, and I understand the frustration.

About Withholding If the reason that your refund is smaller is that less tax was withheld from your pay, that's not a bad thing.

I heard an interesting segment on NPR's Morning Edition (Feb. 14, 2019) quoting Richard Thaler, who received the 2017 Nobel Memorial Prize in Economic Sciences. In it, he discussed how changes to the withholding tables were a big and misunderstood reason for the smaller refunds in many cases.

" 'In a world of rational economic actors,' he said, lowering withholding 'would have made everybody happy, since they would be getting the money they would have to wait all year for, in each paycheck. But we don't live in that world, and people like refunds.' "

NPR also quoted Nicole Kaeding, director of federal projects at the Tax Foundation, a tax-policy think tank, who cautioned against getting angry for the wrong reasons.

" 'Don't judge your taxes by your refund ... Ideally, you don't actually want to receive a large refund. Because what you've done is given the federal government an interest-free loan. Instead, what would be better is to adjust your withholdings so you get more take-home pay in every paycheck.' "

So, how does withholding work? I'll try to make this as fascinating--and brief--as I possibly can.

The Math Let's create a simplified withholding example (using the percentage method) for a single filer who makes $50,000 and claims one allowance. Assume for simplicity's sake that all $50,000 is taxable wages and the salary was the same in 2017 and 2018. In real life, any pretax savings vehicles like HSAs or 401(k)s wouldn't be subject to income tax withholding.

Step 1: Figure out the taxable income in each paycheck by dividing by the number of pay periods. (If you're paid monthly, divide your salary by 12; semimonthly, 24; and so on.) Let's say the person in our example is paid semimonthly, so each paycheck is $50,000/24 = $2,083.33.

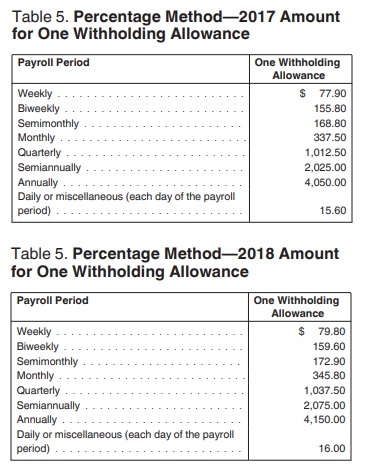

Step 2: Find the amount for one allowance and subtract that from the weekly paycheck amount. (For comparison's sake, I displayed the withholding tables for 2017 and 2018 on top of each other. They are in IRS Publication 15, which is updated every year.)

In our example:

2017: $2,083.33 – $168.80 = $1,914.53 2018: $2,083.33 – $172.90 = $1,910.43

Step 3:

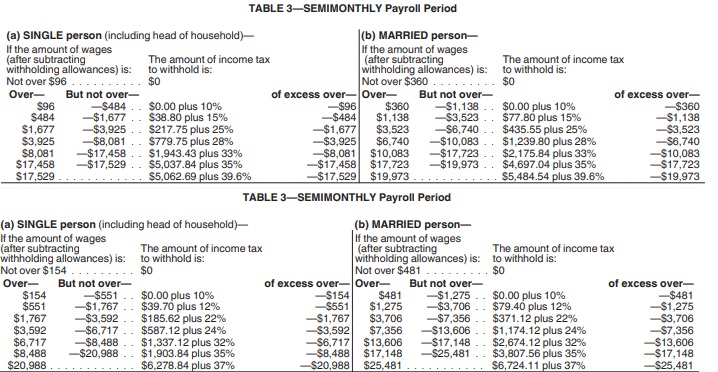

Take the amount left over after subtracting the withholding amount from each paycheck (in our example, $1,914.53 and $1,910.43 for 2017 and 2018, respectively) and find where it fits in the table below.

Then perform the calculation listed (

this is the part that will result in less tax being withheld per paycheck in 2018

).

In 2017, the amount of income tax withheld for our single taxpayer was $217.75 plus 25% of the excess over $1,677.

$217.75 + ($1,914.53 - $1,677)0.25 = $277.13 per paycheck; $6,551.21 per year

In 2018, it was $185.62 plus 22% of the excess over $1,767.

$185.62 + ($1,910.43 - $1,767)0.22 = $217.18 per paycheck; $5,212.19 per year

Helpful Tax Calculators If you're unhappy with your refund amount, the IRS' withholding calculator can help you compute a more ideal scenario. But keep in mind that getting a smaller refund isn't necessarily a bad thing. If your withholding closely matches your actual tax liability, it allows you to put your money to better use by paying down debt or saving for retirement throughout the year rather than lending it to the government interest-free.

Another good resource: The Tax Foundation has a calculator that shows the before and after impact of the tax changes on taxpayers in various filing scenarios and income levels. (You can also create a custom scenario.)

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BC7NL2STP5HBHOC7VRD3P64GTU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)