How Do I Claim Dependents Now That Personal Exemptions Are Gone?

The combination of a higher standard deduction and new and enhanced credits should offset the repealed personal exemptions.

Question: I used to be able to take personal exemptions for myself, my spouse, and my dependents, but now those are gone. How will that affect my taxes this year?

Answer: Many taxpayers are worried that they'll have a higher tax bill for 2018 because exemptions and certain deductions have been repealed. But most households will actually pay less in taxes under the new laws.

Let's take a closer look at the changes.

How Do I Claim My Dependents? On your 2017 1040, you were able to claim a $4,050 personal exemption for yourself, your spouse, and each dependent.

Let's break down the math for a family of seven under the old rules--two parents, three children, and two nonchild dependents:

Under the new rules, there are no exemptions for yourself and your spouse. However, the combination of a much higher standard deduction, an enhanced partially refundable child tax credit ($2,000 per qualifying child, with substantially higher income thresholds), and the new nonrefundable $500 Credit for Other Dependents is intended to help offset the loss of the personal exemptions.

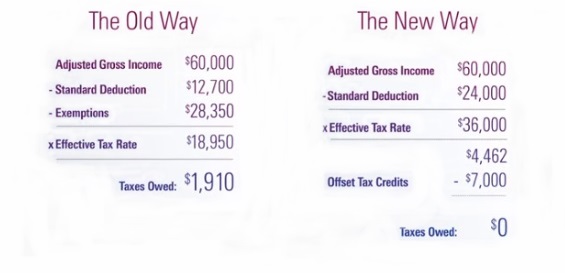

How Does $7,000 in Credits Equate to $28,350 in Lost Deductions? Although it seems like you're giving up more in exemptions than you're gaining in credits, the important thing to remember is that credits reduce the taxes you owe dollar for dollar, while exemptions reduce the amount of income that you have to pay taxes on.

The combination of a higher standard deduction and the dependent credits will actually reduce the amount of tax that most households owe. (In fact, the child tax credit is refundable up to $1,400, which means that if your tax bill is $0, you can get a refund of up to $1,400 for each child if you qualify.)

Am I Eligible for the Credits? The income thresholds for the Child Tax Credit are much higher now. It begins to phase out at $200,000 of modified adjusted gross income ($400,000 for married couples filing jointly), compared with 2017 levels of $75,000 for single taxpayers and $110,000 for married couples filing jointly. Single filers with adjusted gross income above $240,000 ($440,000 for married filing jointly) are phased out completely.

Qualifying children must have a Social Security number and be under age 17. There are some more tests (below) that your dependent must pass to qualify for the Child Tax Credit. To make it easier, the IRS has an interactive tool you can use to determine your children/dependents' eligibility.

Relationship: The taxpayer's (adopted or biological) son, daughter, stepchild, legal foster child, or a descendant (grandchild) of any of them. In addition, the taxpayer's brother, sister, half-brother, half-sister, stepbrother, stepsister, or a descendant (niece or nephew) of any of them.

Age: Under age 19 at the end of the tax year and younger than the taxpayer (or the taxpayer's spouse, if filing jointly), or a full-time student under the age of 24 at the end of the year and younger than the taxpayer (or spouse, if filing jointly). Also, any age if permanently and totally disabled at any time during the year.

Support: The child cannot have provided more than half of his or her own support during the tax year. This test is different from the support test for qualifying relative. A person's own funds are not support unless they are actually spent for support.

Joint return: A married person who files a joint return cannot be claimed as a dependent unless that joint return is filed only to claim a refund of withheld income tax or estimated tax paid.

Residency: The child must have lived with the taxpayer for more than half the year.

Citizen or resident test: To be claimed as a dependent, a person must be a U.S. citizen, U.S. resident alien, U.S. national, or a resident of Canada or Mexico.

Dependent taxpayer test: If anyone can claim you as a dependent, you can't claim a dependent.

If your dependent meets the above criteria but is older than 19 at the end of the tax year or a full-time student over the age of 24, they may qualify for the Other Dependent credit.

Also, if you provided over half support to someone who is your father, mother, or an ancestor or sibling of either of them (for example, your grandmother, grandfather, aunt, or uncle) or a stepbrother, stepsister, stepfather, stepmother, son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, or sister-in-law who had gross income of less than $4,150 income and is not required to file a tax return, they may qualify for the Other Dependent credit.

See 2018 Form 1040 instructions for more.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)