29 Undervalued Stocks

Equities are starting to look attractive. Here are some of our analysts' best ideas across sectors.

The Morningstar US Market Index finished 2018 with a 5% loss. The median stock in our global coverage universe traded at a 14% discount to our fair value estimate at year's end.

"From a bottom-up perspective, global equities are beginning to look attractive," notes Dan Rohr, Morningstar's director of equity research for North America, in his quarter-end wrap-up.

In particular, the once pricey technology sector is more appealing than it's been in a while. The energy sector looks attractive, too. Here are some undervalued stocks across sectors that are among our analysts' best ideas.

Basic Materials The basic materials sector had been among the most overvalued for some time, but no more. At 2018's close, the sector carried a price/fair value estimate of 0.89. Sector director Andrew Lane notes in his quarterly update that the team is finding value in many building materials names and seeing fewer opportunities in the metals/mining and steel industries. The team expects demand growth from China to wane as its economy matures and transitions toward consumption-driven growth.

Communication Services Telecom stocks in the U.S. ended the year trading at a 15% discount to our fair value estimates, while those in Europe were trading at a 24% discount, notes sector director Mike Hodel in his quarterly report. Limited revenue growth potential, often-complex operating structures, heavy debt and exposure to emerging markets--and of course, Brexit--have dampened the allure of the latter for many. Here in the U.S., a merged Sprint S/ T-Mobile US TMUS would drastically improve the long-term structure of the U.S. wireless industry, he notes.

Consumer Cyclical As a group, consumer cyclical stocks finished 2018 at 17% discount to our fair value estimates. About half of the consumer cyclical companies we cover are 4- or 5-star-rated, with autos, personal services, and homebuilders carrying the most attractive valuations, say sector director Erin Lash and senior analyst Dan Wasiolek in their update. Digital efforts are key in many industries in this sector, yet a physical footprint is likely to remain important. Companies that marry the two are most likely to succeed.

Consumer Defensive The median stock we cover in the consumer defensive sector was trading at a modest 7% discount to our valuation at year's end. We think tobacco offers meaningful opportunity, with all of the tobacco companies we cover trading in 4- or 5-star territory, notes Lash in her quarter-end update. More-modest cost inflation could ease some of the margin pressure facing consumer packaged goods operators.

Energy The energy stocks we cover were trading about 23% below our fair value estimate at year end. Given our bearish long-term oil outlook, we think the best opportunities are in volume-driven areas of the sector, such as midstream and refining, says sector director Jeffrey Stafford in his quarterly update. The sell-off has created buying opportunities for many integrateds, exploration and production companies, and services firms, too.

Financial Services At the year's close, there was value to be had in the bank and asset management industries. As a group, bank stocks finished the year trading about 20% below our fair value estimates; asset managers, meanwhile, were about 27% undervalued by our measures. Central banks are still likely to pursue neutral to tightening stances over the next year, notes sector director Michael Wong in his review. Wong adds that asset managers should be able to count on appreciation in their assets under management, and worries about large pricing cuts among active equity managers are overblown.

Healthcare The healthcare sector was about 7% undervalued as of year end. We see a relatively higher share of 5-star stocks in the drug manufacturing industry, notes sector director Damien Conover in his update. The market has placed too much emphasis on potential drug pricing concerns, he says. Lower price increases should reduce the political pressure to cut drug prices and innovation should support steady pricing. Moreover, revoking the Affordable Care Act could pressure healthcare services companies.

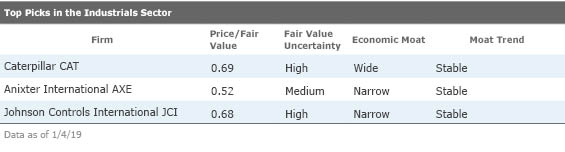

Industrials The industrials sector now ranks among the more undervalued sectors globally, trading at a 15% discount to fair value at 2018's close. There are several 4- and 5-star names in the heavy equipment and industrial distributors industries, in particular, notes sector director Keith Schoonmaker in his quarterly review. We expect operating improvements and improved end-user productivity to fuel revenue growth and margin expansion in the heavy equipment industry; when it comes to industrial distributors, we think concerns about tariffs and Amazon Business are largely misguided, he adds.

Real Estate Real estate is one of the most fairly valued sectors, trading at a 6% discount to our estimate of intrinsic value at the end of 2018. We see few attractively priced investments here, admits analyst Kevin Brown in his update. Real estate companies, REITs in particular, tend to underperform the broader equity market when interest rates rise, but bounce back over time to perform in line with the global equity index, says Brown. "Interest-rate movements can create an opportunity to be contrarian and buy or sell as they stabilize," he notes.

Technology The technology sector looks a lot cheaper than it has in a while: The sector was trading 15% below our fair value estimate at the end of 2018. Opportunities are most plentiful in semiconductors, says sector director Brian Colello in his latest update, with the median stock trading at a 23% discount. Online media name were about 20% undervalued, too: Data and privacy concerns have weighed on Alphabet GOOG /GOOGL and Facebook FB, while worries about the health of the Chinese economy have made Tencent TCEHY and Baidu BIDU undervalued.

Utilities U.S. utilities were only modestly overvalued at the end of 2018, even after a late-year rally. Investment in renewable energy, smart grid, safety, and reliability provides a long runway of earnings growth potential, argues sector strategist Travis Miller in his quarterly update. Strong balance sheets and generally constructive regulation, especially in the U.S., should support continued dividend growth, too. But rising interest rates and accelerating global growth could weigh on the sector in 2019.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T3GL43HDAFE4XKUGIENW4D5DDI.jpg)