2018 Fund Category and Index Performance Data

Our take on the fourth quarter. Plus the best, and worst, performing fund categories and indexes from the last year.

As 2019 kicks off, Morningstar's analysts have provided in-depth reviews and outlooks across equity sector, fund categories, and private markets. Their takes are below along with quarter-end fund category and index data.

Morningstar's Quarter-End Coverage Stock Market Outlook: Global Equities Are Starting to Look Attractive Basic Materials: Fewer Buying Opportunities Than in Most Sectors Communication Services: Attractive, Sustainable Yields on Offer Consumer Cyclical: Firms That Blur the Lines of Digital and Physical Set to Excel Consumer Defensive: Meaningful Opportunity in Tobacco Energy: A Drop in Oil Prices Has Made Energy Stocks More Attractive Financial Services: Value in Banking and Asset Management Firms Healthcare: Specter of ACA Repeal Hangs Over Fairly Valued Sector Industrials: Trade Tensions Lead to Attractive Valuations Real Estate: Only a Few Opportunities in Fairly-Valued Sector Technology: Semiconductor, Software Firms On Sale Utilities: Investors Once Again Treating U.S. Utilities as a Safe Haven

29 Undervalued Stocks

Pitchbook Venture Capital Outlook: A Spirited VC Market Will Continue to Elevate Valuations and Attract New Investors Private Equity: PE Outperforms and Closes the Valuation Gap Emerging Technology Outlook: Shift Towards Bundling for Consumer-Facing Firms

Manager Research Insights The Year in U.S. Equity Funds A Tough Time for All International-Stock Funds in 2018 Bond Funds Endure a Year of Economic Anxiety Kinnel: A Beating for China, Energy Funds in 2018 Low-Cost Building-Block ETFs Drive 2018 Growth

Fund Family Wrap-Ups Vanguard T. Rowe Price Fidelity American Funds

Data Report

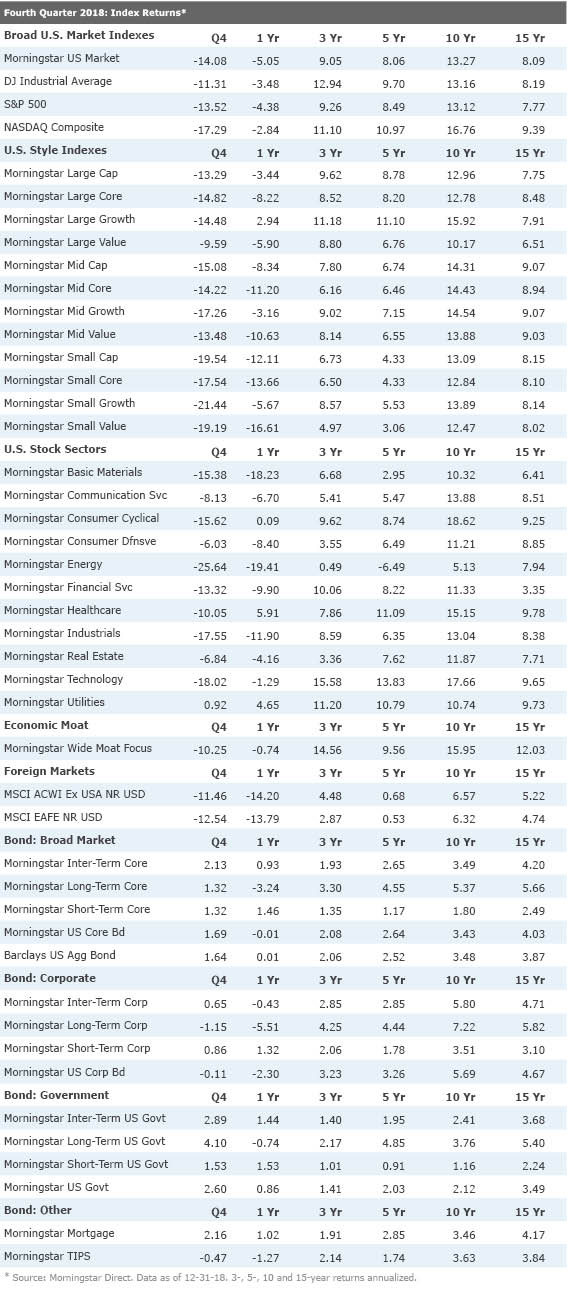

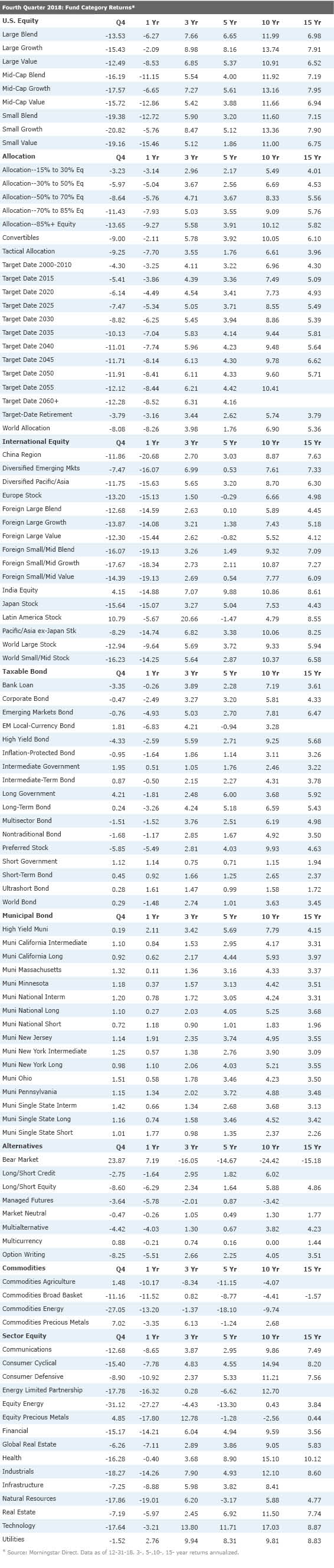

Preliminary Open-End Fund Category Returns Index Returns Download Data (Excel)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)