Emerging Technology Outlook: Shift Towards Bundling for Consumer-Facing Firms

We expect a secular shift away from pure-play shared mobility applications toward bundled mobility as a service.

A common theme we have observed in the landscape of consumer-focused venture-backed technology startups has been the shift toward bundling. By offering multiple products, applications, and services from the same platform, these companies can scale more quickly by growing their user base and maximizing engagement. This secular shift is especially prevalent in financial services and has also been seen in adjacent verticals such as mobility. Driven by shifting consumer preferences, companies like Grab are now expanding services across multiple verticals of financial technology and mobility.

A plethora of fintech companies over the past decade have proliferated to shift customers away from traditional retail banks. These retail banks, whose customers primarily consist of individuals and small and midsize businesses, offer a full suite of end-to-end banking products—from checking and savings to loans to insurance. Packaging one or more of these types of products into a single offering is known as “bundling.” Fintechs have attacked the retail banking value chain via a piecemeal approach, offering targeted, dedicated key services to unbundle these retail banking products. The delivery of these tailored, single-product offerings with new business models, customer acquisition strategies and distribution channels has disrupted the retail banking sector, a development commonly known as “unbundling of the retail bank.”

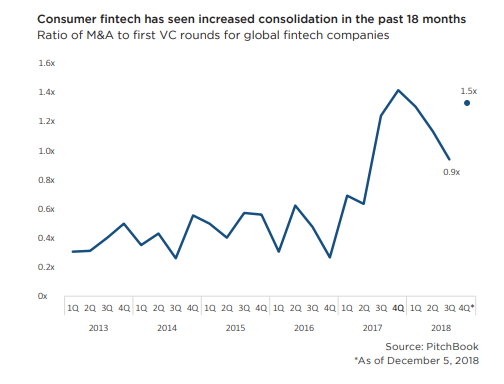

We expect this trend to reverse course this year as many players in the sector will look to deliver bundled offerings. Bundling of retail financial services is common in Asia, where companies like Ant Financial, Tencent, or Grab have bundled services in a single mobile application, consisting of services such as banking, payments, lending, and investment management (some of these also include bundled messaging, ride-sharing, and other services). In North America and Europe, two primary factors will lead to increased bundling of services among incumbent and fintech players: consolidation and product diversification. As the fintech sector reaches an inflection point, incumbent retail banks will aim to claw back market share, and emergent fintech companies will look to retain their customers and further monetize their customer base via consolidation and product diversification.

As for mobility, the rise of ride-sharing giants such as Uber has been emblematic of the shift away from personal vehicle ownership, and we believe the next shift will be from pure-play ride-sharing applications toward bundled mobility-as-a-service solutions. As seen in micromobility, food delivery, and public transportation booking apps, MaaS expands beyond personal transportation and enables the movement of people and goods without necessitating vehicle ownership.

MaaS is not limited merely to food delivery and micromobility. Middle Eastern ride-sharing giant Careem recently announced that it is launching a bus-booking service accessible through its app, allowing users to select pickup and drop-off locations and track buses in real time. A few days later, Uber announced that it was also launching a bus-booking service in Egypt. Singapore-based ride-sharing giant Grab has rebranded itself as a fintech company, with services ranging from payments to food delivery available on its app. Moreover, as ride-sharing companies shift downstream toward last-mile mobility, downstream mobility companies are moving upstream toward cars. Lime recently launched LimePod, a car-sharing service in Seattle, in a bid to compete with incumbents Car2Go, ReachNow, and Zipcar.

Ultimately, bundling creates a source of competitive advantage for shared mobility companies. By being the one-stop shop for urban transportation as well as auxiliary services, MaaS companies gain access to additional users and can scale more quickly. We expect automakers, ride-sharing companies, and investors in the mobility space to increasingly pivot toward last-mile, micromobility, and bundled MaaS solutions, marking a secular shift away from pure-play ride-sharing applications, resulting in elevated levels of mergers and acquisitions in the space in 2019.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)