Venture Capital Outlook: A Spirited VC Market Will Continue to Elevate Valuations and Attract New Investors

We expect valuations to hit new highs, that nontraditional investors will continue to be attracted by strong returns, and that fund sizes may begin to plateau.

- Elevated levels of capital availability and competition at the early stage is leading early-stage valuation step-ups to historic highs.

- Strong returns for VC investors in recent years and the precipitous rise of valuations over the last decade, have encouraged a host of new entrants into the ecosystem.

- The VC asset class may be nearing a ceiling on reasonable fund size for startup financings, as investors run the risk of overpaying in deals given high levels of competition for too-few quality investment opportunities.

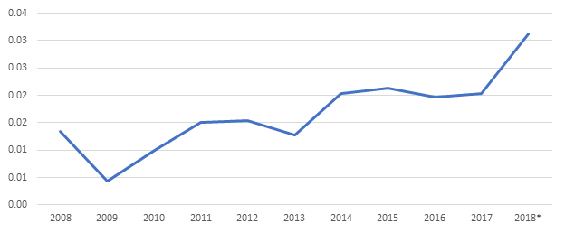

Median early-stage valuation step-ups have increased annually over the past two years, climbing to 1.9 times in 2018. We believe the median will continue to rise in 2019 because of the accelerating velocity of valuation increases at the early stage. Median premoney valuations at the early stage rose 27.5% year over year versus the angel and seed stage, which rose 12.0% year over year. We have two potential theories for why this may be occurring. First, startups may be becoming more effective at putting seed-stage capital to work, accelerating growth after raising a seed round. Second, competition between VCs to invest in top deals at the early stages may be heating up faster than at the angel and seed stage.

Another important factor is that the median age of startups at fundraise has increased more quickly over the past three years for angel and seed deals than for early-stage deals. This suggests that, at the angel and seed stage, companies are taking longer to demonstrate sufficient value to warrant investment and that startups are better able to bootstrap themselves for longer. By the early-stage fundraise, we may be seeing that startups are increasingly able to use their initial fundraise to demonstrate viability and create greater value. To look at this from another angle, we calculate a ratio called the velocity of value creation, or VVC, by dividing the change in valuation between rounds by the days between rounds. This ratio measures the value created (in millions) per days between valuations. Applying this ratio to early-stage deals, we see an upward trend demonstrating that ventures at the early stage are accelerating the rate of valuation growth and/or decreasing time between rounds.

Early-Stage Value Creation Spiked in 2018 Median early-stage VC VVC ($M)

- PitchBook. Data as of Nov. 30.

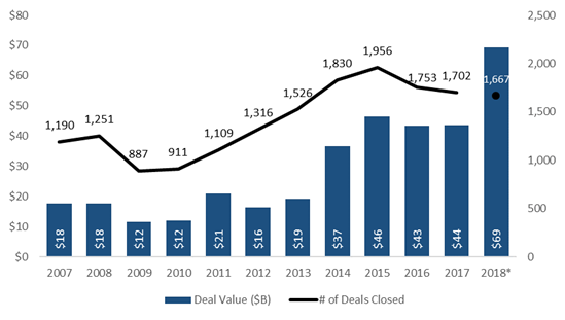

The VC-investing landscape has undergone a historic shift over the past decade, with increasing interest in high-growth opportunities driving more diversity in the investor base and the formation of larger traditional VC funds. This phenomenon has exploded the amount of capital available to companies seeking venture investments. We saw this come to the forefront during 2018, with the value of deals with nontraditional VC investor participation far outpacing any other year this decade, reaching $69.4 billion across 1,667 deals. Much of this has been focused in the late stage, as well as what historically was thought of as the growth stage. Larger and more mature businesses raising further venture funding, rather than pursuing an exit, has opened a new profile of investment opportunities that fit better with asset managers outside of VC.

Nontraditional VC Investors Increase Participation in Outsize Deals U.S. VC deal activity with nontraditional VC investor participation

- PitchBook. Data as of Nov. 30.

The number of unique nontraditional investors completing a direct VC deal also reached a decade high in 2018, signaling continued and growing outside interest in the space. Large pensions, endowments and foundations, sovereign wealth funds, and family offices are among some of the major groups we’re seeing increase activity in direct VC deals. Building out the deal sourcing and due diligence functions can represent serious expenditures for some of these investor types, but the ability to have more control over allocation and investment decisions at a more granular level has been more top of mind for nontraditional VC investors. We expect this shift toward choice to prevail in the VC ecosystem as asset managers look to decrease fees paid and as the space becomes more open and democratized, reducing the initial costs to building direct investment capabilities.

Despite an environment defined by larger deals and valuations, we assert that larger funds may eventually make it harder to deliver venturelike returns to investors due to the recent inflationary dynamics in venture markets. Benchmark Capital, a prominent VC with early investments in the likes of Uber, WeWork, and Instagram, reportedly stated in a shareholder meeting that it would “stick with a smaller pool of capital” to continue “maximizing gains in the winners.” There may be a ceiling on reasonable fund size for startup financings, as investors run the risk of overpaying in deals given high levels of competition for too few quality investment opportunities. Subsequently, we believe that GPs will find a plateau or ceiling of these larger funds that will result in slowed growth of median fund size in the years to come.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)