The ABCs of Buying into Weakness

Even after a downturn, every buying decision requires fresh perspective as it can otherwise expose you to a value trap.

By Tanguy De Lauzon, Morningstar Investment Management Europe LLC and Brad Bugg, Morningstar Australasia Pty Ltd.

Key Takeaways

- Buying into weakness often makes sense, but it is not easy and can sometimes be the wrong thing to do.

- Every buying decision requires fresh perspective, as it can otherwise expose you to a value trap.

- Such traps tend to cluster around certain situations. We believe structural change, rapid disruption, leverage and cashflow as the primary concerns.

"Whether we're talking about socks or stocks, I like buying quality merchandise when it is marked down". [1] - Warren Buffett

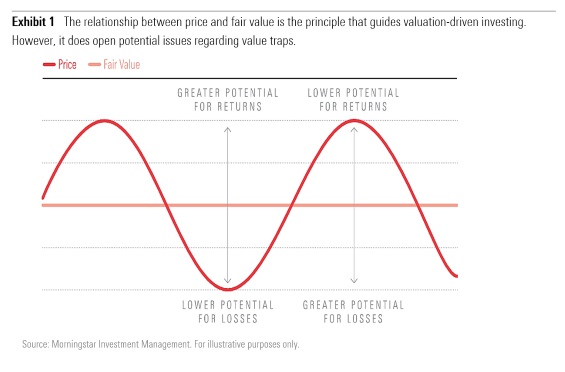

Say an investor buys an asset today and it falls by 40% tomorrow. Should you buy more of it? All else being equal, you would be crazy not to buy more as long as your conviction remains. Yet, the process of ‘buying in the dips’ is beset with behavioural challenges and something every investor must consider carefully.

Primarily, the key risk to buying into weakness is the chance that you’ve invested in a value trap. The first step is to acknowledge the source of value traps, which tend to cluster under the following situations:

- Assets undergoing structural change. This is the most common at an asset class level, which can evolve via comprehendible means (an ageing population or industry in structural decline) or via rapid disruption that is harder to distinguish (wiped out via technological advancements).

- Leveraged businesses that succumb to debt constraints. If an investment falls in price, the debt can suffocate the capital, creating the conditions for a perfectly good business to be a value trap.

- Businesses with poor cashflow management. For example, undertaking a monumental capital expenditure program when there isn't the cashflow to support it, destroying the value of the business.

The other, which is likely to have relevance today, is when assets are still expensive. This may not fit the classic definition of a value trap, but an asset going from extremely expensive to moderately expensive is unlikely to make a good investment, even if the price has fallen meaningfully.

The Risks when Buying into Weakness The problem, of course, is that some investments can tumble into structural decline. Take Kodak for example, where many investors in the 1990's never anticipated the progression of digital cameras, nor that Kodak would be left behind in that progression. Buying in the dips would have been a terrible idea for most investors, as you would have continually bid up this exposure only to find it halve, halve and halve again.

Underpinning the above risks, a key challenge is that ‘early’ and ‘wrong’ can sometimes be indistinguishable in the initial stages of an investment. An investor who is ‘early’ would likely prefer to increase their exposure as the probability of a turnaround increases (much like a poker player should). However, if that investment becomes ‘wrong’ (a value trap), they should consider accepting their losses and move on. It is entirely possible to be both early and wrong if the nature of the asset changes over time.

This is also a warning that cheap assets can get even cheaper. The implication for ‘buying into weakness’ is that we should understand how far valuations can stretch. For example, if an investment falls by 20%, but could fall a further 30%, 40% or 50%, we likely want to avoid going ‘all in’.

In principle, you must therefore conform to the idea that you are often early to the party. After all, you are likely buying the investment today because it is unloved and no one else wants it (yet). By undertaking this exercise, there are no guarantees someone will want it next week, month or even year. Hence the reason value investors often cherish the word ‘patience’.

[1] Source: Berkshire Hathaway 2008 Shareholder letter

Since its original publication, this piece may have been edited to reflect the regulatory requirements of regions outside of the country it was originally published in.

About Morningstar, Inc. Morningstar, Inc. is a leading provider of independent investment research in North America, Europe, Australia, and Asia. The company offers an extensive line of products and services for individual investors, financial advisors, asset managers, retirement plan providers and sponsors, and institutional investors in the private capital markets. Morningstar provides data and research insights on a wide range of investment offerings, including managed investment products, publicly listed companies, private capital markets, and real-time global market data. The company has operations in 27 countries.

About the Morningstar Investment Management Group Morningstar's Investment Management group, through its investment advisory units, creates investment solutions that combine award-winning research and global resources with proprietary Morningstar data. With more than USD$207bn in assets under advisement and management as of 30 September 2018, Morningstar's Investment Management group provides comprehensive retirement, investment advisory, and portfolio management services for financial institutions, plan sponsors, and advisers around the world.

Morningstar's Investment Management group comprises Morningstar Inc.’s registered entities worldwide including: Morningstar Investment Management LLC; Morningstar Investment Management Europe Limited; Morningstar Investment Management South Africa (Pty) Ltd; Morningstar Investment Consulting France; Ibbotson Associates Japan, Inc; Morningstar Investment Adviser India Private Limited; Morningstar Investment Management Asia Ltd; Morningstar Investment Services LLC; Morningstar Associates, Inc.; and Morningstar Investment Management Australia Ltd.

Important Information The opinions, information, data, and analyses presented herein do not constitute investment advice; are provided as of the date written; and are subject to change without notice. Every effort has been made to ensure the accuracy of the information provided, but Morningstar makes no warranty, express or implied regarding such information. The information presented herein will be deemed to be superseded by any subsequent versions of this document. Except as otherwise required by law, Morningstar, Inc or its subsidiaries shall not be responsible for any trading decisions, damages or losses resulting from, or related to, the information, data, analyses or opinions or their use. Past performance is not a guide to future returns. The value of investments may go down as well as up and an investor may not get back the amount invested. Reference to any specific security is not a recommendation to buy or sell that security. There is no guarantee that a diversified portfolio will enhance overall returns or will outperform a non-diversified portfolio. Neither diversification nor asset allocation ensure a profit or guarantee against loss. It is important to note that investments in securities involve risk, including as a result of market and general economic conditions, and will not always be profitable. Indexes are unmanaged and not available for direct investment.

This commentary may contain certain forward-looking statements. We use words such as “expects”, “anticipates”, “believes”, “estimates”, “forecasts”, and similar expressions to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

The Report and its contents are not directed to, or intended for distribution to or use by, any person or entity who is not a citizen or resident of or located in any locality, state, country or other jurisdiction listed below. This includes where such distribution, publication, availability or use would be contrary to law or regulation or which would subject Morningstar or its subsidiaries or affiliates to any registration or licensing requirements in such jurisdiction.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)