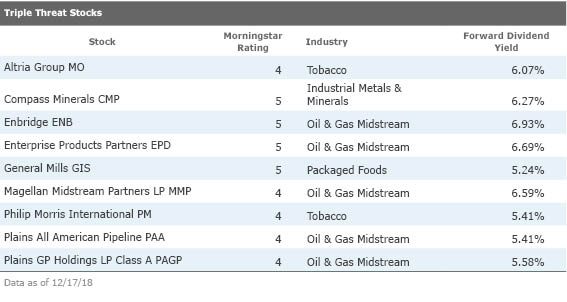

9 Triple-Threat Stocks

These dividend payers all carry wide moats, yield more than 5%, and trade in 4- and 5-star range.

A triple threat has three skills necessary to excel in a given field. In showbiz, the term applies to a performer who sings, acts and dances. In football, the player who can effectively run, pass, and kick is a triple threat. No matter the area of expertise, a triple threat is a rare, valuable find.

When it comes to choosing stocks, investors can look for their own versions of a triple threat, depending on whatever attributes they consider valuable.

Today, we looked for dividend payers that are triple threats by our definition. Specifically, we screened for stocks under analyst coverage with wide economic moats and forward yields in excess of 5% that are trading in 4- or 5-star range, suggesting that they're undervalued by our metrics. We tossed out stocks that didn't pay regular quarterly dividends. Nine stocks made the cut.

Here's a look at three of the names.

Compass Minerals

CMP

Morningstar Rating: 5 stars

Compass Minerals produces salt and sulfate of potash (a specialty fertilizer). The wide-moat firm owns an enviable portfolio of cost-advantaged assets, says analyst Seth Goldstein. Its lays claim to the world's largest active salt mine and controls one of only three naturally occurring brine sources that produces sulfate of potash.

"We think Compass possesses a wide economic moat," he argues. "It holds unique assets with geological advantages that are nearly impossible to replicate, which gives the firm a sustainable cost advantage over other producers of both salt and sulfate of potash."

Yet despite its firm footing, the stock is trading more than 40% below our $81 fair value estimate as of this writing.

"Compass shares remain undervalued, as investors are concerned that recent operational issues might represent a new normal for the company's earnings power," explains Goldstein. "The Goderich mine has suffered various operational hiccups, including a slower than expected production volume ramp-up using the company's new low-cost continuous mining equipment."

The company recently announced the departure of CEO Fran Malecha, too. Goldstein asserts that these challenges will be "fleeting" and expects profitability in 2019 and beyond.

"At current prices, we continue to believe Compass shares offer compelling risk-adjusted upside," he concludes.

Enbridge

ENB

Morningstar Rating: 5 stars

While crude and natural gas pipelines are Enbridge's bread and butter, the company operates a diverse energy portfolio.

"Enbridge's assets are among the best in the North American midstream sector," asserts senior analyst Joe Gemino. "The crown jewel of its portfolio is the Canadian Mainline crude pipeline system, but Enbridge also operates other top-tier assets, such as regional oil sands pipelines, U.S. and Canadian natural gas pipelines, and regulated utilities."

Enbridge's broad network of midstream assets and geographic diversification should serve it well in the low oil and gas price environment, says Gemino, and crude and natural gas pipeline expansions in growing regions will fuel EBITDA growth.

The company recently announced a 10% dividend increase. Some investors were skeptical that Enbridge would meet its targeted increase, Genimo notes, but we think the company can make its payments with its distributable cash flow coverage of 1.65 times the dividend payments.

Shares are trading more than 30% below our $47 fair value estimate.

"We think the time is right for long-term investors to capitalize on the stock's considerable upside while collecting a steady stream of growing income," he concludes.

General Mills

GIS

Morningstar Rating: 5 stars

The maker of Cheerios, Haagen-Daz, and Yoplait, among other well-known brands, enjoys a wide moat thanks to intangible assets and cost advantages, says analyst Sonia Vora, and we expect the firm to generate returns on invested capital above its cost of capital over the next two decades. Its brands have allowed General Mills to bolster its relationships with retailers who rely on leading brands to drive traffic and inventory turnover.

"We believe this has allowed General Mills to maintain valuable shelf space for its offerings, even in areas like yogurt, where its share has been challenged by competition from upstarts and established foes," says Vora. "We expect these relationships to endure over the long run, despite the material competition we expect will persist in the packaged food category."

Moreover, the firm has broadened its distribution to a wider range of channels and geographies and has pursued growth in more on-trend categories like natural and organic products. Economies of scale in production and distribution have allowed General Mills to make substantial investments in research and development and advertising, further securing its competitive edge, notes Vora.

This low-uncertainty stock is trading at a 36% discount to our $58 fair value estimate as of this writing.

This article has been corrected to remove Spectra Energy after its merger with Enbridge.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)