Regional Wild Card

Charging infrastructure is the key to electric vehicle adoption.

Electric vehicle adoption will accelerate over the next decade, driven by a number of variables analyzed in detail in Morningstar’s recent Electric Vehicle Observer.[1] Battery-powered electric vehicles will reach cost parity with vehicles powered by internal combustion engines. Technological innovations will improve batteries, increasing driving range and shortening charging times. In the medium term, emission-driven regulations will spur investment to build better electric vehicles.

In the long run, however, charging infrastructure is the wild card that will either spur or limit electric vehicle adoption in a particular region. A lack of public charging infrastructure in a region limits adoption, as consumers fear being stranded or limited by a vehicle that will not allow them to travel between cities. A 2017 International Council on Clean Transportation white paper cited the number of public charge points as the most important factor in electric vehicle penetration, with an R-squared of 0.78. For adoption to grow, public charging infrastructure needs to be in place throughout cities and along highways.

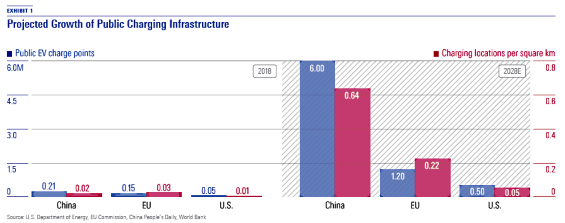

Morningstar’s analysis of charging infrastructure differentiates our global forecast of electric vehicle adoption. We analyze a region’s charging infrastructure by measuring the ratio of charge points per square kilometer as a proxy for infrastructure density. The United States, European Union, and China all average less than three charge points per 100 square kilometers.

Through a massive investment by its state-owned enterprises, China will build the world’s largest charging network. The EU, through a combination of public grants and private networks, will have the second-largest charging network. Range anxiety will disappear in both China and the EU. In the U.S., however, drivers’ range concerns will continue to limit electric vehicle adoption. Along both coasts, infrastructure will be comparable to the EU, but it will be sporadic in the rest of the country.

A Growing Need Around 80% of electric vehicle owners in the U.S. and EU charge their vehicles at home. We think this high percentage is due to the typical owner being affluent—likely to live in a single-family house with a garage and to have the ability to pay for a specialized garage outlet. This is similar to the first automobile owners in the early 1900s, who had to refill their cars by having gasoline delivered to their homes along with heating oil. As more consumers purchased automobiles, gas stations became the primary way for drivers to refuel their cars. We see the same phenomenon playing out for electric vehicles and expect public charging to become the primary means of charging electric vehicles.

As charging infrastructure is built throughout regions, we expect the percentage of owners who charge their vehicles at home to decline. A Level 2 charger requires a 240-volt outlet, which most homes do not have in the garage. A fast charger requires a 400-volt outlet, which is rarer still. (Level 2 chargers cost about $1,200 with installation; fast chargers cost around $8,000, and may not be allowed depending on local regulations.)

Density and Disbursement To assess a region's public charging infrastructure, we look at quantitative and qualitative measures. On a quantitative basis, we look at the ratio of public charging points per square kilometer, which we call the charging ratio, as a proxy for infrastructure density. We count each charging location as a single entity, even though there are multiple charge points at a single location (just as there are usually multiple gas pumps at one gas station) for comparability across regions. We think that once the ratio of charging locations per square kilometer exceeds 0.1, a region should have sufficient charging infrastructure to begin to reduce drivers' range anxiety. When the charging ratio reaches 0.2, range concerns should be relieved within a region.

The exception is China. China plans to build 4.5 million charging points by 2020, which would give the country a charging ratio of more than 0.4. However, more public charging will be needed in China; we estimate that less than half of electric vehicle owners there own a home charging system. The higher percentage of individual home charging stations in the U.S. and EU should allow a charging ratio above 0.2 to relieve range anxiety.

On a qualitative basis, we look for public charging infrastructure plans to build charge points along public highways between cities. Because consumers want the ability to take road trips, highway charging infrastructure is essential to relieving range anxiety.

China has the most charging points as an absolute number, while the EU has the greatest ratio of charging points per square kilometer (Exhibit 1).

All three regions have a ratio of charging points per square kilometer of 0.03 or below as of August. We expect China to continue to have the most charging infrastructure over the next decade and predict China will pass the EU for highest ratio of charge points per square kilometer as well.

Easing Range Anxiety China is investing heavily in charging infrastructure, with the goal of reaching 4.5 million total charging points (including 3 million fast chargers) by 2020. We estimate this number will grow to 6 million by 2028. The charging points will be located in cities and along highways. China's state-owned enterprise State Grid plans to install fast chargers every 50km along major highways. State Grid already owns the largest charging network in the world and plans to grow its network to over 3 million charging points by 2020 by investing nearly CNY 10 billion.

When it comes to building charging infrastructure, China will benefit from its state-owned enterprises. The central planning employed by these companies allows China to build infrastructure faster, as they do not need to undergo a regulatory process like U.S. utilities or worry about near-term profitability like privately funded charging networks. State Grid will undoubtedly generate significant losses in making this massive investment, but it will encourage people to buy electric vehicles instead of conventional cars. Utilities in the U.S. and EU will face a tougher battle to implement the same level of charging infrastructure, especially as the investment immediately benefits a more affluent consumer, while all customers share the cost in higher electric bills.

Europe has around 147,500 charging points, mostly in Western and Northern European cities, with more than 20,000 fast chargers. Germany and the U.K. have the highest ratio per square kilometer. France has the second most charging points out of any country. Much of the charging infrastructure throughout Europe is being funded with public grants. The grants will greatly reduce the up-front costs to build the charging networks. Germany is spending EUR 318 million to install 15,000 charge points along highways throughout the country, including 5,000 fast chargers, by 2020. The U.K. has pledged to install hundreds of thousands of public charging points by 2030.

Additionally, private charging networks funded by automakers are also building infrastructure. Ionity, which is funded by

Over the next decade, we think Europe’s large investment will create the second-best charging infrastructure. We estimate the EU will have 1.2 million charge points by 2028. Most of the locations will likely be in Northern and Western Europe; however, there should still be enough charge points throughout the rest of the EU to relieve range anxiety.

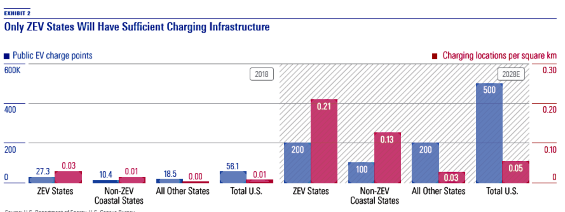

A Fragmented U.S. August electric vehicle infrastructure data from the U.S. Department of Energy show that California and the nine other states that have adopted California's Zero Emission Vehicle program have nearly 50% of total charge points, despite having roughly 30% of total consumer vehicles.

On its own, California has 33% of total charge points in the U.S. and has a charge points/square kilometer ratio in line with France. Non-ZEV states located on the coasts[3] have slightly less than 20% of the total U.S. charge points. The remainder are located throughout the middle of the country, primarily in cities.

We expect U.S. charging infrastructure will come from a combination of private charging networks and regulated utilities. As part of its settlement from its “dieselgate” scandal, Volkswagen will invest $2 billion over the next decade to build a nationwide network of charging stations. However, of the 3,760 charge points that will be built, 1,600 will be in California. Tesla has an extensive network of chargers in the U.S., but the majority of its chargers are along the East and West coasts.[4]

So far, U.S. utilities have taken a conservative approach to building electric vehicle infrastructure, with many still studying the impact of electric vehicles and incorporating them into future plans. Few regulatory actions have been taken in most states outside of California. Although we expect utilities to invest more in charging networks, there is somewhat of a chicken-and-egg problem in states with lower electric vehicle adoption rates.

Utilities can only justify a large investment in charging infrastructure to regulators in states with higher adoption rates; however, many consumers will wait until there is sufficient charging infrastructure to purchase an electric vehicle.

However, California and other ZEV states are allowing more charging infrastructure to be built. To increase private charging investment, California will require electric vehicle space and infrastructure for Level 2 charging in 3% of all parking spaces for new multifamily residential buildings and 6% for new nonresidential buildings. The California Public Utilities Commission approved $738 million in charging projects, which includes $607 million for heavy-duty public charging infrastructure (fast chargers) and $137 million for Level 2 home charging rebates.

Additionally, government agencies in California, Oregon, Washington, and British Columbia, Canada, are teaming up to build the West Coast Electric Charging Highway, which is a network of chargers located every 25 to 50 miles along Interstate 5, from Vancouver to San Diego, as well as along Highway 101 and Highway 99.

Similarly, New York approved $250 million for public charging infrastructure to be built, and New York is a part of the Northeast States for Coordinated Air Use Management, which consists of eight states in the northeastern U.S. that will work together to develop charging infrastructure.

As a result, the ZEV states, which are on the West Coast and in the Northeast, should have sufficient charging infrastructure to relieve range anxiety (Exhibit 2). The non-ZEV coastal states also should have sufficient infrastructure to alleviate range concerns. However, throughout the rest of the U.S., we think that the charging infrastructure will be sporadic and that there will not be enough infrastructure outside of major cities or along nonfederal highways to reduce range anxiety.

Although we forecast the U.S. as a whole will have 500,000 charging points by 2028, the majority of charging infrastructure is likely to be located along both coasts and in major cities. The lack of sufficient electric vehicle infrastructure throughout the rest of the U.S. will make range anxiety a limiting factor in adoption in much of the country.

[1] Goldstein, S., Hilgert, R., Whiston, D., et al. 2018. "Electric Vehicle Sales in China and Europe Will Leave U.S. in the Dust, Driving Above-Consensus Global Adoption Rates." Morningstar Electric Vehicle Observer, September. [2] Goldstein, S., et al. 2018. Page 81. [3] These states include Delaware, Florida, Georgia, North Carolina, New Hampshire, South Carolina, Virginia, Washington, and the District of Columbia. [4] Goldstein, S., et al. 2018. Page 83.

This article originally appeared in the December/January 2019 issue of Morningstar magazine. To learn more about Morningstar magazine, please visit our corporate website.

/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7JIRPH5AMVETLBZDLUSERZ2FRA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)