Calculating the Required Minimum Distribution From Inherited IRAs

The relevant variables and calculations can be complex, depending on the situation.

Looking for "The 401(k) Early Withdrawal Penalty: It's Not Fair!" Click here.

This article has been corrected from its original version.

Custodians will not calculate the required minimum distributions from inherited IRAs--and once you realize the intricacies involved, you'll understand why. Today we'll review how to identify the relevant variables for a variety of inherited IRA situations, which will enable you to make the correct calculations.

Let's begin with a couple of straightforward examples and then move on to the more complex. In all cases, if an RMD was due to the decedent for the year of his or her death, it must be distributed by Dec. 31 of that year. Use the same calculation as the decedent would have used if he or she was still alive.

Spouse Inherits as Sole Beneficiary

The data points you need to collect are:

- The deceased spouse's date of birth and date of death

- The inheriting spouse's date of birth

- The account value as of Dec. 31 of the prior year.

The first determination point is whether the original owner died before or after his or her required beginning date, April 1 of the year following the year he or she would have reached age 70 1/2.

If Owner Died Before Required Beginning Date

When the surviving spouse inherits an IRA from a spouse who had not reached the required beginning date, he or she has three options:

- Re-title the IRA into his or her own account and treat it as any other personally owned IRA.

- Transfer it to an inherited IRA and begin to take the RMD calculated using his or her own life expectancy in the year following the year of death or transfer it to an inherited IRA and delay the RMD until the year the decedent would have reached age 70 1/2, whichever is later, again using his or her own life expectancy.

- Distribute the entire account balance within five years of the year that contains the fifth anniversary of the year of death.

If Owner Died On or After Required Beginning Date

The options available to surviving spouses are:

- Re-title the IRA into their own accounts and treat it as any other personally owned IRA.

- Calculate the RMD using the deceased spouse's remaining life expectancy or the surviving spouse's life expectancy and begin distributions by Dec. 31 of the year following the year of death. (This may be advantageous when the deceased spouse was much younger than the surviving spouse.)

When a spouse maintains the IRA as an inherited IRA, he or she must use the Single Life Table to calculate the RMD based on his or her own or their deceased spouse's life expectancy. The appropriate method is to look up the factor that corresponds to the applicable age at the end of the beginning year. Every year thereafter, subtract one from the initial value.

Surviving spouses can roll over the inherited IRA to their own IRAs at any time in the future. An example of when this would be advantageous is when the inheriting spouse is under age 59 1/2 and wants to take money from the inherited account to avoid the 10% penalty on early distributions from his or her own IRA. Upon reaching age 59 1/2, the surviving spouse can roll the inherited IRA into his or her own IRA and have all the distribution options any other IRA owner would.

A Non-Spouse Inherits an IRA

A non-spouse who inherits an IRA has fewer options, but the same data points must be collected:

- The original depositor's date of birth and date of death.

- The initial beneficiary's date of birth.

- The account balance as of Dec. 31 of the year of death.

Any RMD due to the decedent for the year of death must be taken first using the Uniform Table and the decedent’s age.

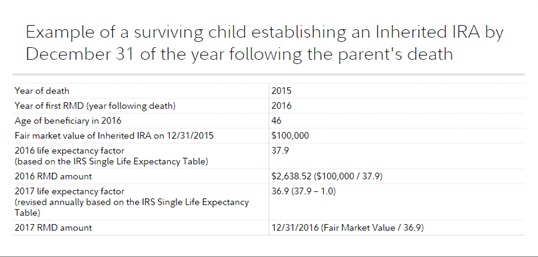

In this situation, non-spouse beneficiaries have only one option for calculating an RMD using a life expectancy method. You determine the beneficiary's age in the year following the year of death and look up the factor on the IRS Single Life Expectancy Table. Divide the balance as of Dec. 31 of the year of death by the factor to calculate the first RMD. For each subsequent year, subtract one from the initial factor rather than going back to the table each year. This method distributes the account balance slightly faster than the re-calculation method would.

In cases where there are multiple non-spouse beneficiaries, each beneficiary can use his or her own age to calculate the RMD only if separate accounts have been established for each of them by Dec. 31 of the year following the year or death. Otherwise, the age of the oldest beneficiary is used for all beneficiaries.

Inherited-Inherited IRAs

When a non-spouse inherits an IRA initially inherited by another beneficiary, a different process is required. As always, any RMD still due to the initial beneficiary for the year of death must be taken first, using the same calculation method as he or she would have used if they were still alive.

The key point to remember is that the initial beneficiary remains the measuring life, not the second beneficiary. The data points that must be collected are:

- The original depositor's date of birth and date of death

- The initial beneficiary's date of birth and date of death.

- The account balance as of Dec. 31 of the year of the initial beneficiary's date of death.

In this case, you first determine the factor from the IRS Single Life Expectancy Table for the initial beneficiary for the year following the death of the original depositor. Subtract one from this factor for each year that has elapsed until the year following the year of the initial beneficiary's death. This is the factor used to determine the second beneficiary's first RMD, and you continue subtracting one for each subsequent year.

Inheriting an Inherited IRA from a Spouse

This is the situation where a spouse inherits an IRA that was inherited by his or her spouse. In this instance, as above, the measuring life remains the initial beneficiary. Regardless of whether the second beneficiary is the spouse of the first beneficiary, the RMD is calculated exactly the same as in the preceding example.

Next month’s article will address the complex situations in which a trust is the beneficiary of an inherited IRA.

Helen Modly, CFP, CPWA, is a wealth advisor with Buckingham Strategic Wealth, a fee-only registered investment advisor. The opinions in this article are the author’s own and may not reflect the opinions of Buckingham Strategic Wealth or Morningstar.com. The author may be reached at nova@bamadvisor.comnow.

/d10o6nnig0wrdw.cloudfront.net/04-24-2024/t_a8760b3ac02f4548998bbc4870d54393_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U772OYJK4ZEKTPVEYHRTV4WRVM.png)