Little Tax Pain for ETF Investors This Year

ETFs' tax-efficient structure and generally lower turnover have helped the funds avoid the large capital gains distributions experienced by open-end funds this year.

Exchange-traded funds are generally touted as tax-efficient fund structures. In early November, Morningstar's Christine Benz highlighted the largest estimated capital gains distributions among mutual funds in 2018. Most fund families have at least one mutual fund that's expected to stick fundholders with capital gains distributions of more than 10% of the fund's net asset value. Compared with actively managed mutual funds, ETFs are set to disburse fewer meaningful capital gains this year. Only two ETFs from the largest fund sponsors are expected to distribute capital gains distributions of greater than 10%. And most ETFs are not expected to distribute any capital gains.

Exchange-traded funds are generally tax-efficient vehicles for two reasons. First, ETFs usually pursue lower turnover strategies than actively managed mutual funds, which reduces realized capital gains, making capital gains distributions less likely. Exchange-traded funds can also harness structural advantages like in-kind transfers. This allows ETFs to meet redemptions by transferring (low-cost basis) shares from the portfolio to market-makers in a tax-free transaction. Mutual funds have to sell securities to raise cash to meet redemptions, which can generate taxable capital gains.

2018 Capital Gain Culprits As of early December, 15 ETF sponsors have published capital gains estimates for 2018. The firms include the largest U.S. ETF sponsors: BlackRock/iShares, Vanguard, State Street Global Advisors, Invesco (formerly PowerShares), Schwab, First Trust, WisdomTree, VanEck, PIMCO, DWS (formerly Deutsche Asset Management), Fidelity, Goldman Sachs, Global X, and Oppenheimer.

Collectively, these fund sponsors represent 1,290 ETFs and $3.4 trillion in assets under management. Of these funds, 74 or 5.7% of the sample are projected to distribute capital gains in 2018. The proportion of funds distributing capital gains is lower this year than the estimated distribution in both 2017 (7.7%) and 2016 (7.0%). Even better, only 14 of the 1,290 ETFs in this 2018 sample expect capital gains distributions that amount to more than 2% of the fund’s NAV as of the end of November.

Exhibit 1 shows the 14 ETFs expected to issue capital gains greater than 2% of their NAV as of the end of November. Note that these figures are only estimates; final values are subject to change. The table shows the midpoints where fund sponsors offered ranges of estimates.

Nine of the 14 funds with high estimated capital gains distributions in Exhibit 1 use derivatives. The structural advantage of ETFs—the in-kind redemption mechanism—proves futile against derivative contracts. It cannot offload gains from these contracts because they’re cash-settled at expiration.

Six of the nine ETFs that use derivatives are currency-hedged strategies. To hedge against fluctuations in foreign exchange changes, these funds’ portfolio managers roll forward currency derivatives contracts regularly.

Two of the funds on the high distribution list,

SPDR SSGA Gender Diversity ETF launched in March 2016 and was born into a bull market. This fund doesn’t have many stocks available to sell at a loss. It distributed 4.1% of its NAV as capital gains last year—near the estimated distribution for 2018.

SPDR NYSE Technology ETF launched in September 2000. This fund equally weights 35 technology stocks. The fund swapped its index in September 2017. It still equally weights 35 technology names, but the selection criteria of the new index are slightly different. At its annual rebalance last December, it substituted 11 of its 35 names. Many of these stocks had large embedded capital gains that State Street wasn’t able to offload via the in-kind redemption process.

Most ETFs expecting large capital gains distributions are new funds without many assets. Nine of the 14 have less than $50 million in assets. Distribution from these small funds will likely affect few investors.

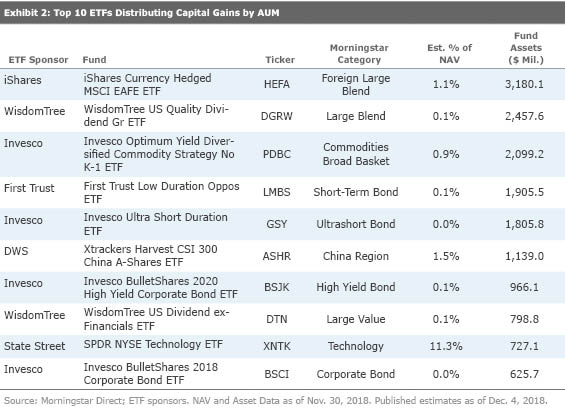

Which Big ETFs Expect Capital Gains? Switching the focus to the biggest funds with estimated capital gains shows which funds will affect a large number of investors. Exhibit 2 shows the top 10 funds by AUM that expect to distribute capital gains in 2018.

Nearly all of these funds’ estimated distributions amount to less than 2 percentage points of their respective NAV. SPDR NYSE Technology ETF is the exception. This is the ninth-largest fund ranked by assets expected to issue capital gains in 2018. And its distribution of 11.3% of the fund’s NAV is expected to be large.

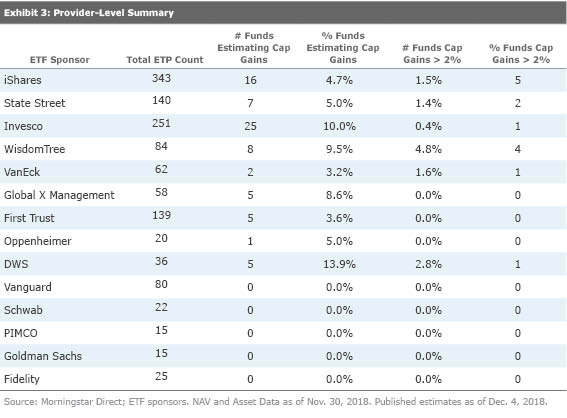

ETF Sponsor Report Cards Some fund families are more susceptible to capital gains distributions than others. For example, fund sponsors that offer more currency-hedged strategies will likely have a higher proportion of funds that distribute capital gains during years in which the U.S. dollar appreciates. Exhibit 3 shows the count and percentage of ETFs in each of the 15 sponsors' lineup that expect to distribute capital gains in 2018.

Vanguard, Schwab, PIMCO, Goldman Sachs, and Fidelity estimate zero capital gains distributions across their ETF lineups. On the other hand, DWS and Invesco estimates that at least 10% of their offerings will distribute capital gains in 2018. Most of these estimates amount to less than 2% of the funds’ NAV. In fact, DWS and Invesco each only have a fund apiece that’s expected to distribute capital gains of more than 2% of NAV.

IShares and WisdomTree lead the pack with the number of funds expected to throw off capital gains greater than 2% of NAV. IShares expects five funds or 1.5% of its offerings to post capital gains greater than 2%. Four of these funds are currency-hedged strategies and the fifth invests in China. WisdomTree reckons four strategies or 4.8% of its funds will issue capital gains distributions greater than 2%. Two of these funds are option-writing strategies, and the other two use currency hedging. It’s not surprising that this lot will distribute capital gains in 2018.

The Big Picture Exchange-traded funds aren't impervious to distributing capital gains but most earn a leg up when it comes to tax efficiency due to their low turnover and in-kind redemption mechanism. There are several characteristics that make some ETFs more prone to distributing capital gains. For example, ETFs that use derivatives that periodically reset are susceptible to capital gains distributions. This usually means currency-hedged strategies, but this year two option-writing strategies made the top distributors list.

Bond funds can also be more susceptible to distributing capital gains. These funds must sell bonds as they approach maturity, which can result in recognizing a gain if the fund added the bond below par value. Emerging-markets funds are another tax-prone lot because some countries prohibit in-kind redemptions.

Most ETFs, especially those that track broadly diversified, market-cap-weighted indexes, are very tax-efficient. Exchange-traded funds that move beyond the area of plain-vanilla may be more susceptible to capital gains distributions. Tax-conscious investors would do well to understand the tax implications of more complex ETF strategies, and scrutinize the tax record of these strategies before investing.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click

for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets,

or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/64dafa24-41b3-4a5e-aade-5d471358063f.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/64dafa24-41b3-4a5e-aade-5d471358063f.jpg)