Sandwich Generation Couple Seeks Check on Asset Allocation

With retirement and college years drawing closer, a couple finds a situation-appropriate stock/bond mix.

This article is part of Portfolio Makeover Week.

Justin and Mallory, both in their mid-40s, are typical of the sandwich generation--people who are simultaneously raising children while also attending to the needs of aging parents. Their sons, 13 and 15, are busy with academics and involved in sporting activities that run throughout the year.

"The boys play club sports, so we travel a bunch and spend a lot of time on this," Justin wrote.

Mallory is also helping to care for her elderly mother, who lives nearby. Mallory had been an elementary school teacher until their children were born; now she squeezes in substitute teaching when her schedule permits. Justin works as a marketing manager for a blue-chip industrial firm.

With their two sons heading off to college within the next five years, the couple had set a goal of paying half of their tuition bills. At the same time, they don't want to short-shrift their own retirements. They'd ideally retire at age 60, Justin says, but he doesn't know if this is doable. Getting out of the snow is also on this couple's wish list.

"We'd like to purchase or rent a place in a warm climate for the winter months, depending on what the kids do. We live in a cold climate, so being snow birds is highly desirable."

And like everyone else, Justin and Mallory are juggling financial priorities in the here and now. They'd like to undertake some renovations on their home, and Justin has grown concerned about the adequacy of their liquid reserves, especially because the family is largely reliant on his salary. He wrote seeking an outside opinion about how to fund their competing financial priorities and ensure that their portfolio is appropriately allocated for their multiple goals.

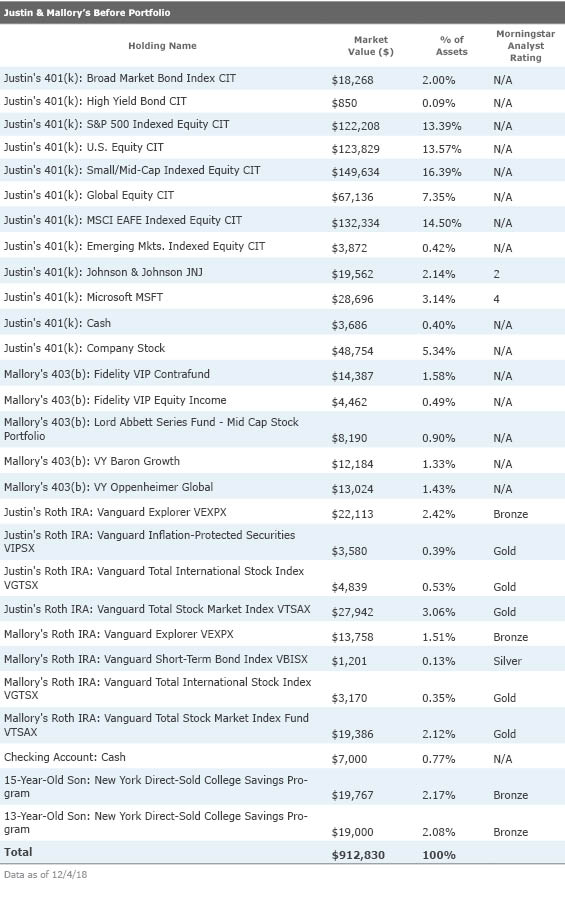

Asset Allocation -- Before

The bulk of Justin and Mallory’s portfolio--about 80% of their total assets--are in Justin's 401(k) plan. Justin has favored his company retirement plan for good reason: His employer contributes 2% of salary for all employees right out of the box, and matches employees contributions of up to an additional 4% of salary. That adds up to a 10% total contribution per year, assuming Justin contributes at least 4% of his paycheck. (He has been contributing 8% of his salary, which adds up to a 14% total contribution, including matching funds.) The 401(k) plan features both actively managed and index-fund options, and Justin has favored the latter, investing primarily in low-cost stock index trackers.

Justin's plan consists of collective investment trusts rather than mutual funds; CITs aren't subject to the same reporting requirements that mutual funds are, and you can't find information on them on Morningstar.com, but they can be extremely low cost, as discussed here. The S&P 500 index CIT in Justin's 401(k) charges just 0.07% per year, while the broad market bond index fund charges 0.08%. The actively managed funds all have multiple managers; as is typical with active products, they're significantly more expensive than the index funds.

Justin also hold a healthy share of his employer's stock, amounting to 7% of his 401(k) assets (6% of their total assets). He has also taken advantage of his plan's brokerage window to invest in a handful of other individual stocks, with positions in

In addition, Justin and Mallory both hold Roth IRAs at Vanguard. These accounts are populated with Vanguard funds, primarily equity index products. Here again, the accounts are aggressively positioned, with stocks consuming well more than 90% of the assets in both accounts.

Mallory also holds her 403(b) from her teaching years; a 403(b) is a retirement plan for educators and other workers in the not-for-profit space. These plans can offer mutual funds through custodial accounts, but they can also offer annuities, which is what Mallory's 403(b) funds are invested in. Within the annuity, she has several subaccounts, which are similar to mutual funds. In contrast to the couple's other accounts, which are dominated by index funds, Mallory's plan is heavy on actively managed options.

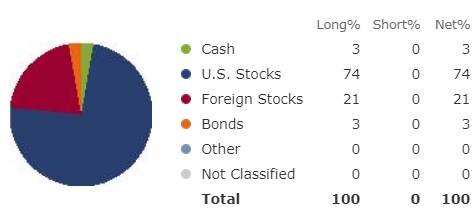

Justin and Mallory are still relatively young, but their retirement assets are still very aggressively positioned in aggregate. An X-ray of their portfolio reveals that they have roughly 95% of assets in stocks and stock funds, with the remainder in bonds and cash. Their emergency fund, at about $7,000 currently, is scant relative to the typical three- to six-month cushion that financial planners recommend.

The couple has used New York's Bronze-rated direct-sold 529 College Savings Program to save for their sons. Both accounts are allocated across multiple holdings. While their 15-year-old's account is invested primarily in equity options, the 13-year-old's 529 is more conservative, featuring 50% stock and 50% bond exposure. Both accounts hold just under $20,000 apiece.

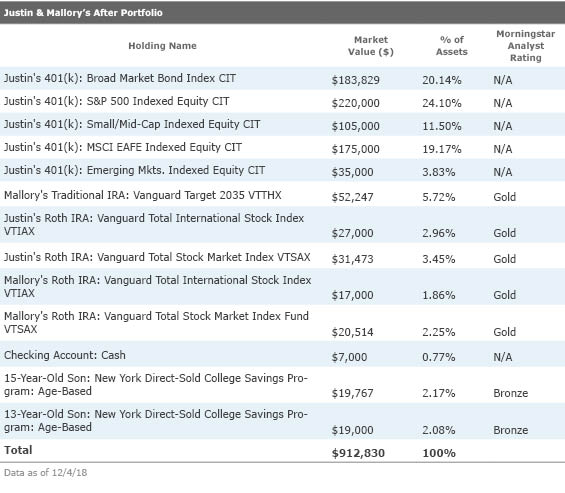

Asset Allocation -- After

Justin and Mallory can pat themselves on the back that their assets are closing in on the $1 million mark; the fact that they've been able to achieve critical mass on a single salary is particularly impressive. While retiring at age 60 may be a bit optimistic, Justin and Mallory are lucky in that they'll be able to rely on pensions for at least part of their income streams. Mallory has a small pension from when she worked full-time. Justin's is larger; while his pension is currently capped and all of his additional retirement funding will come through the 401(k) from here on out, he can still count on $35,000 in annual pension income. To keep their retirement on track, Justin should contribute to his 401(k) at the highest level they can afford each year. Ideally they'd also fund Roth IRAs each year, too.

In addition, I identified several areas where they can make some improvements. First and foremost, the fact that Justin is the primary earner in the family, and a fairly high earner at that, makes an enlarged emergency fund mission-critical. Setting aside three to six months' worth of living expenses can seem like a daunting target, but it can be more manageable if they focus on their very basic living expenses (mortgage, utilities, and so forth) rather than their current expenditures when setting their emergency-fund target.

To help automate the process of enlarging their emergency reserves, they can use an automatic-investment program with Vanguard to dollar-cost average from their checking account into a money market mutual fund within a taxable brokerage account. That will have the salutary benefit of segregating the emergency fund assets from their spending money.

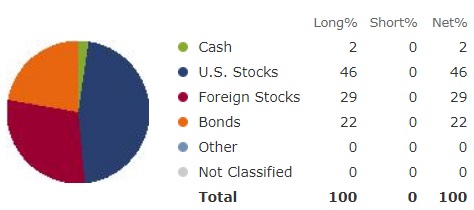

And while their portfolio's equity-heavy posture has no doubt played a big role in the couple's sizable balance, Justin's 401(k), in particular, could stand to be a bit more conservative, both in terms of its asset allocation and security selection. Because Justin is still at least 15 years from retirement, he doesn't need a heavy bond position, or a particularly diversified one. My After portfolio steers 20% of assets to the inexpensive Total Bond Market Index. Within the equity piece of his 401(k), I focused on the inexpensive index funds in the plan and jettisoned the supporting players. While employees often feel an attachment to their employer's stock, company stock can add risk to a plan, as discussed here. Because so much of this couple's financial wherewithal is already riding on Justin's employer, I'd cut that position. (The timing is good, as his employer's stock has performed very well over the past decade.) I also cut the individual stock positions, as Justin says he doesn't have much time to devote to researching and overseeing individual stock positions.

Because Justin and Mallory's Roth IRAs will likely be the piece of their portfolios that they'll spend last during retirement, they can reasonably stick exclusively with stock funds here. My bias would be to keep these portfolios simple, low-cost, and globally diversified.

Mallory's 403(b) includes some solid investment options, especially Fidelity Contrafund. But because she's no longer contributing to the plan, I like the idea of rolling over those assets to a Vanguard IRA. She'll be able to reduce her ongoing carrying costs, and holding those assets alongside their Roth IRAs will simplify oversight and recordkeeping. A low-cost target-date fund is a good fit here, because Mallory won't need to revisit it for years.

Finally, I like the idea of making their 15-year-old's college fund more conservative as soon as possible. They can stick with New York's direct-sold 529 College Savings Program, but switch up the assets within each of the accounts. I like the idea of using the Moderate age-based tracks for each of their sons; they currently feature 25% equity weightings. Those more conservative asset allocations mean the 529s won't grow as robustly as they did in the past, but they also help protect against big losses in the years immediately preceding college.

To sum up, Justin and Mallory should put building up their emergency fund at the top of their financial priorities list, followed by funding Justin's 401(k) so that they can maximize any matching contributions. They can then use any additional funds they're able to free up for 529 and/or Roth IRA contributions. Once college funding is in the rearview mirror, they can turbocharge their retirement savings, as Michael Kitces discusses here.

Streamlining their retirement holdings should also make it simpler to see what they have and assess whether adjustments in order. Doing so also reduces the idiosyncratic risks associated with holding a large position in any one investment style, sector, or company.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U772OYJK4ZEKTPVEYHRTV4WRVM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)