To Index Bonds or Not?

Three considerations: income, total return, and diversification.

In a Slump

noted that, for the first time ever,

(Although that sounds as if catastrophe has struck the fund, it actually is on something of a hot streak, outgaining the category average over the past three months. The source of the fund’s decline in relative performance lies at the beginning of the measurement period; its excellent late-2008 results are now rolling off the 10-year calculation.)

As suggested by the performance discrepancy, Total Bond Market is an unusual index fund, in that it differs meaningfully from its active competitors. It is among the highest-quality, most-liquid funds in its group, holding more than twice the category average in Treasuries. That position has not served it well since the 2008 financial crisis, as the rising economic tide has most benefited the lightest boats.

In discussing whether to hold an index fund such as Total Bond Market or one of the better active funds, Friday’s column reasoned cyclically. The logic: The decade-long economic recovery has helped active funds. When the recovery slows, and recession fears begin in earnest, Total Bond Market will shine. The date of that event is unknown—but this upswing has been long. Best to play it safe by owning the index fund.

That’s a reasonable angle (writes its author), but it’s tactical. The decision can be considered strategically. Over a full market cycle, why might one investor hold Total Bond Market, and why might another prefer an active intermediate-term bond fund?

Cash Today Many investors, of course, buy bond funds for yield. Even if they reinvest the income distributions, rather than receive monthly checks, they take solace in the knowledge that the fund's profits are genuine. They didn't come because somebody bid up securities one day (only, potentially, to knock them down the next). Rather, they occurred because the bonds' issuers paid monies to the fund. Those were cash gains.

If yield is the top priority, Total Bond Market is not an ideal choice. Possessing better-quality notes that can more easily be traded has several advantages—but income is not among them. The index fund’s gross receipts fall substantially short of its typical competitor’s. It makes up much of that lost ground by keeping its expenses very low, but even so, Total Bond Market’s after-cost yield struggles to match the group average.

The category’s best-paying funds tend to be speculative. (Such is the nature of bond funds.) They partake so heavily in higher-yielding credit—such as midquality corporates, structured credit sectors, and junk bonds—that they aren’t substitutes for Total Bond Market. However, a number of successful funds possess both higher payouts and investment-grade credentials. For income-seekers, there are strong, realistic challengers to Total Bond Market.

Cash Tomorrow Others buy bond funds primarily for total return. Not many do so because they believe that bonds will outgain stocks over the long term (although there are a few such pessimists). Rather, it is because equities are too volatile for their tastes, or they have some stocks already, but enough is enough. They seek something that will provide the highest possible returns, without being unduly risky.

For such investors, Total Bond Market is a fine choice. Switching the measure from income to total return benefits the index fund in two ways. First, while delving into lower-quality credits will invariably boost yields, it does not always improve total returns. If the capital losses from credit worries outweigh the income advantage, Total Bond Market’s Treasuries will outperform. Second, it is easy to find high-paying funds. It is much harder to identify, before the fact, funds that will post superior total returns.

That said, the relative performance of bond funds tends to be more predictable than with U.S. equity funds (wherein, notoriously, this year’s leader becomes that year’s laggard). Several intermediate-term bond funds have strong 20-year track records. But so does the index fund. From my perspective, the contest is pretty much a draw.

Bonds as Insurance Now comes Total Bond Market's strongest selling point: diversification. Generally, bond funds don't exist in isolation. Whether the investor favors income or total returns, the fund also carries the additional purpose of hedging. Other portions of the portfolio, including but not limited to stocks, real estate, and commodities, are volatile. They can lose money, in a hurry. One of the tasks of an intermediate-bond fund is to balance the portfolio. When other assets are falling, it should hold its course.

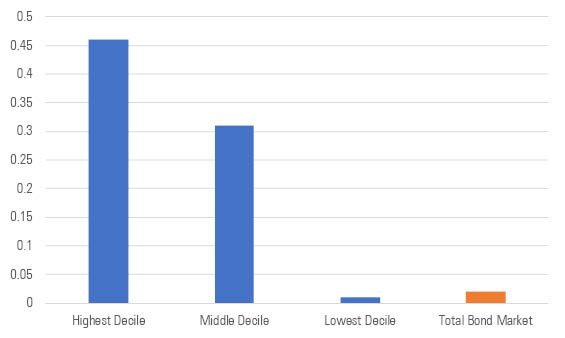

Total Bond Market has done just that. Morningstar’s Miriam Sjoblom (who also kick-started Friday’s column) provides the proof. She calculated the correlation between Total Bond Market and the S&P 500, for the almost 12-year period from 2007 though October 2018. It appears in the chart below, in orange. However, it does not appear very much, because it is a tiny 0.02. The index fund has not danced with the stock market’s tune.

Exhibit 1: Stock-Market Correlation Intermediate bond funds versus the S&P 500 (January 2007-October 2018)

Source: Morningstar Direct.

As the graphic also indicates, Total Bond Market’s correlation is not quite the lowest, as the bottom decile among intermediate-term bond funds comes in at a slightly lower figure, registering 0.01. But it’s close! It is far away indeed from the category average, which is at 0.31. (And further yet from the most correlated funds, represented by the bar on the left.) Clearly, Total Bond Market offers a strong insurance policy.

Wrapping Up When comparing Total Bond Market with the leading actively run rivals, it falls slightly short on income, is fully competitive for total returns, and comfortably delivers the best diversification. In addition, it would seem to be the timely choice, given the length of the current economic recovery. Total Bond Market, or a similar index fund, is what I would purchase, were I in the market for a bond fund.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)