Why Diversification Beats Conviction

The more concentrated a portfolio is, the greater the risk of missing out on the market's biggest winners and underperforming.

A version of this article was published in the September 2018 issue of Morningstar ETFInvestor. Download a complimentary copy of Morningstar ETFInvestor by visiting the website.

Investing with conviction isn't necessarily a good idea. That may seem a bit counterintuitive, particularly with respect to manager selection. After all, an active manager's best ideas can shine more in a compact, high-conviction portfolio than they could in a better-diversified portfolio. It's hard to surmount active fees without taking bold active bets. But as portfolio concentration increases, so do the odds of underperforming the market.

Do Stocks Beat Treasuries? Hendrick Bessembinder, a professor at Arizona State University, illustrates this effect in his provocative paper, "Do Stocks Outperform Treasury Bills?"[1] In it, he demonstrates that most U.S. stocks not only underperformed the market from 1926 through 2016, they also underperformed Treasuries. Over the nine decades he studied, 69% of stocks lagged the broad equity market and 57% failed to outperform Treasuries. This abysmal showing seems inconsistent with the level of compensation that investors demand for equity risk. So, how does this result square with the strong long-term performance of the stock market as a whole?

A small minority of stocks were responsible for most of the market's returns. Bessembinder found that the best-performing 4% of all U.S. stocks generated all the market's gains. The remaining 96% were collectively flat: The wealth generated by the next 38% was wiped out by the bottom 58%, which lost money. In statistics-speak, the market exhibited positive skewness: The big winners pulled the mean (average) return above the median (middle) return, which was negative.

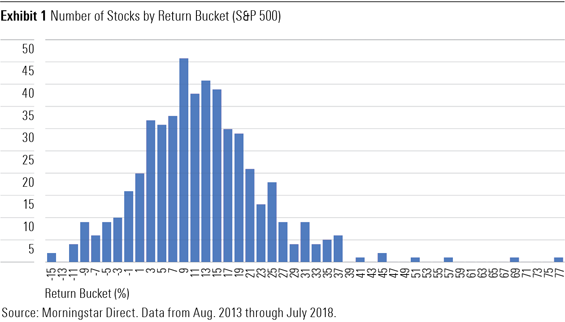

To illustrate, consider the data in Exhibit 1, which shows the dispersion of returns of the stocks in the index over the trailing five years through July 2018. The right-hand tail is longer than the left-hand tail, which pulled the average return of the stocks in the index slightly above the median and created a modest positive skew.

It isn't surprising to find this type of pattern, and it's not just applicable to stocks. Whenever there is a limited lower bound and no upper bound, it is common to find that a few observations have a disproportionate impact on the average, whether it's the distribution of wealth or productivity. As securities with limited liability, stocks' downside is capped at negative 100%, but their upside is unlimited. This means that the gains from the big winners more than compensate for the losses among the big losers. Big winners can turn into dominant competitors (for example,

Compounding tends to increase this positive skewness over time. This is because the winners in successive periods grow at higher rates than the losers, pulling the mean stock return further above the median over time. High volatility also increases skewness. When volatility is high--as it is for most stocks--the odds that a stock will underperform the market increase with the holding period. This is because the effects of skewness overpower the benefits of stocks' positive mean return. Bessembinder found that 46% of stocks beat the market over a one-month horizon. That figure fell to 37% at the 10-year horizon. The odds of success were lower for small-cap stocks than they were for large caps, as their higher volatility led to greater skewness.

Diversify Why does all this matter? It suggests that investing in a concentrated portfolio is a bad idea because the opportunity cost of missing the market's big winners exceeds the benefits of avoiding the (many) losers. Bessembinder directly illustrates this point in his study. He created market-cap-weighted stock portfolios of varying sizes chosen at random each month and measured the performance of those strategies over a few horizons. In these simulations, the risk of underperforming over a decade fell to 52% from 59% as the number of stocks included in the portfolio increased to 100 from five.

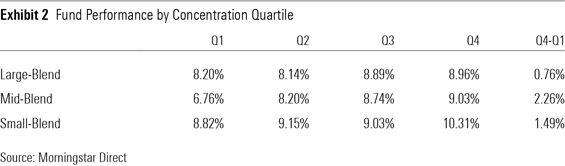

While no one selects stocks at random, these results are consistent with the experience of active mutual fund managers over the past decade. To arrive at this finding, I grouped all active mutual fund managers (including nonsurviving funds) in the large-blend Morningstar Category into quartiles based on the percentage of assets invested in their top 10 holdings at the end of June each year from 2008 through 2017. I then tracked the average performance of the funds in each quartile over the next 12 months and strung the returns together over the full decade. I repeated this process for the mid- and small-blend categories. The results are shown in Exhibit 2 ("Q1" represents the quartile of most concentrated funds).

The data is clear: The more concentrated a portfolio is, the greater the risk of missing out on the market's biggest winners and underperforming. This risk is greater among mid- and small-cap stocks than it is among large ones. It is hard to identify the market's big winners ahead of time, and more difficult still for a concentrated manager to ride those stocks all the way up because doing so would eliminate any semblance of diversification. It is also difficult to hold on to winners because their valuations likely become stretched along the way, which may tempt managers to sell to lock in the gains and invest in a more attractively valued alternative.

Concentrated active managers who do catch some of the big winners can crush the market, but the odds are against them. Neutral-rated

Diversification also blunts the impact of investment mistakes, whether it's failing to recognize the return potential of strong-performing stocks or falling into a value trap. These mistakes are harder to overcome in a concentrated portfolio. For example, Bronze-rated

But if being too concentrated is a sin, so is investing in a benchmark-hugging portfolio with high fees. It is difficult for managers that don't stray far from their index to recoup their fees. Diversification doesn't require limiting active risk, but rather casting a wide net to improve the odds of picking up the market's big winners and limit the impact of individual stock investments if they go wrong.

Broad Indexes Are a Good Starting Point

Broad market-cap-weighted index portfolios, like

While most stocks will likely underperform the market, deviating from the broad market-cap-weighted portfolio doesn't preclude success. For instance, the equal-weighted version of the U.S. stock market portfolio has been even tougher to beat, likely because it benefited more from the greater positive skew in returns among smaller stocks. There are also other ways to outperform.

It is no secret that stocks with certain characteristics like small size, low valuations, high profitability, and strong recent returns (momentum) have tended to offer higher returns than the market over the long term, and they will likely continue to do so. Tilting toward these stocks can help boost expected returns. But it is still important to stay diversified to reduce the risk of missing the big winners, which have a disproportionate impact on the returns to each investment style (factor).

Vanguard U.S. Multifactor ETF VFMF (0.18% expense ratio) offers a good way to lean into some of these rewarded factors, while maintaining a broad portfolio that effectively diversifies stock and factor risk. It targets stocks with attractive value, momentum, and quality characteristics across the entire market-cap spectrum. The managers exclude the most-volatile 20% of stocks in the large-, mid-, and small-cap buckets and target one third of the remaining stocks in each size group with the strongest overall combination of factor characteristics. The resulting portfolio includes more than 600 stocks, the top 10 of which represent only about 10% of the portfolio.

[1] Bessembinder, H. 2017. "Do Stocks Outperform Treasury Bills?" Department of Finance, Arizona State University.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click

for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets,

or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)