Sustainable Funds Largely Sidestep Nissan Controversy

The arrest of Nissan chairman Carlos Ghosn was a shock, but a poor history of corporate governance kept most ESG-focused funds away.

The arrest of Nissan Chairman Carlos Ghosn in Japan on charges of under-reporting his compensation was shocking news, but investors paying attention to the company's corporate governance practices shouldn't have been all that surprised.

, Nissan Motor Co's corporate governance performance ranks dead last in the global automobile subindustry group. That's 41st out of 41 companies.

On the subject of remuneration in particular, Sustainalytics points out in its current analysis (which predates Monday's revelations) that the company's remuneration practices "raise some concerns" because payments to executive directors are large and the "controlling shareholder appears to be involved in setting the remuneration." The report also notes that the company lacks a remuneration committee.

From the screenshot below, you can see that Nissan Motor Co is a laggard not only in the way it handles remuneration, but is a laggard or underperformer in four of the other five categories in Sustainalytics' corporate governance framework. Poor corporate governance practices also raise Nissan's overall ESG risk, which places in the worst quintile of the subindustry.

This is a great example of why it makes sense to incorporate ESG analysis into the investment process. It can help you avoid value-destroying controversies like this one in the first place or at least help you understand the risk you're taking on.

Nissan Motor lost 5.85% Monday; Renault RNLSY, which owns nearly half of Nissan and is part of the overall Nissan-Renault-Mitsubishi business alliance--of which Ghosn is chief executive--lost 7.1%.

But therein lies another part of the story. Renault is one of the better overall ESG performers in the automobile manufacturers subindustry, but a closer reading of Sustainalytics' corporate governance report reveals that it is an underperformer when it comes to audit and financial reporting and a laggard in terms of ownership and shareholder rights. Overall ESG ratings don't always tell the whole story, so it pays to dig into the details.

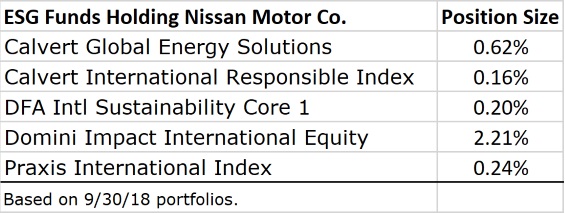

ESG Funds Largely Avoid Nissan Most ESG funds appear to have already steered clear of Nissan. Among 60 U.S.-based ESG open-end funds and ETFs that invest globally or only outside the U.S., only five had positions in Nissan as of their most recent portfolios dated Sept. 30. One fund, Domini Impact International Equity DOMIX, had a large active overweight in the stock.

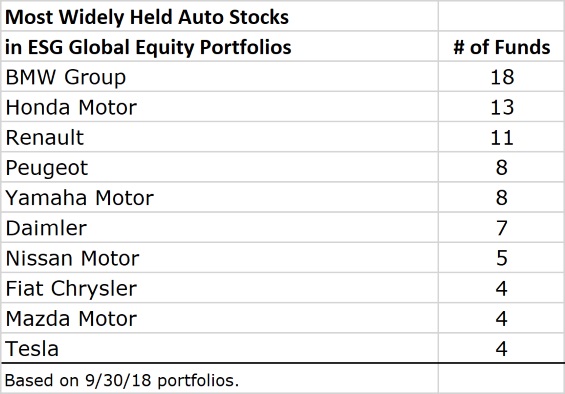

ESG funds tend to like Renault better, although all 11 of those that hold the stock are index funds.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7JIRPH5AMVETLBZDLUSERZ2FRA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)