Ratings Highlights for October

Overall, 168 strategies were rated, eight of which were new to coverage.

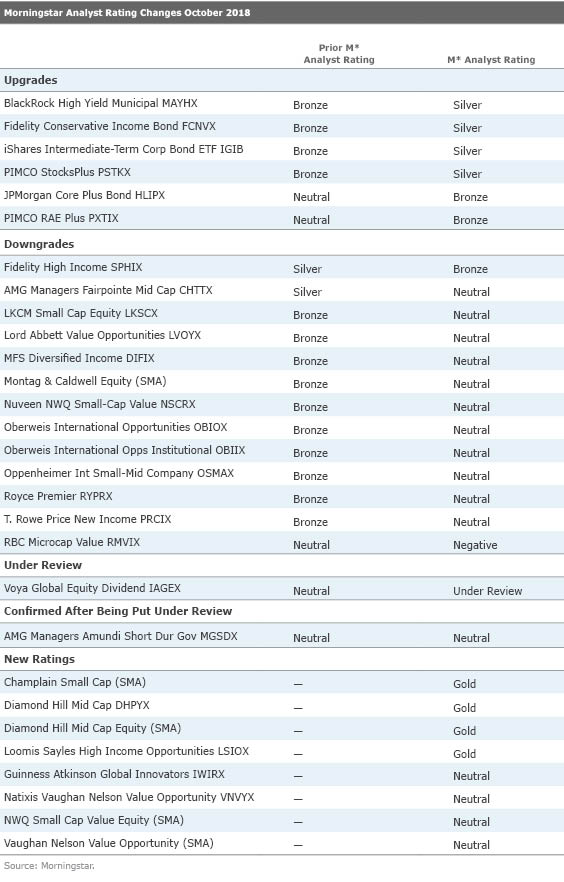

In October, Morningstar manager research analysts affirmed the Morningstar Analyst Ratings of 140 strategies. Additionally, six ratings were upgraded, while 13 ratings were downgraded. Only one fund was placed under review. A select group of ratings is showcased below, followed by the full list of ratings changes for the month.

Upgrades

The rating for

Downgrades

New Ratings

Coverage of

For a list of the open-end funds we cover, click here. For a list of the exchange-traded funds we cover, click here. For information on the Morningstar Analyst Ratings, click here.

/s3.amazonaws.com/arc-authors/morningstar/53105aea-e88d-401b-acb5-ba9695f97c2a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/53105aea-e88d-401b-acb5-ba9695f97c2a.jpg)