About Those New Vanguard ESG ETFs

Funds’ reliance on exclusions is a throwback.

By focusing only on exclusions, Vanguard has missed the mark with its new environmental, social, and governance exchange-traded funds. Last month, the firm launched its first two ESG ETFs, the Vanguard ESG U.S. Stock ETF ESGV and the Vanguard ESG International Stock ETF VSGX. The U.S. fund tracks the FTSE US All Cap Choice Index, and the international fund tracks the FTSE Global All Cap ex US Choice Index. Combining the two funds, theoretically, gives investors exposure to global equities through an ESG lens.

The problem is that these funds aren’t really ESG funds, at least not in the sense that I would define the term. Granted, the ESG space has some challenges with terminology reflecting varied approaches, but, for the most part, funds calling themselves “ESG” today explicitly integrate environmental, social, and corporate governance criteria to select companies with positive ESG characteristics.

The typical passive ESG fund tracks an index that is constructed using company-level ESG analytics to tilt its portfolio toward companies that are doing a better job addressing the material ESG risks and opportunities facing their business. For companies in the energy, utilities, and industrials sectors, as an example, that means focusing on issues like carbon emissions; for tech companies, data privacy; for apparel firms, supply-chain oversight. For industries where innovation and expertise are at a premium, ESG analysis may look at pay, benefits, diversity, and corporate culture. Ethical corporate governance, product safety and usefulness, treatment of workers, and community relations are important ESG considerations across the board.

The new Vanguard funds, however, don’t reflect an ESG integration approach. They are throwbacks, evoking the pre-ESG era when “socially responsible” portfolios employed a more-limited negative-screening approach that excludes companies based on their products or practices.

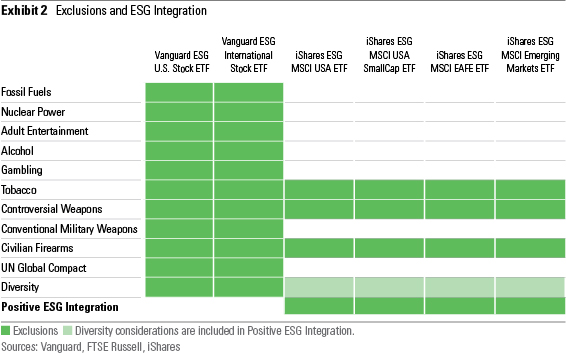

Specifically, the new Vanguard ESG ETFs track FTSE indexes that exclude companies based on three types of products:

- Nonrenewable Energy (Fossil Fuels and Nuclear Power)

- Vice Products (Adult Entertainment, Alcohol, Gambling, and Tobacco)

- Weapons (Controversial Weapons, Conventional Military Weapons, and Civilian Firearms)

The funds also exclude companies that are in violation of any of the 10 principles of the UN Global Compact, which cover corruption, the environment, human rights, and labor. Finally, companies could be excluded because of poor diversity practices, but the criteria for that is vaguely stated in the index methodology.

Rather than tilting toward companies with better ESG profiles, the Vanguard funds simply use negative screens to exclude a relatively few companies from a broad market index.

So what’s wrong with that? Certainly the funds’ list of exclusions is one that many sustainable investors may support. But plenty of ESG funds offer at least some of the same exclusions while also keeping their primary focus on positive ESG integration. Their investors get a more comprehensive ESG portfolio that leans toward companies with better sustainability profiles.

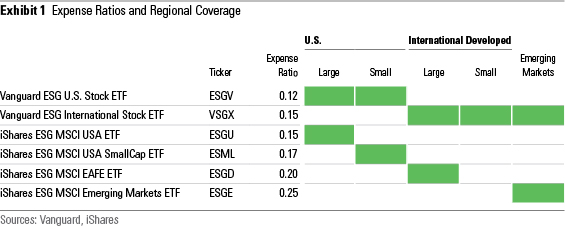

Vanguard--because it is Vanguard--is likely to attract many advisors and individual investors to these funds because of their low fees: ESGV’s expense ratio is 0.12%, VSGX’s is 0.15%. Many will make their first ESG investment in these funds, and many will think, incorrectly, that exclusionary screening is what ESG is all about. A focus on screening rather than positive ESG integration could also lead to underperformance, depending on how effectively FTSE Russell optimizes the indexes to neutralize the tracking error created by the exclusions.

Alternatively, investors might consider selecting from the iShares sustainable core ETF lineup. To get similar market exposures to the Vanguard ESG ETFs, investors would have to select iShares ESG MSCI USA ETF ESGU, iShares ESG MSCI USA SmallCap ETF ESML, iShares ESG MSCI EAFE ETF ESGD, and iShares ESG MSCI Emerging Markets ETF ESGE.

The slightly more expensive iShares ETFs are based on MSCI ESG indexes that consist of companies with positive ESG characteristics, while also employing a limited number of exclusions for civilian firearms, controversial weapons, and tobacco.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-25-2023/t_f3a19a3382db4855b642d8e3207aba10_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)