Morningstar Names the Best 529 College Savings Plans for 2018

Two upgrades and nine downgrades highlight this year's ratings.

Each year, we assign Morningstar Analyst Ratings to college savings plans based on five key pillars: Process, People, Parent, Price, and Performance. We also consider if any plans convey unique benefits, such as local tax breaks, grants, and scholarships, though these usually do not drive the overall outcome. In 2018, Morningstar assigned analyst ratings to 62 plans, which represent more than 95% of assets invested in 529 plans. Morningstar analysts upgraded two plans and downgraded nine.

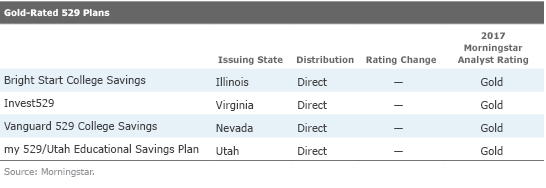

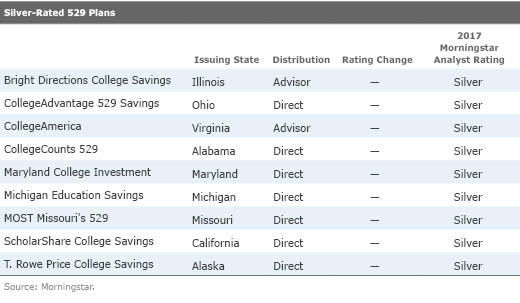

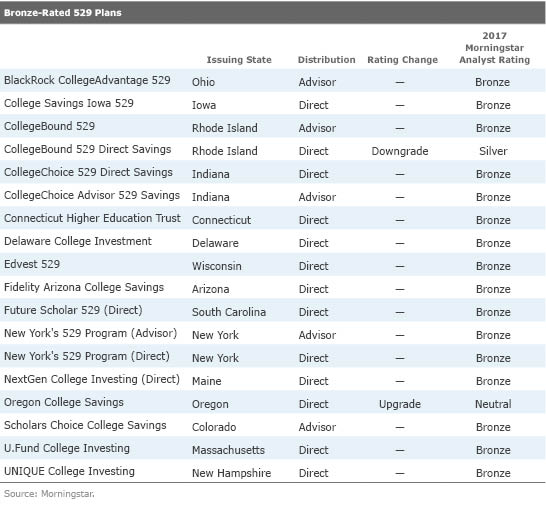

Morningstar identified 31 plans that it believes to be best-in-class options, assigning these programs Analyst Ratings of Gold, Silver, or Bronze. These plans for the most part follow industry best practices, offering some combination of the following attractive features: low fees, a strong set of underlying investments, a solid manager selection process, a well-researched asset-allocation approach, an appropriate set of investment options to meet investor needs, and strong oversight from the state and program manager. These features improve the odds that a plan will continue to be a strong option for investors. Gold-rated plans have all or a vast majority of these attributes. Silver- and Bronze-rated plans embody most of these qualities but often have some room for improvement.

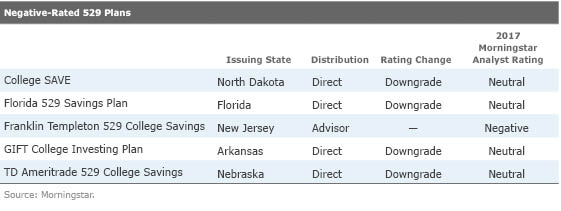

Morningstar also identified five plans that earn Negative ratings; four of which were downgraded from Neutral in 2018. These plans lack compelling traits and have at least one flaw that makes them worth avoiding, such as high fees.

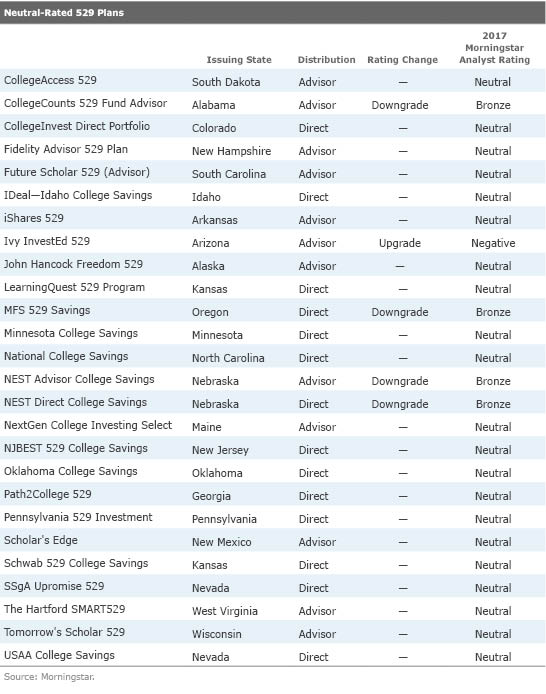

Twenty-six plans earned Neutral ratings. Some Neutral-rated programs may hold appeal for in-state residents because of meaningful added benefits, such as local tax breaks; participants should look closely at any in-state incentives during their search.

The Valedictorians Four plans continued to merit Morningstar Analyst Ratings of Gold. These plans stood out for their low costs, strong stewardship, and exceptional investment options. Silver-rated plans also remained steadfast.

Most Improved We upgraded two college savings plans this year. The Oregon College Savings Plan was upgraded to Bronze from Neutral, and Arizona's Ivy InvestEd 529 Plan was upgraded to Neutral from Negative.

Oregon, along with new program manager Sumday, a BNY Mellon affiliate, adopted a progressive glide path for its age-based portfolios, an industry best practice, and overhauled its investment lineup with high-quality passive and active strategies from a variety of firms, including Vanguard, DFA, and T. Rowe Price. These enhancements make it an attractive option for residents and nonresidents alike.

The Ivy InvestEd 529 Plan lowered fees and smoothed the glide path of its age-based portfolios by adding additional steps in 2017. Notably, in October 2018, Morningstar upgraded program manager Waddell & Reed's Parent rating to Neutral from Negative. The firm has faced a number of setbacks in recent years, but Phil Sanders has implemented meaningful improvements since becoming CEO in August 2016. The firm rebuilt its analyst staff, appointed heads of research and risk management, and transitioned to a team-managed structure on many funds. Overall, our confidence in the firm's stability has improved.

Two Plans That Rely on Vanguard Get An 'F' For Fees Two plans that feature Vanguard as its investment manager and Ascensus as the program manager were downgraded to Negative from Neutral because of excessively high fees for Vanguard's typically low-cost index funds. The Arkansas GIFT College Investing Plan and North Dakota's College SAVE have similar investment lineups and investment processes as other plans that use Vanguard as the investment manager, like the Gold-rated Vanguard 529 College Savings Plan. Prices depend somewhat on scale, or assets across the plan, and Arkansas and North Dakota are relatively small and therefore charge high program management fees that erode Vanguard's usual edge in price. There's little incentive for even in-state college savers to stay in the plans when similar fare is offered at a much more palatable price.

As the 529 industry continues to make significant fee cuts, plans standing still on fees have become increasingly unattractive. We downgraded three of Nebraska's plans (NEST Direct College Savings Plan, NEST Advisor College Savings Plan, and TD Ameritrade 529 College Savings Plan) and Alabama's CollegeCounts 529 Fund Advisor Plan because they haven't cut fees as aggressively as most peers.

Morningstar Analyst Rating Inputs Since 2012, ratings for 529 plans have used the same scale as the Morningstar Analyst Rating for mutual funds. Both Analyst Rating methodologies consider the same five factors to arrive at the final rating, though the 529 ratings reflect the quality of the entire plan--not a single investment, as is the case for the fund rating. To arrive at an Analyst Rating for 529 plans, analysts consider:

Process: Did the plan hire an experienced asset allocator to design a thoughtful, well-diversified glide path for the age-based portfolios? What suite of investment options is offered?

People: What is Morningstar's assessment of the underlying money managers' talent, tenure, and resources?

Parent: Are the program manager and investment manager good caretakers of college savers' capital? Is the state managing the plan professionally?

Performance: Have the plan's options earned their keep with solid risk-adjusted returns over relevant time periods?

Price: Are the investment options a good value?

Want to learn more about your plan's strengths and weaknesses? Go beyond the Morningstar Analyst Rating and read detailed analyses of 62 of the largest 529 plans. Click here to try a Premium Membership, free for 14 days.

Associate analyst Stefan Sayre contributed to this article.

/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

/s3.amazonaws.com/arc-authors/morningstar/1ce41a40-52cb-4f36-a566-a312fdb580cd.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1ce41a40-52cb-4f36-a566-a312fdb580cd.jpg)