13 New Stocks in the Wide Moat Focus Index

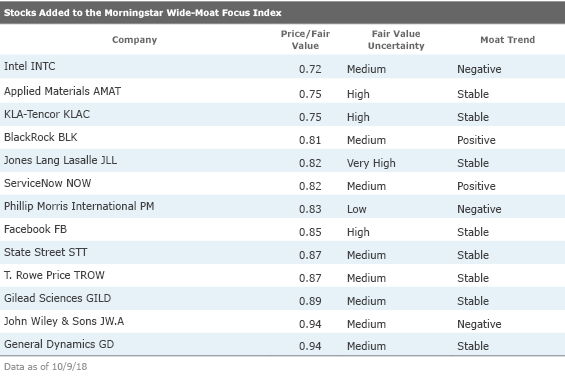

The Morningstar Wide Moat Focus Index has added several semiconductor stocks and asset managers, among others, to its roster.

Another quarter, another tweak to the Morningstar Wide Moat Focus Index.

Specifically, we reconstitute one subportfolio of the index each quarter. We re-evaluate the index's holdings and add and remove stocks based on a preset methodology. Doing so helps keep the index true to its goal of providing exposure to competitively advantaged (wide-moat) stocks selling at the lowest current market price/fair value ratios.

The index consists of two subportfolios containing 40 stocks each, many of which are overlapping positions. The subportfolios are reconstituted semiannually in alternating quarters, on a "staggered" schedule. Because stocks are equally weighted within each subportfolio, the reconstitution process also involves right-sizing positions.

After the most recent reconstitution on Sept. 21, half of the portfolio added 13 positions and eliminated 12. The index now holds 54 positions.

The Additions A trio of asset managers and as many semiconductor stocks were added to the index last month.

"It's been a difficult year for the U.S.-based asset managers, with the 12 firms we cover down close to 20% on average since the start of 2018, compared with a nearly 8% price gain for the S&P 500 index," notes sector strategist Greggory Warren. Increased regulation of asset managers globally, distribution channel disruption in the U.S. and other developed markets, and the ongoing shift from active to passive products leaves the industry at crossroads today, argues Warren. These forces have driven some wide-moat names--

Meanwhile, semiconductor stocks

in early September: Fears of further pricing declines and delayed capacity expansion plans drove down stock prices, explains senior analyst Abhinav Davuluri. Davuluri thinks the market's reaction was overdone and that the sell-off provided a buying opportunity. Wide-moat

The Drops

Seven stocks were removed because their price/fair values fell outside of our buying range:

The remaining five stocks--

- CVS' downgrade stems from its forthcoming merger with Aetna. Senior equity analyst Vishnu Lekraj says, "The new entity will be one of the most powerful players within the healthcare ecosystem." He sees a significant opportunity for CVS/Aetna to improve the profit and return outlook for the managed care organization, but there will be increased costs at the firm's retail operations. As a result, the combined firm earns a narrow economic moat rating.

- We downgraded Franklin Resources' moat rating to narrow in September, after re-examining the switching costs and intangibles we view as sources of economic moats for the asset management industry, says Warren. Though the firm has the scale and brands to be competitive, its organic growth rate during the past five years has averaged a negative 4.4%, which was worse than the industry overall. We expect headwinds for asset managers to stiffen further as we move forward, making annual organic growth in assets under management even more challenging here, concludes Warren.

- We cut GE's economic moat rating to narrow in June. While we still think the firm's aviation and healthcare segments carry wide moats, the downgrade stems from weak performance in other segments. "We think it will be challenging for GE to isolate the less desirable portions of its portfolio and lift its ROIC profile without significant dis-synergies," says analyst Joshua Aguilar. As a result, we're no longer confident that GE's excess returns will persist 20 years--which is our expectation for wide-moat stocks.

- L Brands--known for its Victoria's Secret, Bath & Body Works, and Henri Bendel brands--experienced its moat downgrade during the summer. "Consumer trends have opened the door for competition to materialize," explains senior equity analyst Jaime Katz. The firms pricing power has come under pressure and gross margins have deteriorated. We're no longer confident that the firm's excess returns can persist for two decades, she says.

- We adjusted Stericycle's moat rating to narrow in spring. The firm's core domestic medical waste operations still enjoy robust competitive advantages. "However, changes in healthcare end markets over the past decade (namely consolidation of independent healthcare practices into larger hospital groups) have reached the point where Stericycle is seeing a large portion of its small-quantity account pricing materially bid down," says analyst Matthew Young. As a result, we're less confident that the firm's excess returns will persist for 20 years.

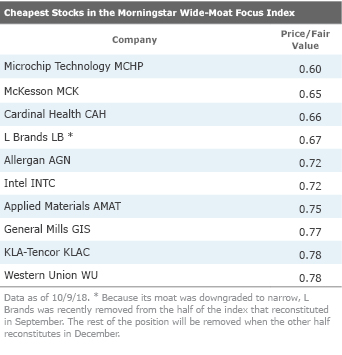

High-Quality Stocks in the Bargain Bin The table below lists the 10 cheapest stocks in the Morningstar Wide Moat Focus Index as of Oct. 9.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)