Changes to the Kiddie Tax May Benefit High-Income Parents

The new rules are attractive for many families who plan accordingly.

The Tax Cuts and Jobs Act attempted to simplify the complicated "kiddie tax" calculation. It did not change how the kiddie tax is applied, but it does use the highly compressed trust income tax rates in place of the parent's marginal rate. At first glance, this may seem like a negative development, but certain parents will benefit.

The kiddie tax was enacted to prevent parents from shifting assets to their children so investment income would be taxed at the child’s often much lower rate. Under tax law prior to the new tax law, a child whose parents made less than $100,000 owed far less in taxes than a child whose parents made, say, $1 million. Now every child is taxed the same, regardless of the parent's tax bracket.

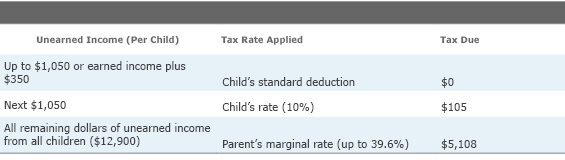

For example, two siblings each have unearned ordinary income of $15,000. Assume their parents are in the highest marginal tax bracket. Before new rules introduced through the tax law, each child's income would have been taxed as follows:

Total tax for both children would be ($105 +$5,108) X 2, or $10,426. The actual calculation to arrive at those dollar figures was laborious, especially if the child also had earned income and capital gain or qualified dividend income. Most parents opted just to report the unearned income above a child's rate threshold on their personal return.

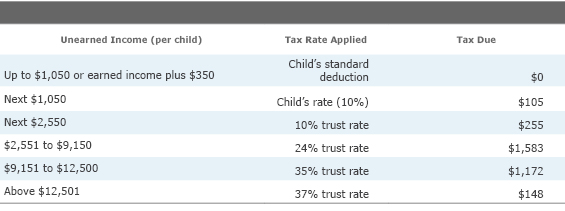

Beginning with the 2018 tax year through 2025, the tax on each child's unearned income above their standard deduction and the $2,100 levels will be calculated differently. There is no change to the taxation of unearned ordinary income up to the child’s rate threshold.

Using the same $15,000 of unearned ordinary income for each sibling, the new tax would be calculated as follows:

Total tax for both children will be ($105 + $255 + $1,583 + $1,172 + $148) X 2, or $6,526. That is a tax savings of almost $4,000.

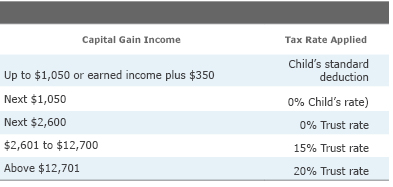

For unearned income taxed at long-term capital gain or qualified dividend rates, the trust brackets also are used.

When the child has both earned and unearned income, the standard deduction counts against earned income first.

Who Is Subject to the Kiddie Tax? The kiddie tax could potentially apply to any year before the year in which the child reaches age 24. All four of the following must be true for the tax year in question:

- The child does not file a joint tax return.

- At least one parent is alive at the end of the year.

- The child has net unearned income that exceeds the current threshold of $2,100, and the child has taxable income greater than the standard deduction.

- The child falls into one of the following age-related rules:

- The child has not reached 18 by year end.

- The child is 18 or older, but does not have earned income that exceeds half of his or her support. (Scholarships do not count as support.)

- The child is between 19 and 23 at year-end and is a student, and does not have earned income that exceeds half of his or her support. (A student attends school full-time for at least five months during a year.)

Support is defined as all amounts spent to provide the child with food, lodging, clothing, education, medical and dental care, recreation, transportation, and other similar necessities. For children between 18 and 23, if the parents could claim the child as a dependent (even though there is no longer a dependent exemption), then the age-related rules will apply.

Planning Implications Parents in a lower tax bracket than their child may want to consider moving some of the child's assets into a 529 college savings plan to avoid current taxation on the investment earnings. In this case, gifting additional assets to the child likely will only result in higher taxation to the household.

Parents in the 35% to 37% brackets may want to consider shifting more assets to their children to absorb the lower brackets that will then be applied. Moving assets to multiple children will also increase the tax savings for the household. The first $11,249 of ordinary income per child will be taxed at 0% to 24% versus the parent's higher rate. For this group, the new kiddie tax rules are very attractive.

NOTE: The information presented here is not specific to any individual's personal circumstances. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

Helen Modly, CFP, CPWA, is a wealth advisor with Buckingham Strategic Wealth, a fee-only registered investment advisor. The opinions in this article are the author’s own and may not reflect the opinions of Buckingham Strategic Wealth or Morningstar.com. The author may be reached at nova@bamadvisor.com.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)