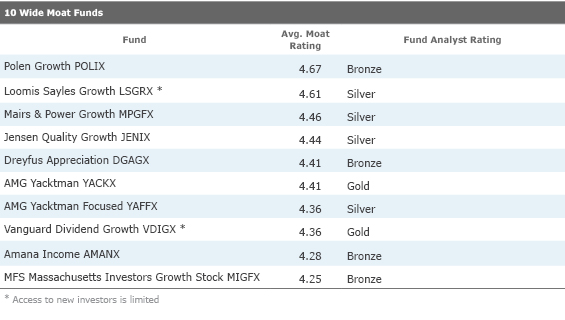

10 Solid Wide-Moat Funds

These Morningstar Medalists earn the highest average moat ratings among U.S. equity-focused mutual funds.

Even infrequent readers of Morningstar.com probably know that when it comes to stock investing, we're advocates of a wide-moat approach: We favor companies that have established competitive advantages, because they can more effectively fight off challengers than those companies that haven't carved out economic moats. And from a performance standpoint, wide-moat stocks tend to hold up better in market downturns: The Morningstar Wide Moat Focus Index lost less than 20% in 2008, versus a 37% tumble for the S&P 500.

For those investors who dig the moat concept but who don't invest in individual stocks, we created Morningstar's average moat rating. A fund's average moat rating marries our economic moat ratings for stocks to a mutual fund's portfolio. To receive an average moat rating, funds must have at least 50% of their assets in stocks that earn moat ratings from Morningstar. Those funds with a rating of 4 or higher can be considered wide-moat funds; from 3.5 to 4.0, moderately wide; 2.5 to 3.5, narrow moat; 1.5 to 2.5, minimal; and 0 to 1.5, no moat.

Average moat ratings are available to Premium Members via our

. Using that tool, we screened for Morningstar Medalist U.S. equity funds with average moat ratings of 4.0 or better. Forty-four funds made the cut. Premium Members who'd like to re-create the list can do so as follows:

Fund Category = U.S. Equity AND Morningstar Analyst Rating >= Bronze AND Distinct Portfolio Only = Yes AND Average Moat Rating = Wide

Here are the 10 mutual funds with the highest average moat ratings as of their latest portfolios.

We talked about three of these wide-moat funds--

Here's a little bit about each of the remaining top 10 funds that are open to all new investors.

Fayez Sarofim & Company has subadvised Bronze-rated

Gold-rated

Managed in accordance with Islamic law, Bronze-rated

Lastly, the manager of Bronze-rated

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/237L6UCCT5DIJOTXSUHF5NKFYM.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/R7HDJUUCAVCXZH56GSOH6M55CU.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)