One of the Most Useful ETF Data Points You May Never Have Heard Of

Morningstar's price/fair value ratio for ETFs is a useful starting point for bargain-hunters.

Morningstar's fair value estimate for exchange-traded funds leverages the bottom-up fundamental analysis produced by our global team of equity research analysts, distilling their extensive work into one powerful metric of the estimated intrinsic value of a portfolio of stocks.

Our equity analysts evaluate stocks for what they truly are--pieces of a business. Instead of prognosticating short-term price movements or momentum, our analysts focus on determining the value of a business, its risks, and whether the stock price accurately reflects both the value and risk. This philosophy of fundamental research is the foundation for our valuation model. We believe that:

- how much capital a company invests and what it earns on that capital drive shareholder value;

- free cash flow--not reported earnings--is what counts;

- as Warren Buffett has said, "Growth is always a component in the calculation of value--sometimes a positive, often a negative." If a company can't earn its cost of capital, growth destroys value instead of creating it;

- competitive advantages disappear over time;

- It is dangerous to assume that the future will be better than the past.

These core beliefs guide our stock analysts as they estimate future cash flow, using their in-depth knowledge of each company and its competitive position within its industry. Our analysts forecast revenue growth, profit margins, and capital investment (and all of the numbers that go into them) for each firm they cover.

Their forecasts for each company populate our discounted cash flow model, which calculates the present value of the company's future discretionary cash flow based on its cost of capital, as determined by our analysts.

The Math Behind Our Fair Value Estimate for ETFs Our per-share fair value estimate for ETFs represents the aggregate, asset-weighted fair value estimate of the stocks in an ETF's portfolio that are covered by Morningstar equity analysts, divided by the ETF's number of shares outstanding. Morningstar's equity analysts might not cover each of the stocks in an ETF's portfolio. In those cases, when calculating the ETF's fair value estimate, we assume that all stocks that aren't under coverage are trading at fair value. We only calculate fair value estimates for ETFs with a "hit ratio"--the aggregate value of the securities Morningstar analysts cover divided by the aggregate value of all securities in the portfolio--greater than 0.67. This means that we are able to calculate fair value estimates for 278 equity ETFs, representing 28% of the current universe of 1,008 equity ETFs and accounting for 64% of total assets in this universe.

Fair Value = ∑ (Number of Shares Outstanding x Fair Value Estimate Per Share) + Cash

Notes:

- For stocks that Morningstar does not cover, we assume that their price is equal to their fair value.

- Therefore, FV = ∑ (Number of Shares Outstanding x Last Closing Price) for any stocks that do not have analyst-driven fair value estimates.

- Dividing the result by the number of an ETF's outstanding shares yields the fair value estimate per ETF share.

How It Can Be Used Our fair value estimate for ETFs in isolation is interesting but not yet useful. It is most useful when compared against an ETF's current market price. Dividing an ETF's market price by our fair value estimate for its shares gives us a price/fair value ratio.

- A price/fair value ratio less than 1 indicates that an ETF's portfolio may be undervalued relative to our analysts' estimates of the worth of its individual constituents.

- A ratio greater than 1 indicates that the portfolio may be overvalued.

- A ratio equal to 1 indicates that the portfolio may be fairly valued.

Of course, no single data point should be used in isolation to gauge the value of either a single security or a portfolio of them--a more holistic assessment is required. That said, this valuation measure, like many others, can serve as a useful sanity check when assessing your existing portfolio and as a decent starting point when prospecting the broader market for new ideas.

What's Cheap and What's Dear Today?

Our current fair value estimate for

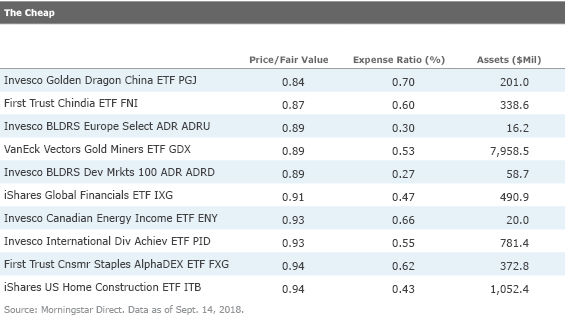

The exhibits below show the 10 most under- and overvalued equity ETFs--as measured by our price/fair value ratio--as of Sept. 14. In a fully valued market, it should come as little surprise that the most compelling values have a lot of hair on them. Using the price/fair value estimate as our guide, current valuations look favorable in Chinese stocks, European large-cap banks, and gold miners. Whether the prospective reward is worth the accompanying risks in any of these market segments is anyone’s guess. On the other hand, it appears that stocks in the medical devices and oil & gas equipment and services industries are getting a bit overripe, as three of 10 of the most richly priced funds on our list target these corners of the market. Large sector bets also explain the current richness of funds like

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)