State Street Global Advisors Has Mobilized. It's Time to Execute

State Street continues improving, but its new leadership could strengthen product development.

Morningstar's manager research team recently wrapped up due-diligence meetings with senior leadership at State Street Global Advisors' office in Boston. SSGA demonstrated that it has the structure and leadership in place to serve its fundholders well. Its revamped senior leadership team is finding its footing, but is capable of executing the firm's strategy. The firm has shown progress toward improving its business practices, but could do more to bolster its product development process. SSGA maintains its Parent Pillar rating of Neutral.

This parent rating is based on Morningstar’s assessment of how well a firm is looking out for its fundholders by focusing on the strength of its investment organization and business practices. SSGA’s investment organization is in great shape. Its indexed-equity and fixed-income management teams have been remarkably stable, and each has a deep bench. The firm is well staffed and able to support the portfolio management and trading of its funds.

The firm also boasts a top-tier stewardship program to push the holdings of its funds to act in shareholders’ best interest. Led by Rakhi Kumar, this team seeks to promote strong corporate governance, environmental, and social practices in its funds’ holdings through proxy voting, and in some cases, proactive engagement with senior management. In the United States, SSGA seems to be ahead of the curve on the stewardship front among the largest passive sponsors. While all investors benefit from these stewardship efforts, prioritizing them demonstrates SSGA’s commitment to doing best by its fundholders.

Strengthening Business Practices SSGA has made strides to improve its business practices after losing market share to its U.S. passive fund competitors during the financial crisis in 2009-10. The improvement started in earnest in 2015, when State Street Corporation refocused its efforts on its asset management business by committing greater resources to it and hiring Ron O'Hanley as SSGA's new CEO. He improved SSGA's investment strategy and risk-management governance. He also streamlined the decision-making of SSGA's fund business, SPDR, by bringing functional areas such as marketing and product development in-house. From a business practices perspective, SSGA continues the upward trajectory set in 2015.

The investment dollars to SSGA from State Street should continue to flow because O’Hanley will assume the CEO role of State Street Corporation in 2019. Cyrus Taraporevala, his longtime lieutenant, replaced O’Hanley in early 2018. So far, Taraporevala has continued to chug along the path set out by O’Hanley. Taraporevala brings a focus on team-building and continues to bolster SSGA’s leadership ranks. Notable hires include Noel Archard, head of Product Development; and Sue Thompson, head of Distribution. Each hire is an industry veteran with leadership experience at both Vanguard and BlackRock. With new business people in place, SSGA may be able to emerge from the shadow of its parent corporation. In early 2018, SSGA moved to a new office separate from State Street Corporation, and SSGA now seems to have its own identity and renewed sense of ownership among its senior leaders.

Finding the Path to Investor-First Product Development SSGA inherited the custodial banking culture of its parent company, which relies heavily on committees. This is a double-edged sword. On the positive side, SSGA has a separate fiduciary committee in place to guard the interests of its fundholders. At the same time, the client-first trust-bank culture likely increased SSGA's willingness to partner with large clients to launch funds. This has led to a disjointed fund lineup because decisions to launch funds have been a function of its large client interest. Senior leaders at SSGA have acknowledged that the firm could prune its fund offerings and be more cognizant with the funds it launches in the market.

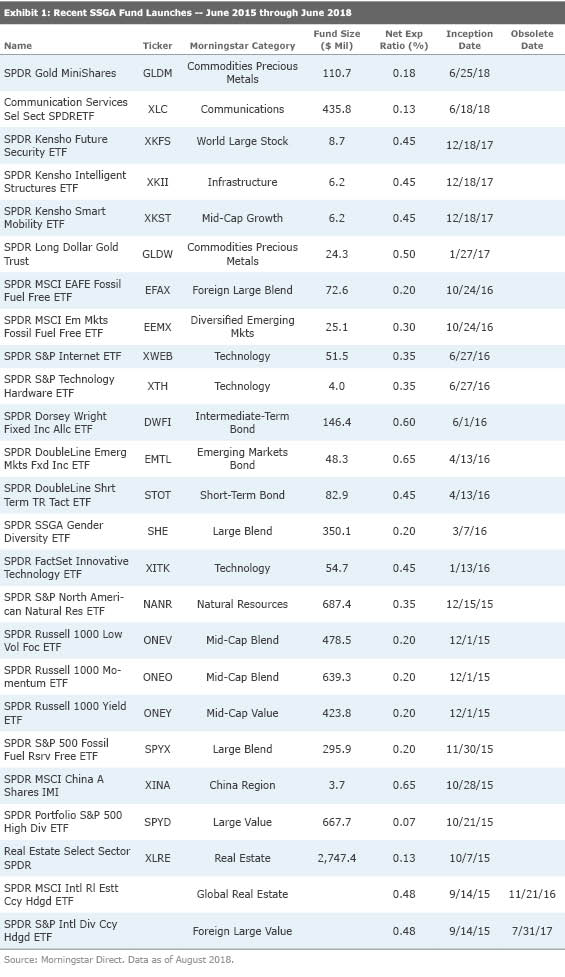

During the past three years through June 2018, SSGA has launched 25 funds in the U.S. It’s tough to discern the strategic vision behind this new product mix presented in Exhibit 1.

Several of these fund launches are the direct outcome of client demand. The launch of

Closing Time Conversely, SSGA is walking the talk when it comes to cleaning up its fund lineup. The firm has been much more willing to close funds with questionable investment merit during the past three years through June 2018. This can be partially explained by SSGA's new senior leadership. They're in the position to objectively cut funds launched during prior regimes. SSGA has closed 38 funds over the three-year period through June 2018, more than the total number of fund closures prior to June 2015. SSGA opted to close international sector funds, most of its multifactor single-country equity fund offerings, and funds that targeted narrow slices of emerging equity markets. It's beneficial for investors that SSGA shutters funds like these, but it's tough for SSGA to score too many points for shuttering them considering that the firm launched them in the first place.

SSGA has more tools in its arsenal to improve its product lineup than launch and shutter buttons. The firm has also improved its lineup by swapping the underlying indexes on its broad, market-cap-weighted offerings and cutting their expense ratios in autumn 2017. Dubbed the SPDR Portfolio suite, these offerings follow on the trend from many other passive asset managers in the U.S. to launch low-cost “core portfolio” funds. Although they’re hardly first to market with these, it does demonstrate a willingness to put investors’ interests first, offering broadly diversified funds at a low cost. But most investment-management firms are in business to make money, so these fee cuts were not completely altruistic. The SPDR Portfolio suite launch coincided with its inclusion onto the commission-free ETF list of online-brokerage TD Ameritrade. Investors with TD Ameritrade accounts can buy and sell many of State Street’s funds without paying brokerage commissions. This funnels investor dollars on this platform toward the SPDR Portfolio funds and helps offset the revenue loss from the fee cuts.

SSGA also improved its fund lineup by simplifying the strategies of its multifactor single-country funds. Now these funds track market-cap-weighted indexes of the targeted country rather than pursuing country and factor exposure simultaneously. This index swap better aligns with how investors are using these products and helps investors better set risk and return expectations. Although simplifying its lineup and closing funds with questionable investment merit are steps in the right direction, SSGA can still show more discipline with the funds it brings to market.

Putting It All Together SSGA has done well to put the structure and team in place to improve its business practices and build on the strong stability of its investment management team. The firm's strong stewardship program also demonstrates a focus on its fundholders' best interests. If SSGA can find its product-development voice and continue to execute on the strategic plan that O'Hanley and Taraporevala have set forth, then it should be in a stronger position to look out for the best interests of its shareholders.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click

for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets,

or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/64dafa24-41b3-4a5e-aade-5d471358063f.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/64dafa24-41b3-4a5e-aade-5d471358063f.jpg)