U.S. Equity Funds Seeking Shelter From High Corporate Debt

Some potential ways to cut risk while maintaining equity exposure.

A version of this article was published in the June 2018 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

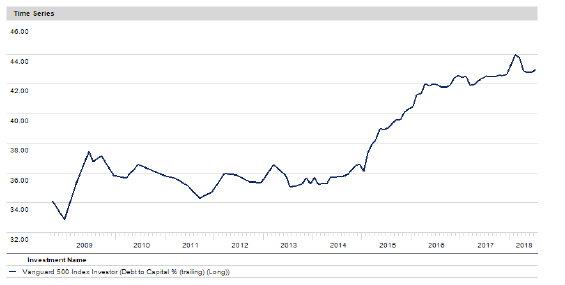

There's some evidence that U.S. companies are deleveraging, but overall corporate debt remains on par with levels during the 2007-09 financial crisis. U.S. companies feasted on ultralow interest rates after the credit crisis a decade ago, borrowing not only to invest in their businesses but also to buy back shares and pay dividends. According to the Federal Reserve, total U.S. corporate debt was equal to 45.2% of U.S. gross domestic product in 2018's first quarter, down a tenth of a percentage point from six months prior.

This still-high level of corporate borrowing shows up in mutual fund portfolios, too. The

- source: Morningstar Direct

What’s more, Wells Fargo Securities estimates that about $4 trillion of corporate debt will need to be refinanced over the next five years. If interest rates spike or the economy falls into recession, many companies could feel the squeeze of higher rates and perhaps diminished access to capital when they need it most.

The Landscape You may remember that funds with high average debt/capital ratios were some of the hardest hit during the financial crisis. A fund's average debt/capital is often heavily influenced by where it invests, as there can be considerable variability in debt levels across markets, as well as throughout the market-cap spectrum.

For example, U.S. companies tend to be more heavily indebted than foreign companies, at least as it is reflected in mutual fund portfolios. As mentioned above, the S&P 500’s average debt/capital is about 43.0%. But outside the U.S., as measured by

Similarly, large-cap U.S. companies tend to have higher debt/capital ratios than small- and mid-cap companies. The Russell 2000 Index’s average debt/capital is 37.8%; while not low in historical terms, it is well below the S&P 500’s. Finally, the companies behind growth stocks also tend to carry more debt than their value counterparts. The Russell 3000 Growth Index has an average debt/capital ratio of 44.7% versus 40.5% for the Russell 3000 Value Index.

Neither of these dynamics is surprising. Large-cap companies tend to be more stable than either small- or mid-cap companies and therefore have more borrowing capacity. The same holds for growth over value companies, as the former’s higher growth and earnings make them more attractive to lenders. However, high debt levels and high price multiples for growth companies could make for a toxic combination during a deep downturn.

Finally, average debt/capital is limited in its utility to a degree. What matters as much as a company’s debt/capital is its interest coverage and cash flows. Some companies, such as utilities, tend to have fairly high debt/capital ratios, but they can generally afford to given their predictable cash flows.

The Candidates Nevertheless, with debt and valuations in mind, we sought U.S. equity funds that target companies with strong balance sheets (that is, relatively low debt/capital ratios) and that tend to lean toward value. To be sure, there's no guarantee that such a combination will protect investors during the next downturn. After all, value stocks fared worse than growth stocks during the past few corrections.

And although corporate debt has been rising for years, companies haven't really been punished for high debt levels since the credit crisis 10 years ago. So, with those caveats in mind, here are several funds with a preference for strong balance sheets and reasonable valuations.

Royce Special Equity

RYSEX

This small-value fund’s relative results have suffered in the nearly 10 years since the market bottomed, but that’s because it’s more prepared for the next downturn than just about any other U.S. equity fund. Comanagers Charlie Dreifus and Steven McBoyle

look for companies not only with low debt but also with growing free cash flow. Their commitment to low debt shows in the fund’s June 2018 average debt/capital of just 19.2%, which is among the lowest for all U.S. equity funds. Plus, the fund’s 12.6%

cash weighting gives it a further buffer. However, the fund is concentrated, especially by sector, with about 75% of the portfolio in industrials, consumer discretionary, and technology stocks alone.

iShares Edge MSCI Multifactor USA ETF

LRGF

This exchange-traded fund offers as much exposure as possible to value, momentum, size (that is, mid- and small-cap stocks) and quality factors while still matching the risk profile of its underlying index, the mostly large-cap MSCI USA Index. As part of this quality factor, the portfolio's 35.0% average debt/capital is quite a bit below the S&P 500's. From a value perspective, while the portfolio lands in the blend portion of the style box, its average price multiples are quite a bit lower than the S&P 500's as well. Finally, its low 0.20% expense ratio is attractive for a multifactor ETF.

Fidelity Low-Priced Stock

FLPSX

This mammoth (almost $36 billion in assets) mid-cap value fund is run by legendary manager Joel Tillinghast. The fund manages its heft by investing in more than 900 stocks, leaving the portfolio extremely diversified. Tillinghast uses a company’s balance sheet as a way to value it but also as a way to control risk. As a result, the fund’s 32.7% average debt/cap is well below that of the S&P. The fund also has a nearly 10% cash buffer.

Again, there are no guarantees when it comes to bear-market protection, outside of holding cash. But low-debt funds offer a way to mitigate one risk--exposure to highly indebted companies while still maintaining equity exposure. Of course, addressing one risk often means accepting another, whether it’s opportunity cost or another type of exposure, such as having an overweighting to defensive sectors. So, more than anything else, make sure that you are comfortable with the risks your funds are assuming and how they play off of each other.

/s3.amazonaws.com/arc-authors/morningstar/e6b4cff4-0d77-4881-abc5-5b0b34d64bf6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e6b4cff4-0d77-4881-abc5-5b0b34d64bf6.jpg)