Another Lesson on Why Taxable Money in Active Stocks Is a Bad Idea

Harbor International Fund investors are getting soaked with taxable gains equivalent to around 38% of NAV.

Key Takeaways

- In general, investing taxable money in active stock funds is a bad idea.

- There are lessons to be learned from the Harbor fund's example, such as giving a wide berth to active stock funds that are sitting on large unrealized gains while experiencing heavy investor outflows.

Investing Taxable Money in Active Equity Funds: Bad Idea We've written previously about investing taxable money in active stock funds. To briefly summarize our research findings: Bad idea. Most active stock funds won't beat a comparable index fund or exchange-traded fund after taxes. Why? Competition (that is, it's tough to beat the index even before fees), costs, and taxes.

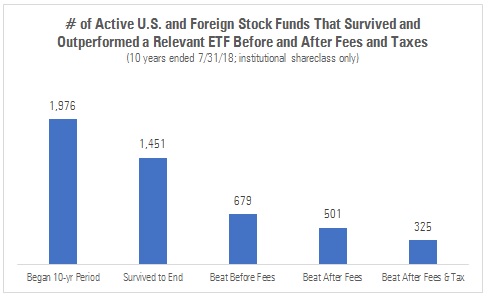

To illustrate, here's a chart that takes all the "institutional" class U.S.-stock and foreign-stock funds that existed on Aug. 1, 2008, and walks them forward 10 years. The leftmost bar shows the number of funds that began the period; the bar to its right tallies the number of funds that managed to survive the ensuing decade; the third bar reveals the number of surviving funds that beat a relevant ETF before fees; the bar to its right shows the same but after fees; and the rightmost bar shows the number of funds that beat the relevant ETF after fees and taxes [1].

Source: Morningstar Analysts

Of the nearly 2,000 active equity funds that began the 10-year period, only 300 proceeded to beat a comparable ETF after fees and taxes. That’s a 16% beat rate for the cheapest class of active stock funds.

Case Study: Harbor International Fund Stark as that picture is, the reality doesn't always sink in for investors until they're about to receive a big capital gains distribution and must reckon with the tax consequences. That's where taxable shareholders in Harbor International Fund might find themselves today: Last week that fund announced it would make an estimated $23 to $27 per share taxable distribution, equivalent to about 38% of the fund's then-NAV. Ouch.

(For more information on why funds make cap-gains distributions, the tax consequences, and best practices for tax-managing, read this useful explainer from my colleague, Christine Benz.)

There are lessons in the Harbor fund’s impending distribution, but they’re easier to grasp if we briefly review why the distribution is arising in the first place.

- Big embedded gain: The Harbor fund was sitting on a $4.5 billion unrealized gain, itself a consequence of the fund's low-turnover style and a succession of years in which its holdings gained value. When so many of the stocks in the portfolio have a low cost basis, it can be hard for management to avoid realizing gains when it's forced to make a sale.

- Investor outflows: The fund was seeing investor redemptions and, with that, finding it necessary to sell some of its appreciated holdings to raise the money needed to cash shareholders out. In so doing, it was realizing capital gains that had to be distributed. Indeed, by Harbor's estimation, roughly half of the $23 to $27 per share distribution stems from sales management made to meet investor redemptions.

- Manager replacement: The fund's board opted to replace its longtime manager, Northern Cross, with a different manager, Marathon Asset Management, which apparently intends to sell substantially all of the fund's appreciated stock holdings in favor of different names they prefer. Thus, what was already shaping up to be a trying year for the fund's taxable investors [2] became a bloodbath.

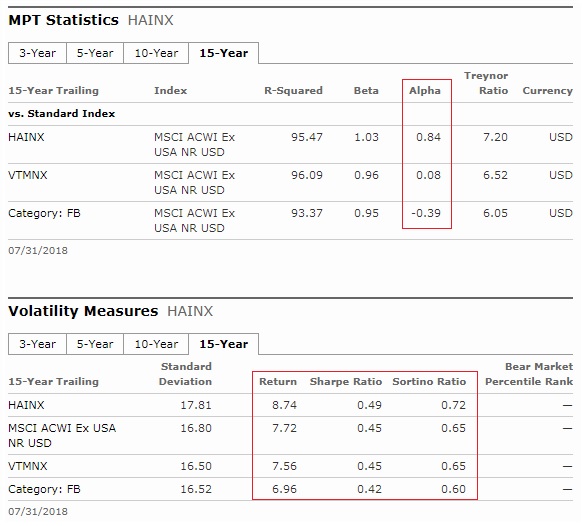

Lessons Harbor International is a fund that has succeeded after fees—its long-term pretax net returns still handily top those of its average peer and comparable indexes, before and after risk.

Source: Morningstar Analysts

But because of this confluence of circumstances, it couldn’t avoid making a gigantic distribution that will pinch shareholders who have invested taxable money. What are the lessons?

- Think twice about investing taxable money in active stock mutual funds: This is the overarching point, but it bears repeating. True, it's indeed possible that some stock index mutual funds could be forced to make significant capital gains distributions in the future. Why? Like active funds, some are also sitting on hefty unrealized gains that could be difficult to sidestep in the event of outflows triggered by a sell-off. But ETFs boast unique advantages that normally allow them to flush out low-cost-basis shares, thereby minimizing the incidence of capital gains distributions. Thus, if there's a comparable stock ETF available, it should be no contest after-tax—the vast majority of active stock funds are likely to lag it.

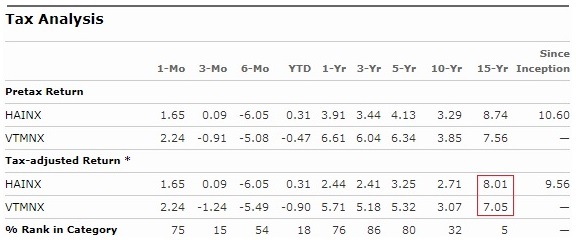

- Keep an eye out for active stock funds that have amassed big unrealized gains and are seeing investor outflows. You can find data on a fund's "potential cap gains exposure"—which is essentially the sum of its undistributed realized gains and its unrealized gains divided by its net assets—on the "Tax" tab of each Morningstar.com fund report. For example, here's the "Tax" tab for Harbor International Fund. We make asset flow data available in some of our tools, such as Morningstar Direct, but if you don't have access check out the "Statement of Changes in Net Assets" in a fund's most recently filed semiannual or annual report. You can find those reports on file with the SEC or access them from the "Filings" tab of each Morningstar.com fund report. Here are the most recent filings for the Harbor fund, for instance.

- Be especially wary of active stock funds already prone to making big distributions (that is, funds sitting on big unrealized gains and suffering investor redemptions) but where there's the additional possibility of a major portfolio overhaul in the future. These situations aren't a dime-a-dozen but could arise when there's a manager change, especially when the fund is being run by a third-party manager (sometimes referred to as a "subadvisor") that's underperforming, and where the investment mandate is wide.

Source: Morningstar Analysts

- If you're determined to invest taxable money in an active stock fund, consider funds that are capital-appreciation-oriented, run by managers who trade infrequently, and are sitting on small unrealized gains or, better yet, a built-up store of losses that should help to blunt capital gains distributions for the foreseeable future. This can take some gumption: It might mean investing in newer, less-proven funds (explaining absence of unrealized gains), in areas that have been losers (emerging markets being a recent example), or with worthy managers that have had a very tough stretch. You won't feel great doing it, but it'll at least give you a better chance of avoiding big capital gains distributions.

- Related to the previous, the best time to plunk taxable money in an active stock fund is probably in the months following a bear market. By then, funds have likely already made at least a few taxable distributions and outflows may have tapered off. Moreover, if losses have been substantial, the funds might have built-up loss carryforwards that can help to ensure tax efficiency in future years (this was what we saw following the 2000-02 tech bust and the global financial crisis). Of course, it's important to keep in mind that our research has found active stock funds tend to do worse in bull than bear markets, so what you gain in tax efficiency you might more than sacrifice in pre-tax performance.

Conclusion The lesson here isn't that the Harbor fund failed its investors or was irresponsibly managed. Long-term it has done a good job for shareholders, on balance, and until recently had been an after-tax standout as well thanks to management's low-turnover investing approach. But it vividly illustrates the limits of the open-end fund structure in avoiding capital-gains incurrences, especially when compared with ETFs. Even when they succeed, as this fund has done over the long haul, they can still fall short. For that reason, most investors are likely better off putting their taxable assets in equity index funds or ETFs rather than active stock mutual funds.

Endnotes [1] For purposes of the test we compiled the gross, net, and pre-liquidation/post-tax returns of the institutional share class of all funds in the nine U.S. style-box categories plus foreign large blend, foreign large value, foreign large growth, and world large-cap stock. We considered any fund that was classified in one of these categories as of Aug. 1, 2008, to be "alive" and any fund that didn't have all three of the 10-year returns as of July 31, 2018—gross, net, and post-tax—to be "dead." We then compared the gross, net, and post-tax returns of surviving funds to the gross, net, and post-tax returns of the following ETFs:

iShares Russell 1000 ETF US Fund Large Blend

iShares Russell 1000 Growth ETF US Fund Large Growth

iShares Russell 1000 Value ETF US Fund Large Value

iShares Russell Mid-Cap ETF US Fund Mid-Cap Blend

iShares Russell Mid-Cap Growth ETF US Fund Mid-Cap Growth

iShares Russell Mid-Cap Value ETF US Fund Mid-Cap Value

iShares Russell 2000 ETF US Fund Small Blend

iShares Russell 2000 Growth ETF US Fund Small Growth

iShares Russell 2000 Value ETF US Fund Small Value

iShares MSCI EAFE ETF US Fund Foreign Large Blend

iShares MSCI EAFE Value ETF US Fund Foreign Large Value

iShares MSCI EAFE Growth ETF US Fund Foreign Large Growth

iShares MSCI ACWI ETF US Fund World Stock

[2] Note: At least one fifth of the Harbor fund’s assets are in tax-deferred or tax-exempt accounts—$4.3 billion of the fund’s $20.5 billion in total net assets recently sat in its “retirement” share class, and it’s likely that at least some of the assets in the other two share classes are qualified as well.

/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/550ce300-3ec1-4055-a24a-ba3a0b7abbdf.png)