As Stocks Hit New Milestones, Control What You Can

No one knows what's next for stocks, but records can be a good time to double check your plan.

With the S&P 500 hitting an intraday high and stocks entering the longest bull market in history, it shouldn't be a surprise that investors are asking if the market is due for a downturn.

There is no good answer to that question. The truth is, no one knows what the short term will bring for the market. Some of the factors that have been driving stocks higher (including improving earnings, still low interest rates, and tame inflation) are in place, but anything from a trade war to a monetary policy error to something that isn't even on our radar could just as well knock the market down.

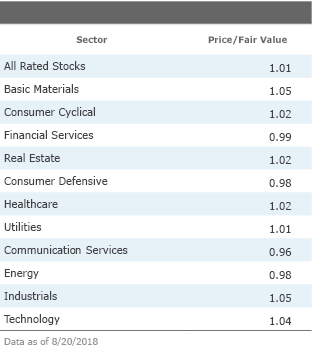

And has the bull market left stocks looking pricey? On average, Morningstar's equity research team thinks no. On a market-cap-weighed basis, the average stock in our coverage universe is only 1% overvalued today. And as seen in the table below, some sectors even look like they are trading at a discount to their intrinsic worth.

What should investors do? The milestones reached today are not in and of themselves a reason to make any changes to your financial plan. But they cold be a good opportunity to double check that your portfolio is in good shape in case a downturn is in the cards. For example, you may have more equity exposure than you want after stocks' strong run; it may be an opportune time to rebalance and take some risk off the table. This is particularly important for investors who may not have a long time frame before tapping into their portfolio for spending needs. In short, focus on what you have control over and worry less about what the market is going to do.

Earlier this year, Christine Benz put together a market downturn tool kit that lays out the steps on how to make that happen.

/s3.amazonaws.com/arc-authors/morningstar/96d7bd4e-92b9-4928-87ef-a13a06b394fa.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5GAX4GUZGFDARNXQRA7HR2YET4.jpg)